- Canada

- /

- Real Estate

- /

- TSXV:RPP

Here's Why We Think Regent Pacific Properties (CVE:RPP) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Regent Pacific Properties (CVE:RPP), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Regent Pacific Properties' Improving Profits

In the last three years Regent Pacific Properties' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Regent Pacific Properties' EPS shot from CA$0.0069 to CA$0.015, over the last year. It's not often a company can achieve year-on-year growth of 112%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the one hand, Regent Pacific Properties' EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

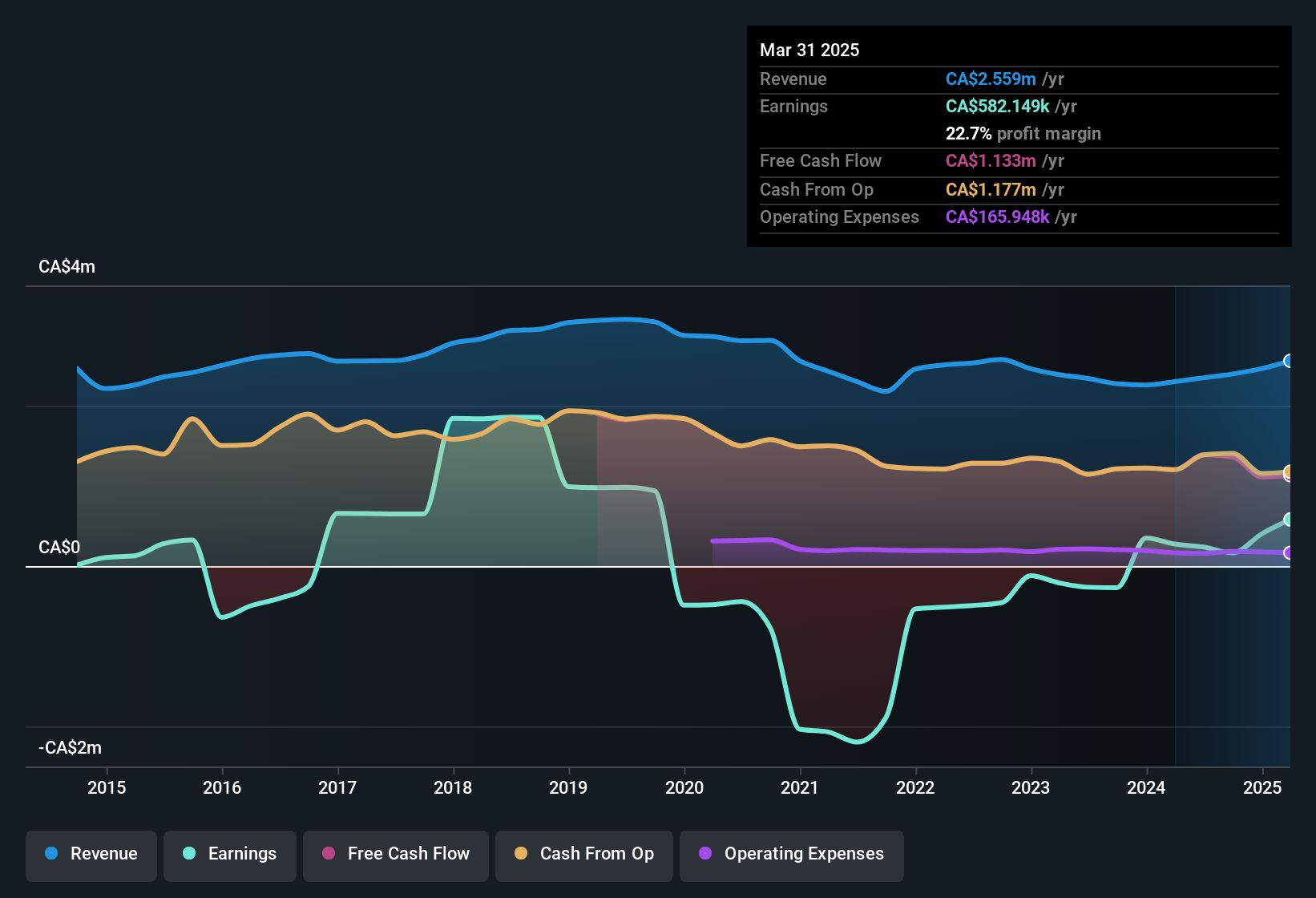

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Check out our latest analysis for Regent Pacific Properties

Since Regent Pacific Properties is no giant, with a market capitalisation of CA$2.0m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Regent Pacific Properties Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Regent Pacific Properties shareholders is that no insiders reported selling shares in the last year. Add in the fact that Shong-Tak Tam, the Independent Director of the company, paid CA$14k for shares at around CA$0.054 each. It seems that at least one insider is prepared to show the market there is potential within Regent Pacific Properties.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Regent Pacific Properties will reveal that insiders own a significant piece of the pie. In fact, they own 60% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Although, with Regent Pacific Properties being valued at CA$2.0m, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to CA$1.2m. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Regent Pacific Properties Worth Keeping An Eye On?

Regent Pacific Properties' earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Regent Pacific Properties belongs near the top of your watchlist. Still, you should learn about the 5 warning signs we've spotted with Regent Pacific Properties (including 3 which are a bit unpleasant).

The good news is that Regent Pacific Properties is not the only stock with insider buying. Here's a list of small cap, undervalued companies in CA with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:RPP

Regent Pacific Properties

Operates as a real estate development and investment company in Canada.

Moderate risk with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026