- Canada

- /

- Real Estate

- /

- TSX:SVI

Property Gain and Toronto Expansion Could Be a Game Changer for StorageVault Canada (TSX:SVI)

Reviewed by Sasha Jovanovic

- Earlier this week, StorageVault Canada Inc. announced it has finalized and received proceeds from the expropriation of one of its properties, recording an additional CA$15 million gain and bringing the total realized gain to approximately CA$30 million.

- Alongside this, the company expanded its third-party management platform by adding high-profile locations in downtown Toronto and at the intersection of Highway 401 and Highway 400, reinforcing its operational footprint in key urban markets.

- To understand how these property gains and management expansion shape StorageVault's investment narrative, we’ll focus on the growth in its Toronto urban market presence.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is StorageVault Canada's Investment Narrative?

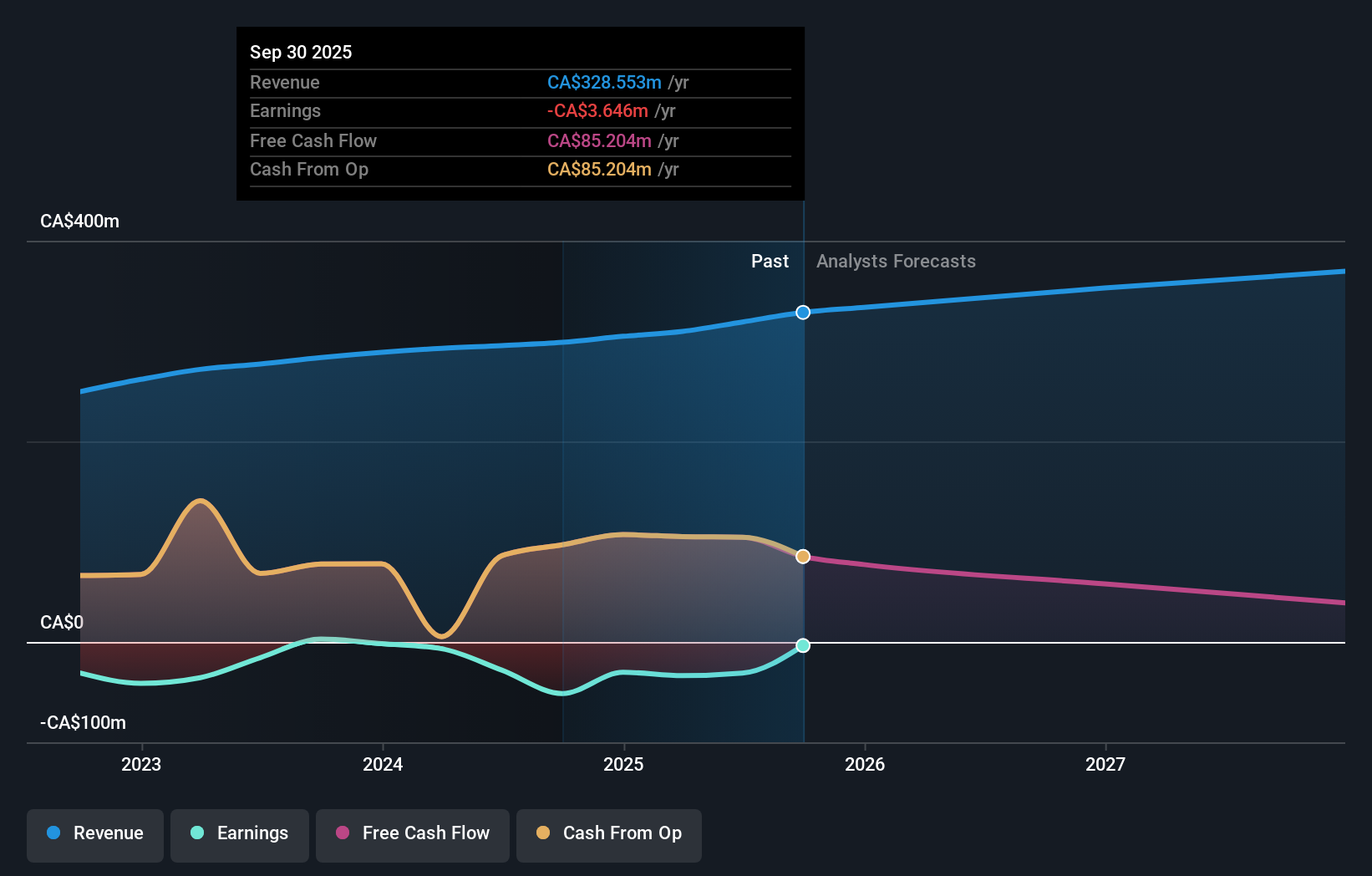

Owning StorageVault Canada often comes down to believing in steady self-storage demand, the company’s ability to execute disciplined growth, even while unprofitable, and potential for scale in high-density markets. The just-announced CA$30 million gain from a property expropriation provides a short-term financial boost and highlights the hidden asset value in StorageVault’s portfolio, but, since expropriations are non-recurring, the direct impact on long-term cash flows or underlying earnings potential is likely to be limited. What stands out more is the rapid expansion of its management platform in critical Toronto locations; this could strengthen StorageVault’s competitive foothold and support its revenue growth ambitions in a crowded market. However, persistent net losses, a history of substantial insider selling, and recent drops from key stock indexes mean risks remain top of mind, possibly amplifying market volatility and impacting investor confidence, especially now, as new catalysts shift the narrative.

But while urban expansion is compelling, financial losses remain a concern investors should not overlook.

Exploring Other Perspectives

Explore another fair value estimate on StorageVault Canada - why the stock might be worth as much as CA$1.24!

Build Your Own StorageVault Canada Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StorageVault Canada research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free StorageVault Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StorageVault Canada's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVI

StorageVault Canada

Owns, manages, and rents self-storage and portable storage space to individual and commercial customers in Canada.

Imperfect balance sheet with concerning outlook.

Market Insights

Community Narratives