- Canada

- /

- Real Estate

- /

- TSX:SVI

StorageVault Canada (TSX:SVI) Revenue Growth Beats Market Average, Reinforcing Bullish Narratives

Reviewed by Simply Wall St

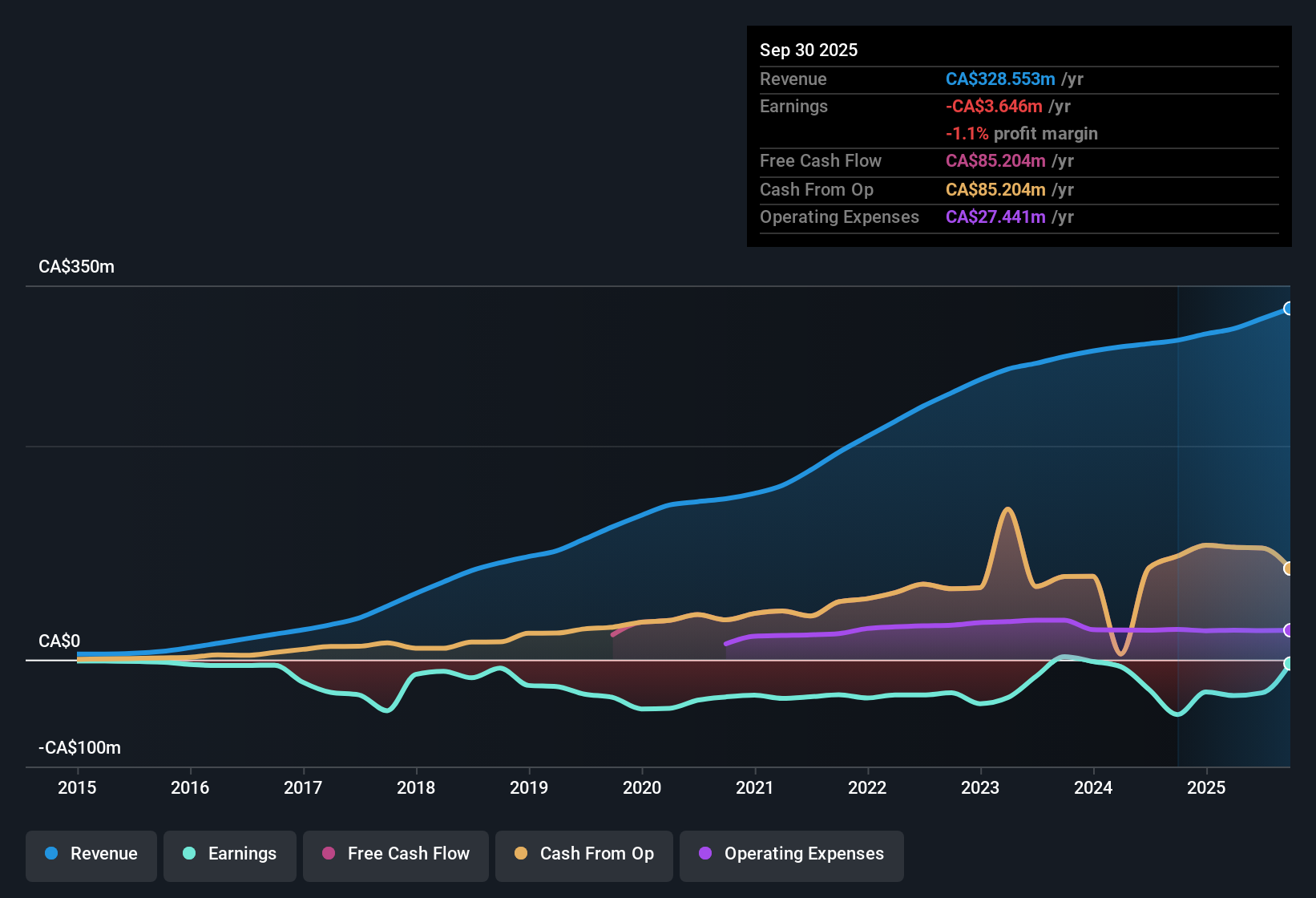

StorageVault Canada (TSX:SVI) is forecast to grow revenue at 5.2% per year, outpacing the broader Canadian market’s projection of 4.9% annual growth. While the company remains unprofitable, losses have narrowed by an average of 7.3% per year over the past five years, with no signs yet of turning a net profit. The major draw for investors is StorageVault’s robust top-line growth. However, questions around ongoing unprofitability and a premium valuation compared to peers remain central to the story.

See our full analysis for StorageVault Canada.With the headline results set, the next step is to see how they compare to the narratives shaping market sentiment. Some expectations could get validated, while others may need a second look.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow by 7.3% Per Year, Yet Profit Still Out of Reach

- Despite ongoing unprofitability, StorageVault's annual losses have been shrinking by an average of 7.3% over the past five years, signaling concrete progress on cost discipline but still no net profit achieved in any recent period.

- Market commentary highlights that bullish investors often point to consistent loss reduction as evidence the business model is gaining traction. However,

- the absence of any positive net margin so far challenges the idea that StorageVault can meaningfully flip to profitability simply through organic growth,

- and with no material change in profit margins, questions linger on how soon positive cash flow might materialize even as revenue grows.

Premium Price-to-Sales: 5.7x vs. 2.4x Sector

- StorageVault trades at a Price-To-Sales ratio of 5.7x, which stands well above the Canadian Real Estate industry average of 2.4x and is also higher than its peer average of 5.4x.

- Prevailing analysis points out that while a higher P/S can reflect quality or growth expectations,

- the company's P/S premium is difficult to justify given its ongoing unprofitability and the fact that the share price of CA$4.95 is more than six times higher than its DCF fair value of CA$0.79,

- so current pricing leaves little margin for error if revenue growth ever slows below market expectations.

Valuation Disconnect Widens as Price Diverges From Fair Value

- The current share price of CA$4.95 massively exceeds the estimated DCF fair value of CA$0.79, creating a disconnect that signals investors are paying a premium far above modeled long-term cash flows.

- Analysis emphasizes that this gap fuels debate among investors, since

- sector optimism and the draw of defensive, recurring revenues have helped sustain StorageVault’s valuation momentum even in the absence of profitability,

- but this leaves the stock vulnerable if sentiment or sector trends shift, as the valuation cushion relative to modeled fair value is so thin.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on StorageVault Canada's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

StorageVault’s premium valuation, persistent losses, and lack of positive net margin highlight real risks if revenue growth falters or if market sentiment turns.

If you want to target companies with better value fundamentals and less downside risk, check out these 875 undervalued stocks based on cash flows to spot attractively priced alternatives that could offer much stronger upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVI

StorageVault Canada

Owns, manages, and rents self-storage and portable storage space to individual and commercial customers in Canada.

Imperfect balance sheet with concerning outlook.

Market Insights

Community Narratives