- Canada

- /

- Real Estate

- /

- TSX:MEQ

How Strong Net Income Growth at Mainstreet Equity (TSX:MEQ) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Mainstreet Equity Corp. reported its earnings for the third quarter and nine months ended June 30, 2025, showing sales of C$69.67 million and net income of C$46.56 million for the quarter, both higher than the same period last year.

- Continued growth in earnings per share points to strong operational performance and profitability compared to previous results.

- We’ll explore how this strong net income growth shapes Mainstreet Equity’s investment narrative and the company’s overall performance outlook.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Mainstreet Equity's Investment Narrative?

To be a shareholder in Mainstreet Equity, it’s important to believe in the company’s consistent operational momentum and the prospects for its rental property business, while staying mindful of potential earnings volatility. The recent quarterly results showed another clear jump in revenue and net income, reinforcing a strong profitability story. This latest news could reshape the short-term narrative: with high net margins (amplified by a one-off gain), headline numbers appear impressive, but core recurring earnings are less robust than they seem. While this bump might bring positive short-term sentiment, the updated risk is that earnings may cool significantly, analysts have already forecast a steep multi-year profit decline, contrasting with the current streak of strong quarters. That said, the main catalysts remain future rental market trends, interest expenses, and any new portfolio moves, none of which fundamentally shifted with the latest report. Despite the recent results, swift changes in rental demand or financing costs could quickly affect performance.

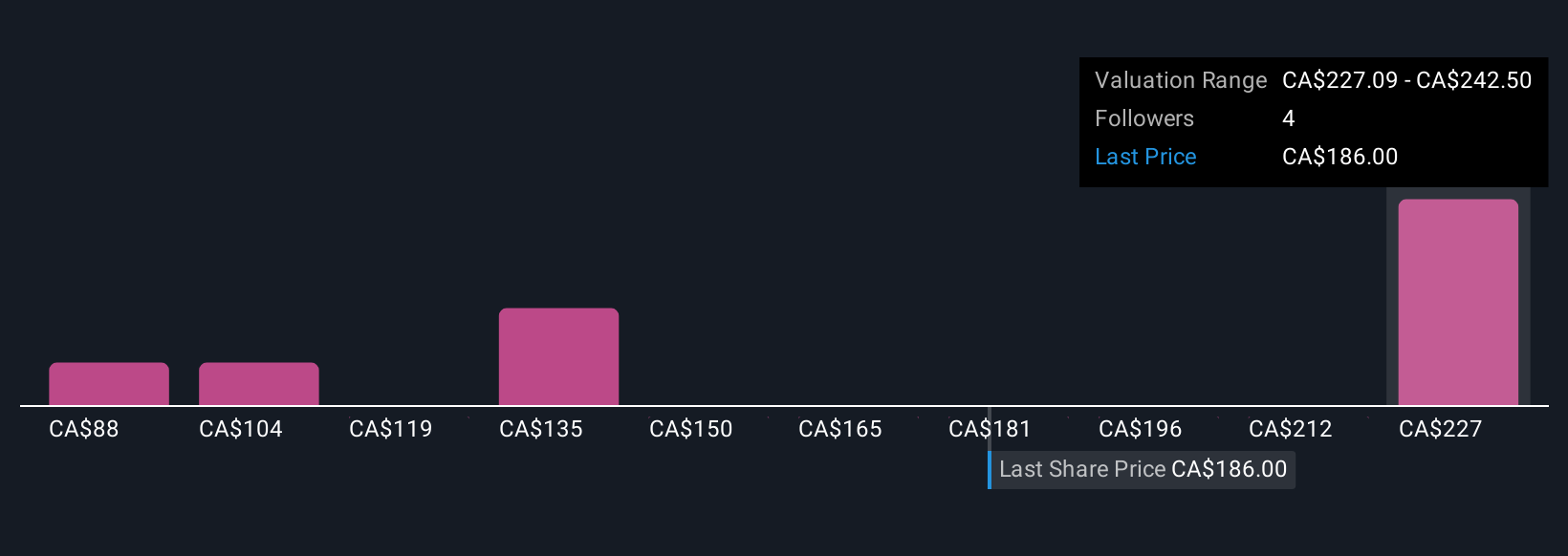

Mainstreet Equity's shares are on the way up, but they could be overextended by 35%. Uncover the fair value now.Exploring Other Perspectives

Explore 4 other fair value estimates on Mainstreet Equity - why the stock might be worth as much as 19% more than the current price!

Build Your Own Mainstreet Equity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mainstreet Equity research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mainstreet Equity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mainstreet Equity's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MEQ

Mainstreet Equity

Engages in the acquisition, redevelopment, repositioning, and management of mid-market residential rental apartment buildings in Western Canada.

Proven track record with low risk.

Market Insights

Community Narratives