- Canada

- /

- Real Estate

- /

- TSXV:PKT

Parkit Enterprise Inc.'s (CVE:PKT) Share Price Is Still Matching Investor Opinion Despite 26% Slump

Parkit Enterprise Inc. (CVE:PKT) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

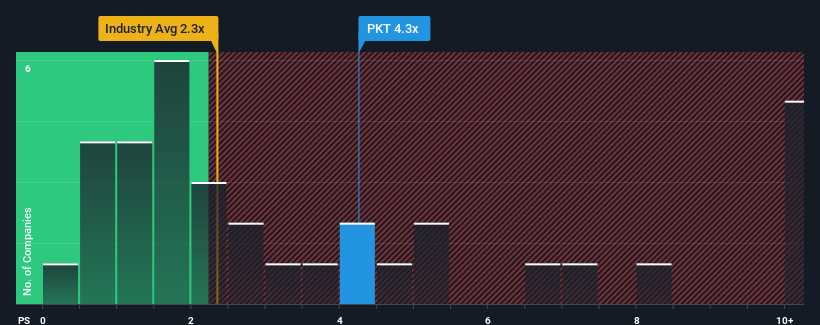

Although its price has dipped substantially, when almost half of the companies in Canada's Real Estate industry have price-to-sales ratios (or "P/S") below 2.3x, you may still consider Parkit Enterprise as a stock probably not worth researching with its 4.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Parkit Enterprise

How Parkit Enterprise Has Been Performing

The revenue growth achieved at Parkit Enterprise over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Parkit Enterprise will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Parkit Enterprise?

The only time you'd be truly comfortable seeing a P/S as high as Parkit Enterprise's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 4.6% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Parkit Enterprise's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

There's still some elevation in Parkit Enterprise's P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Parkit Enterprise can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Parkit Enterprise has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If these risks are making you reconsider your opinion on Parkit Enterprise, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:PKT

Parkit Enterprise

Parkit Enterprise is an industrial real estate platform focused on the acquisition, growth and management of strategically located industrial properties across key urban markets in Canada.

Good value with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026