- Canada

- /

- Real Estate

- /

- TSX:GDC

3 TSX Penny Stocks With Market Caps Below CA$200M

Reviewed by Simply Wall St

The Canadian stock market has experienced gains recently as trade tensions ease, with the U.S. reaching a new trade deal with the U.K. and planning talks with China. In such a climate, investors might consider exploring opportunities beyond well-known stocks, where penny stocks—typically smaller or newer companies—can offer unique prospects for growth and affordability. Although the term "penny stocks" might seem outdated, these investments remain relevant today, providing potential for strong financial performance when backed by solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.80 | CA$80.92M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.08 | CA$88.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.23 | CA$131.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.65 | CA$432.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.11 | CA$584.93M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.78 | CA$4.45M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.57 | CA$521.71M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.59 | CA$131.46M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.18M | ✅ 2 ⚠️ 3 View Analysis > |

| Enterprise Group (TSX:E) | CA$1.71 | CA$132.58M | ✅ 3 ⚠️ 5 View Analysis > |

Click here to see the full list of 900 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Genesis Land Development (TSX:GDC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genesis Land Development Corp. is an integrated land developer and residential home builder that owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, with a market cap of CA$178.22 million.

Operations: Genesis Land Development Corp. has not reported any specific revenue segments.

Market Cap: CA$178.22M

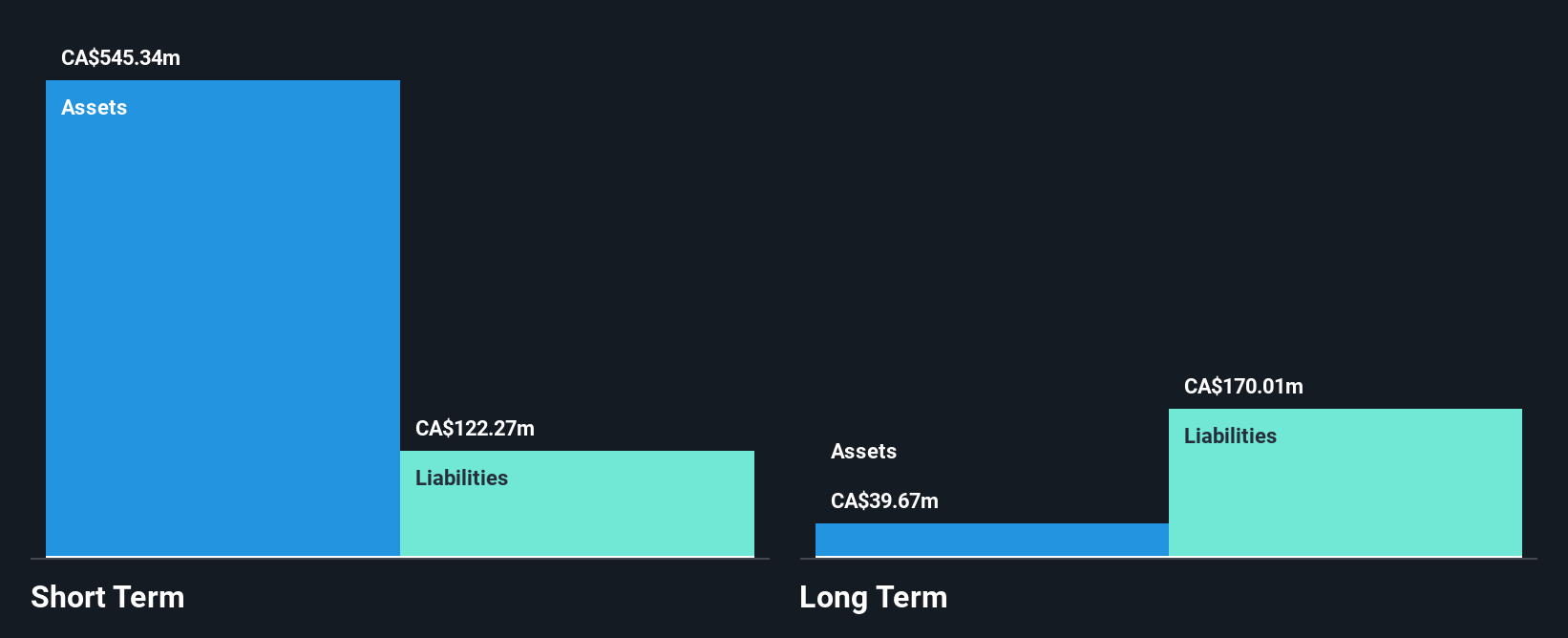

Genesis Land Development Corp. has demonstrated robust earnings growth, with a significant 81.6% increase over the past year, surpassing its five-year average and the broader real estate industry growth rate. Despite a stable weekly volatility and high-quality earnings, its recent financials show a decline in quarterly revenue to CA$58.21 million from CA$68.31 million year-on-year, alongside slightly reduced net income of CA$6.03 million. The company maintains strong asset coverage for liabilities and declared a special dividend of CA$0.105 per share, though it faces challenges with increased debt levels and an inexperienced management team averaging 1.2 years tenure.

- Dive into the specifics of Genesis Land Development here with our thorough balance sheet health report.

- Understand Genesis Land Development's track record by examining our performance history report.

Hemisphere Energy (TSXV:HME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hemisphere Energy Corporation acquires, explores, develops, and produces petroleum and natural gas interests in Canada with a market cap of CA$166.47 million.

Operations: The company's revenue is derived entirely from its petroleum and natural gas interests, amounting to CA$79.71 million.

Market Cap: CA$166.47M

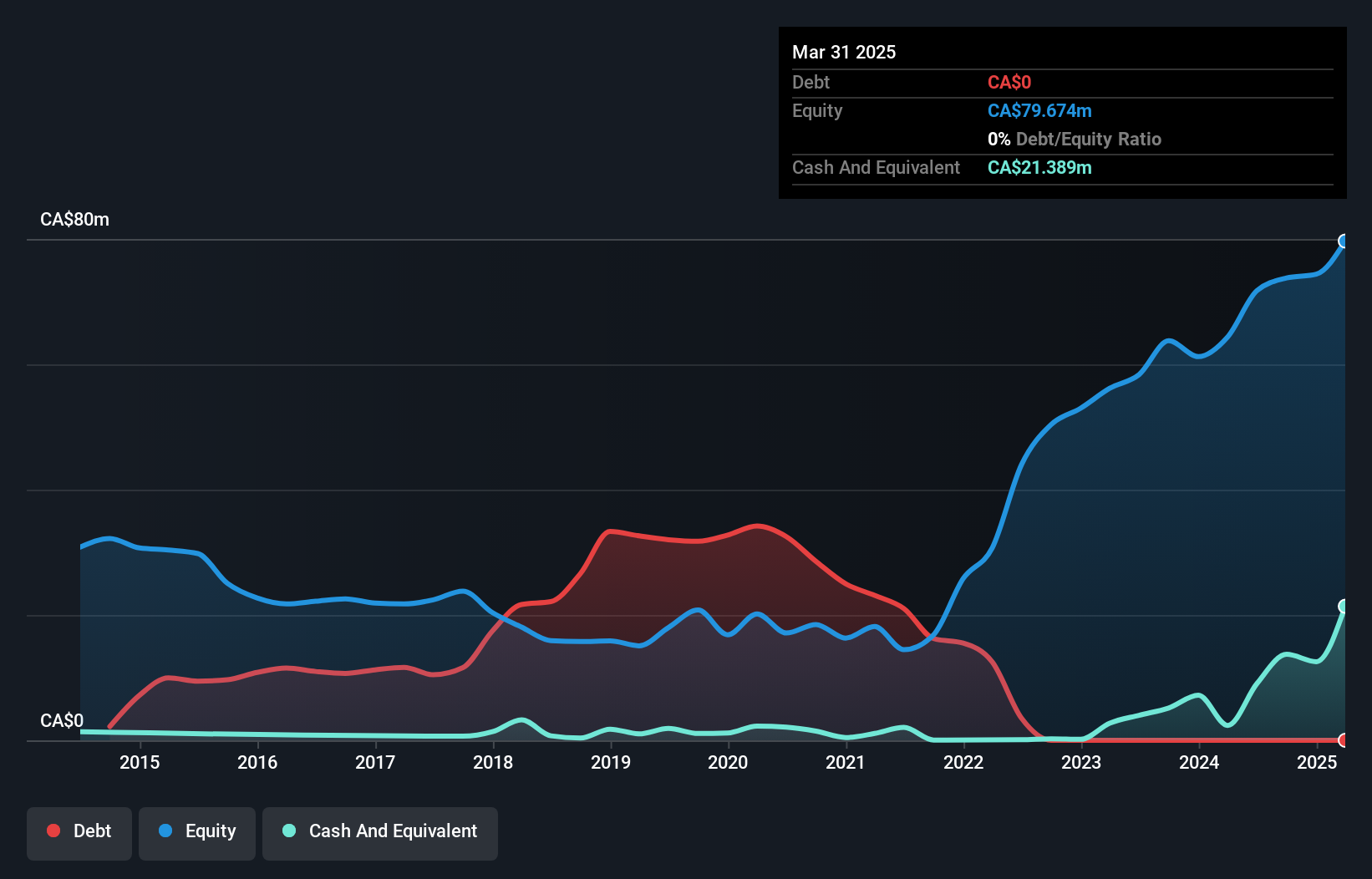

Hemisphere Energy Corporation has demonstrated solid financial performance with a revenue increase to CA$79.11 million and net income rising to CA$33.1 million for 2024, reflecting strong earnings growth of 36.8% over the past year. The company benefits from a seasoned management team and board, with no debt burden enhancing its financial stability. Despite short-term assets not fully covering long-term liabilities, Hemisphere's profitability is underscored by an outstanding return on equity of 44.5%. The recent special dividend announcement highlights confidence in its financial health, although future earnings are forecasted to decline by an average of 12.3% annually over the next three years.

- Jump into the full analysis health report here for a deeper understanding of Hemisphere Energy.

- Gain insights into Hemisphere Energy's outlook and expected performance with our report on the company's earnings estimates.

Century Lithium (TSXV:LCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Century Lithium Corp. is an exploration and development-stage company focused on the identification, acquisition, exploration, evaluation, and development of lithium and other mineral properties in the United States with a market cap of CA$56.81 million.

Operations: Century Lithium Corp. currently does not report any revenue segments as it is in the exploration and development stage, focusing on lithium and other mineral properties in the United States.

Market Cap: CA$56.81M

Century Lithium Corp. is a pre-revenue exploration and development-stage company with a market cap of CA$56.81 million, focusing on lithium projects in the U.S. The company recently announced potential CAPEX reductions of up to 25% for its Angel Island project, following an internal Optimization Study aimed at streamlining processes and reducing costs. Despite being debt-free, Century Lithium faces challenges with less than a year's cash runway and ongoing auditor concerns about its ability to continue as a going concern. Recent policy developments in the U.S. may provide strategic opportunities for securing domestic lithium supply chains.

- Take a closer look at Century Lithium's potential here in our financial health report.

- Review our historical performance report to gain insights into Century Lithium's track record.

Make It Happen

- Discover the full array of 900 TSX Penny Stocks right here.

- Contemplating Other Strategies? AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GDC

Genesis Land Development

An integrated land developer and residential home builder, owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, Canada.

Solid track record and good value.

Market Insights

Community Narratives