- Canada

- /

- Real Estate

- /

- TSXV:NXLV

NexLiving Communities (CVE:NXLV) Is Paying Out A Larger Dividend Than Last Year

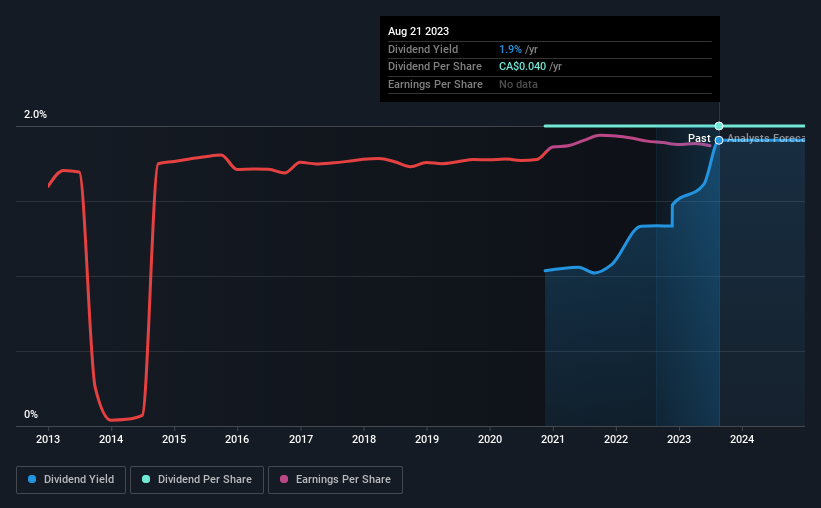

The board of NexLiving Communities Inc. (CVE:NXLV) has announced that it will be paying its dividend of CA$0.01 on the 29th of September, an increased payment from last year's comparable dividend. This will take the annual payment to 1.9% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for NexLiving Communities

NexLiving Communities' Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, NexLiving Communities was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

EPS is set to fall by 2.8% over the next 12 months. Assuming the dividend continues along recent trends, we believe the payout ratio could be 2.3%, which we are pretty comfortable with and we think is feasible on an earnings basis.

NexLiving Communities Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The most recent annual payment of CA$0.04 is about the same as the annual payment 3 years ago. NexLiving Communities hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. It's encouraging to see that NexLiving Communities has been growing its earnings per share at 59% a year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

An additional note is that the company has been raising capital by issuing stock equal to 22% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

We Really Like NexLiving Communities' Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. We should point out that the earnings are expected to fall over the next 12 months, which won't be a problem if this doesn't become a trend, but could cause some turbulence in the next year. All of these factors considered, we think this has solid potential as a dividend stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 6 warning signs for NexLiving Communities you should be aware of, and 2 of them can't be ignored. Is NexLiving Communities not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if NexLiving Communities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NXLV

NexLiving Communities

Owns and manages multi-unit residential real estate properties in Canada.

Proven track record with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026