- Canada

- /

- Residential REITs

- /

- TSX:BEI.UN

Have Boardwalk Real Estate Investment Trust (TSE:BEI.UN) Insiders Been Selling Their Stock?

Anyone interested in Boardwalk Real Estate Investment Trust (TSE:BEI.UN) should probably be aware that the Independent Lead Trustee, Arthur Havener, recently divested CA$332k worth of shares in the company, at an average price of CA$45.76 each. The eyebrow raising move amounted to a reduction of 22% in their holding.

Check out our latest analysis for Boardwalk Real Estate Investment Trust

The Last 12 Months Of Insider Transactions At Boardwalk Real Estate Investment Trust

The President, Roberto Geremia, made the biggest insider sale in the last 12 months. That single transaction was for CA$1.6m worth of shares at a price of CA$44.13 each. That means that an insider was selling shares at slightly below the current price (CA$46.89). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. It is worth noting that this sale was only 22% of Roberto Geremia's holding.

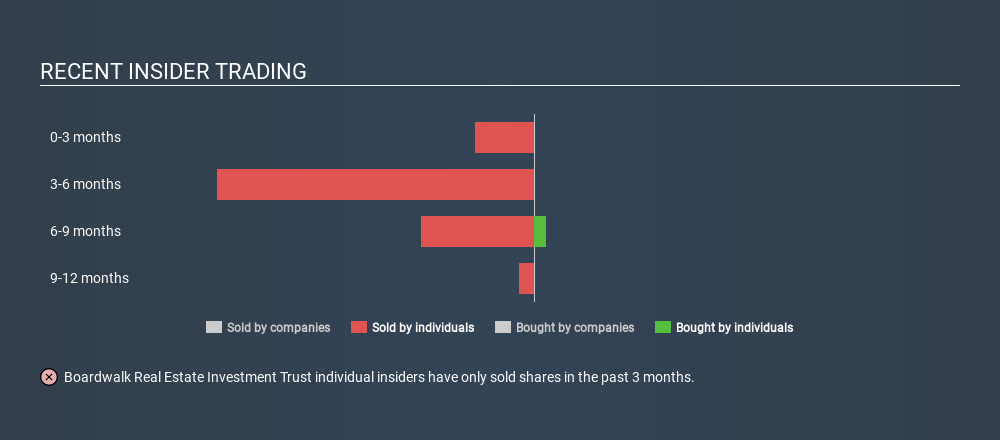

Over the last year we saw more insider selling of Boardwalk Real Estate Investment Trust shares, than buying. You can see the insider transactions (by individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership of Boardwalk Real Estate Investment Trust

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Our data indicates that Boardwalk Real Estate Investment Trust insiders own about CA$12m worth of shares (which is 0.5% of the company). We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

What Might The Insider Transactions At Boardwalk Real Estate Investment Trust Tell Us?

An insider hasn't bought Boardwalk Real Estate Investment Trust stock in the last three months, but there was some selling. Zooming out, the longer term picture doesn't give us much comfort. On the plus side, Boardwalk Real Estate Investment Trust makes money, and is growing profits. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. So we'd only buy after careful consideration. Of course, the future is what matters most. So if you are interested in Boardwalk Real Estate Investment Trust, you should check out this free report on analyst forecasts for the company.

Of course Boardwalk Real Estate Investment Trust may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:BEI.UN

Boardwalk Real Estate Investment Trust

Boardwalk REIT strives to be Canada's friendliest community provider and is a leading owner/operator of multi-family rental communities.

Good value slight.

Market Insights

Community Narratives