The Canadian market has shown moderate growth, with the TSX up 3% this year amidst stabilizing yields and contained inflation. In such a landscape, investors often seek opportunities in lesser-known areas like penny stocks, which despite their outdated name, continue to hold potential for significant returns. These smaller or newer companies can offer a mix of affordability and growth potential when backed by strong financials, making them an intriguing prospect for those looking to uncover hidden value in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.76 | CA$174.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.81 | CA$444.19M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.9M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.72 | CA$641.48M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

| New Gold (TSX:NGD) | CA$4.03 | CA$3.08B | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$1.94 | CA$189.49M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.07 | CA$201.14M | ★★★★☆☆ |

Click here to see the full list of 937 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Telescope Innovations (CNSX:TELI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Telescope Innovations Corp. is a chemical technology company that develops manufacturing processes and tools for the pharmaceutical and chemical industries in the United States and Canada, with a market cap of CA$18.26 million.

Operations: The company generates CA$4.13 million in revenue from its chemicals segment.

Market Cap: CA$18.26M

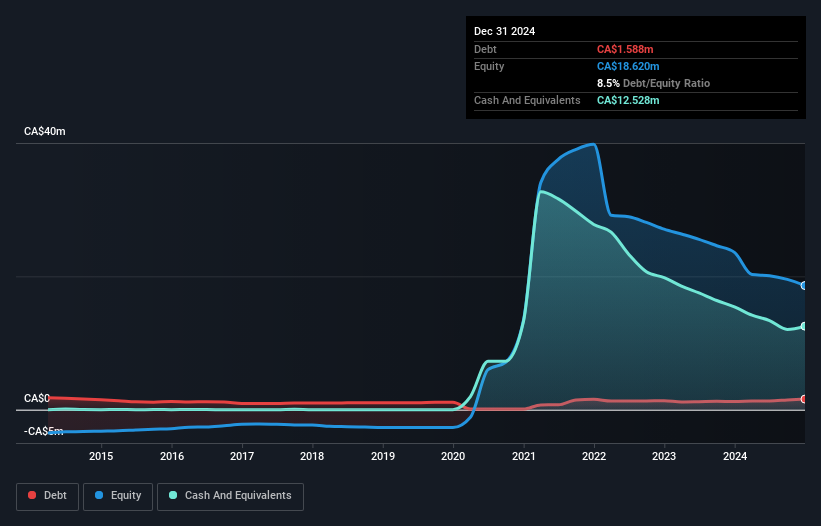

Telescope Innovations, with a market cap of CA$18.26 million, is navigating the challenges typical of penny stocks. Despite being unprofitable and having negative return on equity, it maintains a cash runway exceeding three years due to positive free cash flow growth. The company recently announced a private placement to raise CA$3 million, which could bolster its financial position. However, auditors have expressed doubts about its ability to continue as a going concern. Telescope's innovative ReCRFTTM technology demonstrates potential in lithium processing but hasn't yet translated into significant revenue growth or profitability improvements.

- Unlock comprehensive insights into our analysis of Telescope Innovations stock in this financial health report.

- Learn about Telescope Innovations' historical performance here.

Red Light Holland (CNSX:TRIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Red Light Holland Corp. focuses on the production, growth, and sale of functional mushrooms and mushroom home grow kits for the recreational market in North America and Europe, with a market cap of CA$16.07 million.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to CA$5.49 million.

Market Cap: CA$16.07M

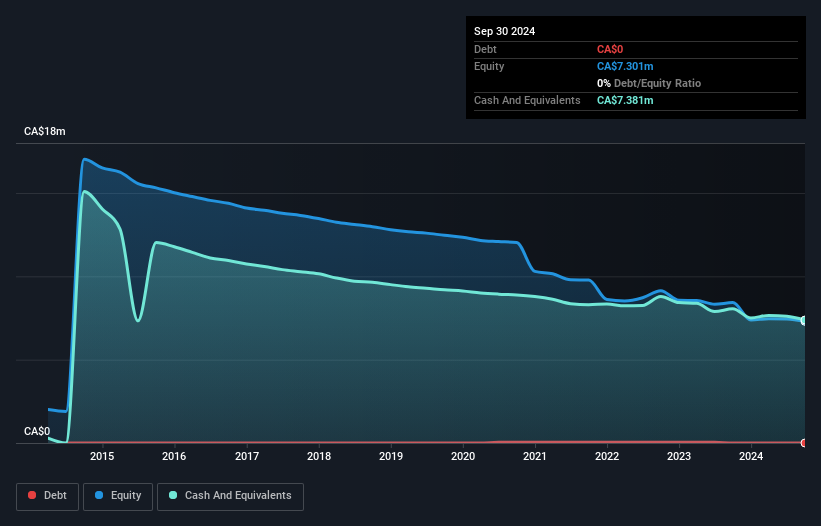

Red Light Holland, with a market cap of CA$16.07 million, is navigating the volatile landscape typical of penny stocks. Despite generating CA$5.49 million in revenue from its Pharmaceuticals segment, it remains unprofitable with a negative return on equity and increasing losses over five years. The company maintains a stable cash runway exceeding three years and has more cash than total debt, which provides some financial stability. Recent strategic alliances with Irvine Labs aim to enhance product commercialization through innovative preservation technology for psilocybin products, potentially opening new markets and revenue streams in emerging legal markets worldwide.

- Dive into the specifics of Red Light Holland here with our thorough balance sheet health report.

- Explore historical data to track Red Light Holland's performance over time in our past results report.

Capitan Investment (TSXV:CAI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Capitan Investment Ltd., along with its subsidiary, focuses on investing in real estate development projects and has a market capitalization of CA$4.35 million.

Operations: The company's revenue is primarily derived from the acquisition, exploration, and development of petroleum and natural gas reserves, generating CA$0.68 million.

Market Cap: CA$4.35M

Capitan Investment Ltd., with a market cap of CA$4.35 million, is a pre-revenue entity primarily focused on real estate development. The company reported a net loss of CA$0.045 million for the third quarter, showing slight improvement from the previous year. Despite its unprofitability and negative return on equity, Capitan is debt-free and has strong short-term assets exceeding both its short- and long-term liabilities. The firm boasts an experienced board and maintains a cash runway exceeding three years, providing some stability amidst high share price volatility typical of penny stocks in Canada.

- Click here and access our complete financial health analysis report to understand the dynamics of Capitan Investment.

- Review our historical performance report to gain insights into Capitan Investment's track record.

Make It Happen

- Unlock our comprehensive list of 937 TSX Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:TRIP

Red Light Holland

Engages in the production, growth, and sale of functional mushrooms and mushroom home grow kits to the recreational market in North America and Europe.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives