- Canada

- /

- Industrial REITs

- /

- TSX:DIR.UN

Do Dream Industrial Real Estate Investment Trust's (TSE:DIR.UN) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Dream Industrial Real Estate Investment Trust (TSE:DIR.UN). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Dream Industrial Real Estate Investment Trust

Dream Industrial Real Estate Investment Trust's Improving Profits

Over the last three years, Dream Industrial Real Estate Investment Trust has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. It's good to see that Dream Industrial Real Estate Investment Trust's EPS have grown from CA$1.09 to CA$1.22 over twelve months. That's a 12% gain; respectable growth in the broader scheme of things.

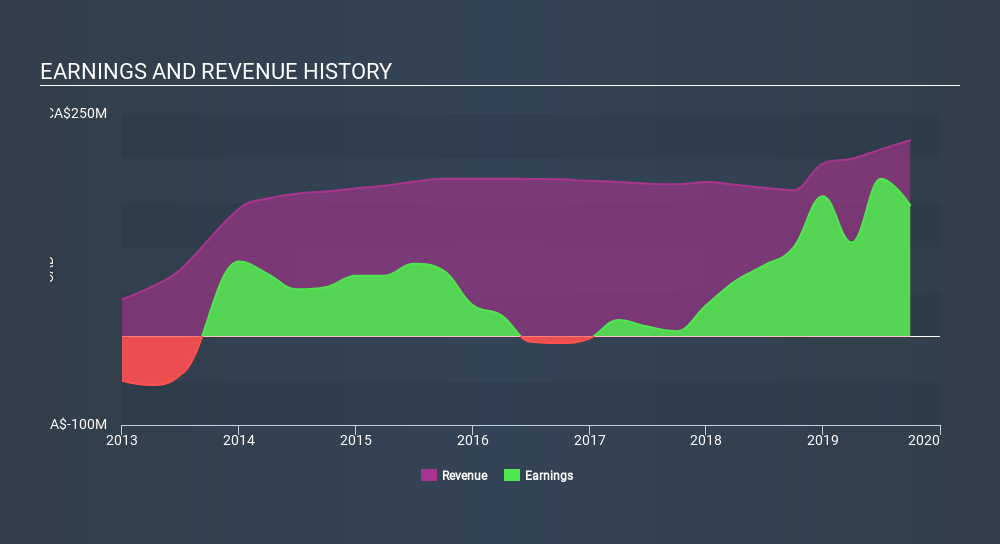

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Dream Industrial Real Estate Investment Trust's EBIT margins were flat over the last year, revenue grew by a solid 34% to CA$220m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Dream Industrial Real Estate Investment Trust's balance sheet strength, before getting too excited.

Are Dream Industrial Real Estate Investment Trust Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's a pleasure to note that insiders spent CA$4.4m buying Dream Industrial Real Estate Investment Trust shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Non-Independent Trustee Michael Cooper who made the biggest single purchase, worth CA$4.0m, paying CA$13.45 per share.

It's me that Dream Industrial Real Estate Investment Trust insiders are buying the stock, but that's not the only reason to think leader are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. I discovered that the median total compensation for the CEOs of companies like Dream Industrial Real Estate Investment Trust with market caps between CA$1.3b and CA$4.2b is about CA$2.9m.

The CEO of Dream Industrial Real Estate Investment Trust only received CA$610k in total compensation for the year ending December 2018. That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Dream Industrial Real Estate Investment Trust Deserve A Spot On Your Watchlist?

One positive for Dream Industrial Real Estate Investment Trust is that it is growing EPS. That's nice to see. Like chocolate chips in vanilla ice cream, the insider buying, and modest CEO pay, make it better. The sum of all that, for me, points to a quality business, and a genuine prospect for further research. Of course, just because Dream Industrial Real Estate Investment Trust is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

As a growth investor I do like to see insider buying. But Dream Industrial Real Estate Investment Trust isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:DIR.UN

Dream Industrial Real Estate Investment Trust

Dream Industrial REIT is an owner, manager and operator of a global portfolio of well-located, diversified industrial properties.

Very undervalued established dividend payer.

Market Insights

Community Narratives