- Canada

- /

- Retail REITs

- /

- TSX:CHP.UN

The Choice Properties Real Estate Investment Trust (TSE:CHP.UN) Share Price Has Gained 37% And Shareholders Are Hoping For More

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term Choice Properties Real Estate Investment Trust (TSE:CHP.UN) shareholders have enjoyed a 37% share price rise over the last half decade, well in excess of the market return of around 7.2% (not including dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 26% , including dividends .

View our latest analysis for Choice Properties Real Estate Investment Trust

Choice Properties Real Estate Investment Trust isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Choice Properties Real Estate Investment Trust can boast revenue growth at a rate of 12% per year. That's a pretty good long term growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 6.4% full reflects the underlying business growth. The key question is whether revenue growth will slow down, and if so, how quickly. There's no doubt that it can be difficult to value pre-profit companies.

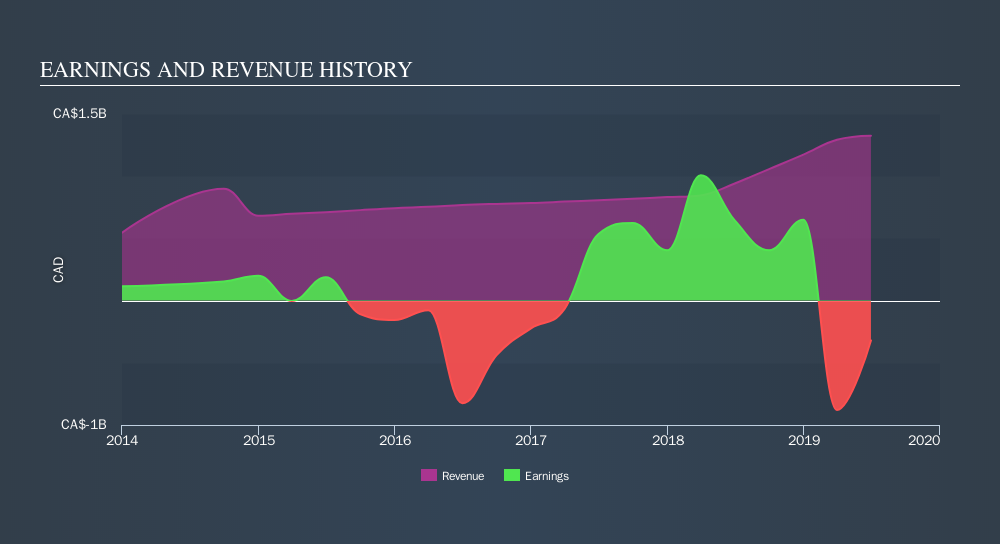

The graphic below depicts how earnings and revenue have changed over time.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Choice Properties Real Estate Investment Trust

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Choice Properties Real Estate Investment Trust, it has a TSR of 81% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Choice Properties Real Estate Investment Trust shareholders have received a total shareholder return of 26% over the last year. And that does include the dividend. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Choice Properties Real Estate Investment Trust by clicking this link.

Choice Properties Real Estate Investment Trust is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:CHP.UN

Choice Properties Real Estate Investment Trust

Choice Properties is a leading Real Estate Investment Trust that creates enduring value through places where people thrive.

Established dividend payer and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion