- Canada

- /

- Retail REITs

- /

- TSX:CHP.UN

Choice Properties REIT (TSX:CHP.UN): Assessing Valuation Following Share Buyback Authorization

Reviewed by Simply Wall St

Choice Properties Real Estate Investment Trust (TSX:CHP.UN) has unveiled a new share buyback program, authorizing the repurchase of up to 8% of its outstanding trust units. Investors are watching how this move could impact the stock’s long-term value.

See our latest analysis for Choice Properties Real Estate Investment Trust.

Momentum has been trending higher for Choice Properties Real Estate Investment Trust, with a year-to-date share price return of 13.67% and a robust 15.64% total shareholder return over the past year. The buyback announcement adds to this positive sentiment, following a period of steady performance gains and indicating management’s confidence in long-term value creation.

If you’re thinking beyond real estate, this could be a good opportunity to broaden your search and uncover fast growing stocks with high insider ownership.

With the stock up more than 13% year to date and trading just below analyst price targets, the big question remains: Is the current valuation still attractive, or has the market already priced in future growth opportunities?

Price-to-Earnings of 6.4x: Is it justified?

Choice Properties Real Estate Investment Trust currently trades at a price-to-earnings ratio of 6.4x, which is significantly lower than its North American Retail REITs industry peers. With the last close at CA$15.22 and this multiple in mind, the stock appears undervalued by comparison.

The price-to-earnings (P/E) ratio measures how much investors are paying for each dollar of company earnings. For real estate investment trusts, the P/E ratio helps indicate whether the market is optimistic or skeptical about the company’s profit outlook.

This exceptionally low multiple suggests that market participants may be underestimating the company's recurring earnings potential, especially following its recent profitability milestone. It also points to the possibility of further upside if the company maintains or increases these earnings.

When compared to the North American Retail REITs average of 24.1x, Choice Properties’ P/E stands out as a potential bargain. Investors may be pricing in risks or one-off factors, but if these factors prove temporary, the multiple could move closer to peers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.4x (UNDERVALUED)

However, ongoing industry uncertainty and fluctuating revenue growth could still temper investor optimism and present challenges to maintaining current valuation levels.

Find out about the key risks to this Choice Properties Real Estate Investment Trust narrative.

Another View: The SWS DCF Model

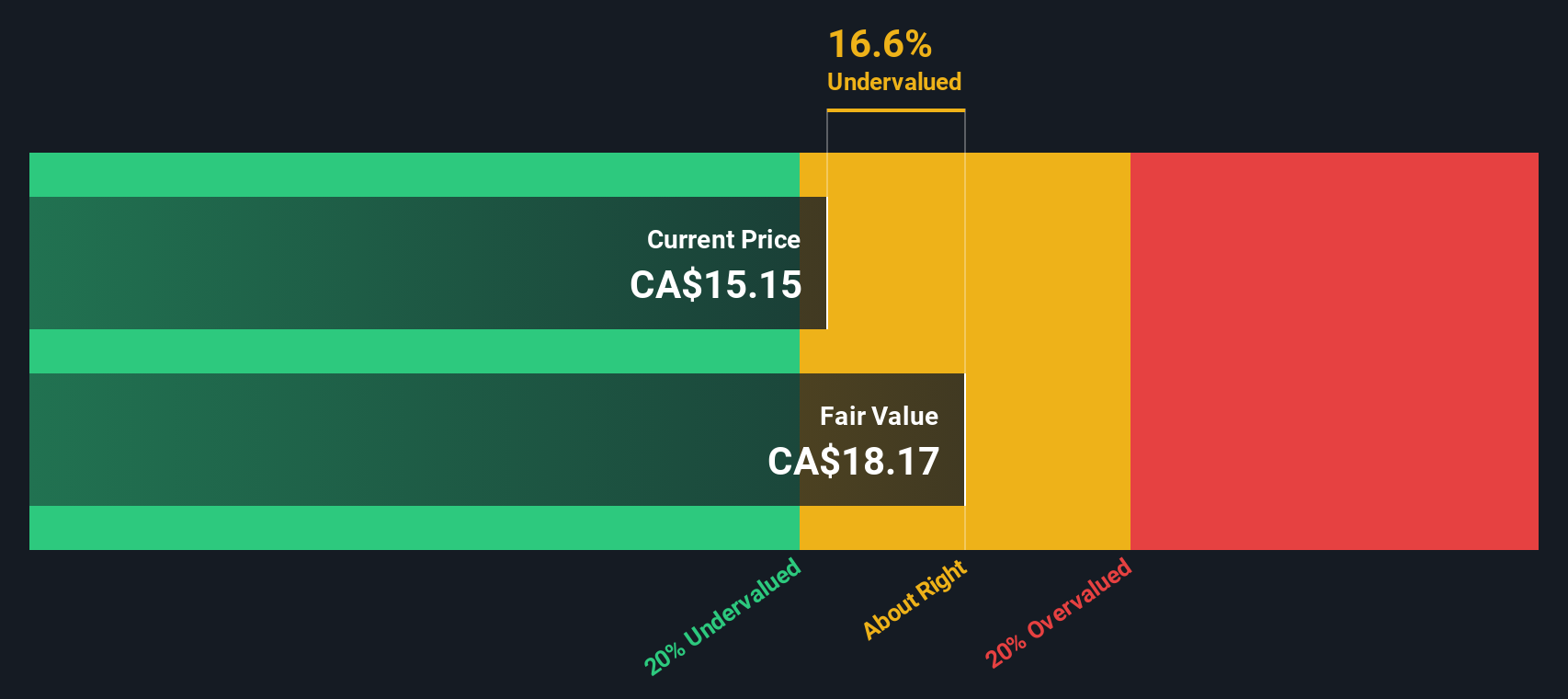

While the low price-to-earnings ratio presents Choice Properties Real Estate Investment Trust as undervalued, the SWS DCF model provides a different perspective. According to this approach, the stock is trading about 17% below estimated fair value, which supports the notion of attractive upside. However, it is important to consider whether these projections would remain valid if market conditions change.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Choice Properties Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Choice Properties Real Estate Investment Trust Narrative

If you want to see things from your own perspective or dive deeper into the numbers, you can easily craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Choice Properties Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for their next opportunity. Don’t let these potential winners pass you by. Find your edge with a wider view of the market.

- Find potential income-boosters by checking out these 15 dividend stocks with yields > 3% poised to deliver reliable yields above 3%.

- Tap into powerful innovation and spot early trends with these 25 AI penny stocks transforming industries with breakthrough artificial intelligence solutions.

- Capitalize on market inefficiencies by seeking out these 915 undervalued stocks based on cash flows that could be trading well below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CHP.UN

Choice Properties Real Estate Investment Trust

Choice Properties is a leading Real Estate Investment Trust that creates enduring value through places where people thrive.

Established dividend payer and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026