- Canada

- /

- Real Estate

- /

- TSX:SVI

StorageVault Canada (TSX:SVI) Valuation in Focus After $30M Property Gain and Toronto Expansion

Reviewed by Kshitija Bhandaru

StorageVault Canada (TSX:SVI) just closed the books on a meaningful property expropriation, resulting in a $30 million gain. At the same time, it is managing two new Toronto locations, which could shift its long-term value story.

See our latest analysis for StorageVault Canada.

StorageVault’s latest $30 million expropriation gain and its Toronto expansion have come during a period of renewed investor interest. While share price momentum has built with a 22% gain year-to-date and a 17% move over the past 90 days, the one-year total shareholder return sits at just under 4%. This reminds us that operational wins can take time to translate into sustained shareholder gains.

If this shift in StorageVault’s story has you curious, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With major asset gains and an expansion in Toronto boosting its profile, is StorageVault’s current share price a bargain for investors, or has the market already factored in the company’s future growth potential?

Price-to-Sales of 5.5x: Is it justified?

StorageVault Canada currently trades at a price-to-sales ratio of 5.5x, making it appear more expensive than its sector peers. The last close price of CA$4.84 reflects this premium and raises key questions about valuation and future growth expectations.

The price-to-sales ratio compares a company’s share price to its revenues, indicating how much investors are willing to pay per dollar of sales. For real estate management and development companies, this metric can signal the market’s confidence in stable cash flows and future revenue potential, especially if profits are volatile or negative.

StorageVault’s 5.5x ratio stands out compared to the Canadian real estate industry average of 2.4x and the peer average of 5.2x. In addition, it is above an estimated “fair” price-to-sales level of 4.3x. This suggests the market may be factoring in higher expectations for revenue growth or strategic moves. If sentiment shifts or results fall short, there could be a re-rating towards this fair ratio.

Explore the SWS fair ratio for StorageVault Canada

Result: Price-to-Sales of 5.5x (OVERVALUED)

However, slowing annual revenue growth and a history of negative net income may prompt investors to reconsider how much upside remains.

Find out about the key risks to this StorageVault Canada narrative.

Another View: What Does Our DCF Model Show?

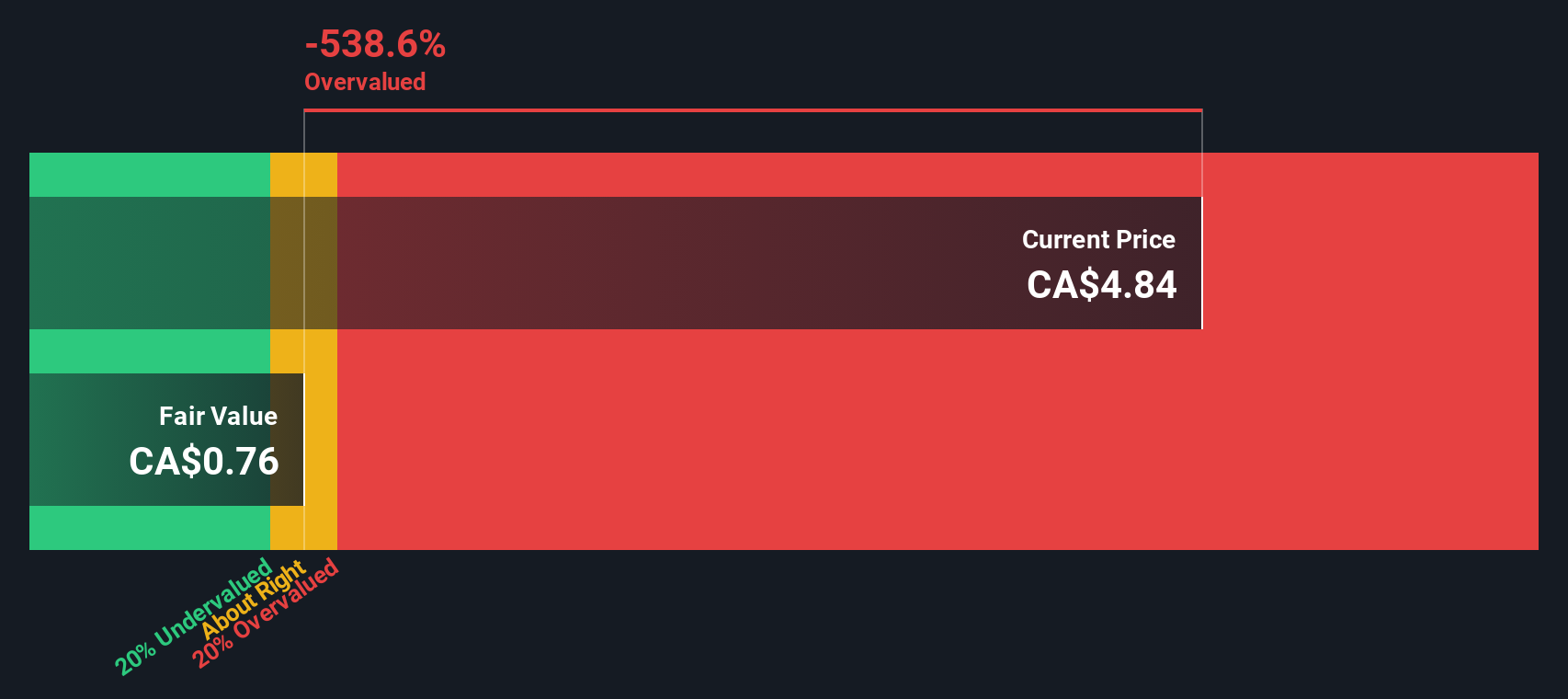

While the price-to-sales ratio paints StorageVault as expensive compared to industry norms, our DCF model offers a different perspective. According to this approach, the current share price of CA$4.84 is actually above our fair value estimate of CA$0.75. This suggests StorageVault may be overvalued. Does this mean further upside is limited, or is the market betting on a brighter future?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StorageVault Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StorageVault Canada Narrative

If you think the story could unfold differently or want to dig deeper yourself, you can quickly shape your own view in just a few minutes with Do it your way.

A great starting point for your StorageVault Canada research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the market by checking out fast-moving stocks targeting next-wave innovation. Don’t let your portfolio miss out on tomorrow’s winners.

- Uncover game-changers transforming healthcare by checking out these 33 healthcare AI stocks with the latest breakthroughs in AI-powered treatments.

- Tap into high-yield opportunities and strengthen your passive income stream using these 18 dividend stocks with yields > 3% boasting reliable payouts over 3%.

- Experience the potential of cryptocurrencies and blockchain adoption firsthand with these 79 cryptocurrency and blockchain stocks and stay a step ahead of digital finance trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVI

StorageVault Canada

Owns, manages, and rents self-storage and portable storage space to individual and commercial customers in Canada.

Imperfect balance sheet with concerning outlook.

Market Insights

Community Narratives