- Canada

- /

- Industrial REITs

- /

- TSX:DIR.UN

Will Dream Industrial (TSX:DIR.UN) Rethink Its Growth Model After Withdrawing a Major Equity Offering?

Reviewed by Sasha Jovanovic

- Earlier this week, Dream Industrial Real Estate Investment Trust announced both the filing of a universal shelf registration covering units and debt securities, and the filing, and prompt withdrawal, of a CA$250 million at-the-market follow-on equity offering.

- This rapid sequence of capital market actions highlights shifting funding priorities and may give insight into management's evolving approach to supporting growth and managing liquidity.

- We'll explore how the filing and withdrawal of a significant equity offering could affect the company's growth assumptions and capital flexibility.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Dream Industrial Real Estate Investment Trust Investment Narrative Recap

To be comfortable owning Dream Industrial Real Estate Investment Trust, investors typically need to believe in the continued strength of industrial property leasing and effective capital management in the face of rising costs and competition. This week's rapid filing and withdrawal of a CA$250 million equity offering has not materially affected the near-term catalysts like ongoing lease-up activity, but it keeps the spotlight on liquidity and funding flexibility, especially as elevated debt remains the key risk right now.

Among the recent announcements, the completion of a CA$200 million senior unsecured debenture issue in July 2025 stands out as directly relevant to the company’s flexible approach to capital. This move bolsters available liquidity and may provide a buffer as management continues to weigh debt versus equity financing amid shifting market conditions and expansion plans. Contrasting the company’s ability to access the debt markets, investors should also be aware of what persistent high leverage could mean for...

Read the full narrative on Dream Industrial Real Estate Investment Trust (it's free!)

Dream Industrial Real Estate Investment Trust is projected to reach CA$611.3 million in revenue and CA$350.3 million in earnings by 2028. This outlook assumes a 5.9% annual revenue growth rate and a CA$132.7 million increase in earnings from the current level of CA$217.6 million.

Uncover how Dream Industrial Real Estate Investment Trust's forecasts yield a CA$13.78 fair value, a 9% upside to its current price.

Exploring Other Perspectives

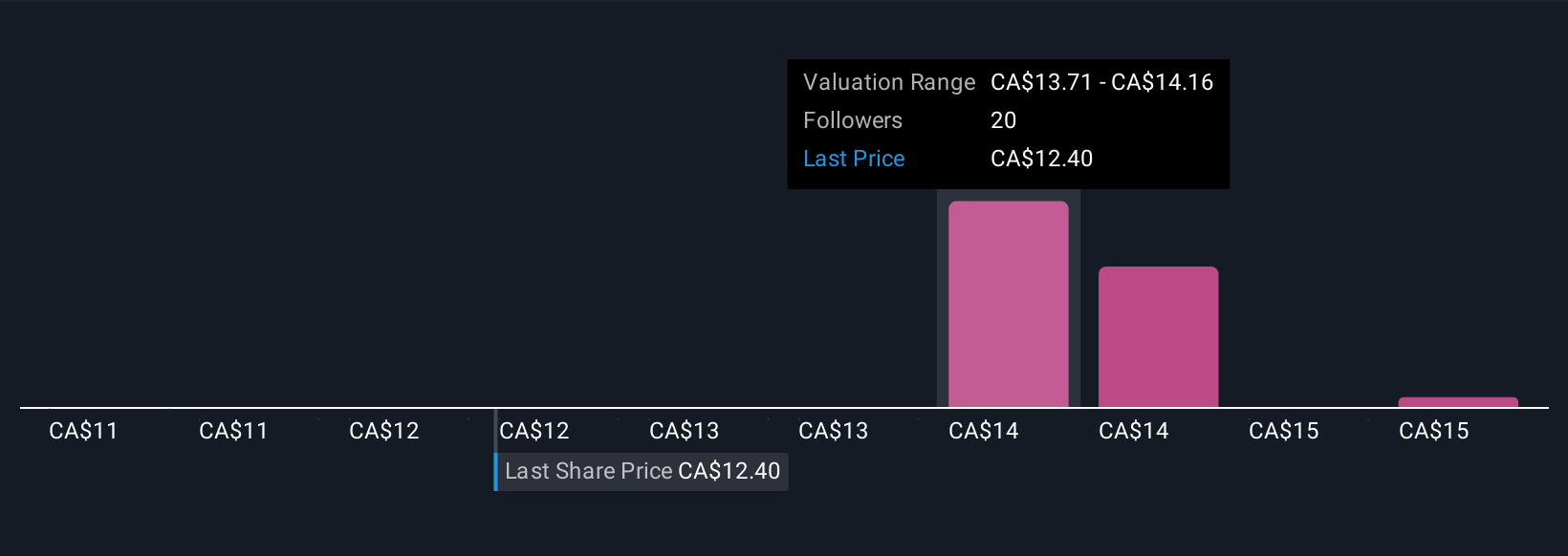

Simply Wall St Community members provided five fair value estimates for DIR.UN, ranging from CA$11.00 to CA$16.89 per unit. While leasing momentum supports optimism for future growth, the spread in valuations highlights how views on growth and debt risks can shape diverse outlooks on the company's potential.

Explore 5 other fair value estimates on Dream Industrial Real Estate Investment Trust - why the stock might be worth as much as 33% more than the current price!

Build Your Own Dream Industrial Real Estate Investment Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dream Industrial Real Estate Investment Trust research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dream Industrial Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dream Industrial Real Estate Investment Trust's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DIR.UN

Dream Industrial Real Estate Investment Trust

Dream Industrial REIT is an owner, manager and operator of a global portfolio of well-located, diversified industrial properties.

Proven track record average dividend payer.

Market Insights

Community Narratives