- Canada

- /

- Real Estate

- /

- TSX:FSV

FirstService (TSX:FSV) Margin Jump Reinforces Bullish Narratives Despite Valuation Risks

Reviewed by Simply Wall St

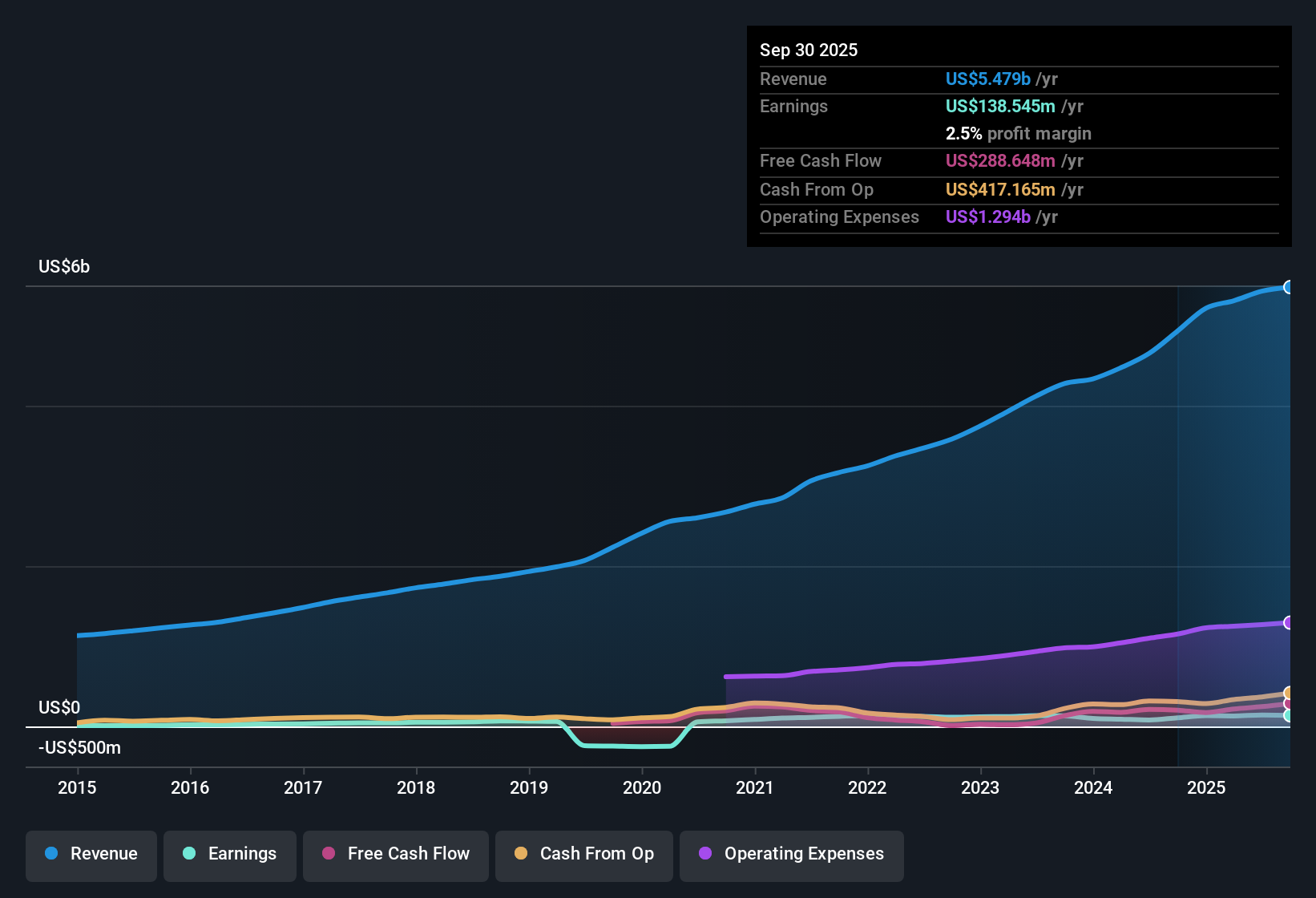

FirstService (TSX:FSV) posted a net profit margin of 2.6%, up from 1.7% a year ago. Earnings jumped 76.8% over the past year, far outpacing the 3.9% average annual growth of the last five years. Revenue is projected to rise 6.5% per year, well above the Canadian market’s 4.9% forecast. Earnings are expected to expand 25.46% annually, outstripping the market’s 12.2% pace. With these improvements in both profit margins and growth rates, the latest figures point to clear operational momentum and efficient execution.

See our full analysis for FirstService.Next, we put these headline numbers in context by comparing them with the most widely followed narratives shaping market expectations. This highlights where the data strengthens or undermines the big-picture stories.

See what the community is saying about FirstService

Margin Expansion Drives Profit Quality

- Profit margins have increased from 1.7% to 2.6% in the latest period, highlighting improved operational efficiency and translating a greater share of revenue into actual profits.

- According to the analysts' consensus view, these margin gains are attributed to ongoing investments in technology and efficiency, which have already begun boosting free cash flow and are expected to keep supporting scalable earnings and incremental margin gains over the long term.

- Consensus notes that service and repair work is up, with technology upgrades streamlining labor and client interface costs and contributing to the margin expansion.

- However, consensus also cautions that recent efficiency-driven margin drivers may moderate going forward, making continued top-line growth increasingly important for further improvements.

- A strong margin trend helps explain why analysts are looking to future efficiencies for earnings growth. See how this shapes the company’s outlook in the consensus analysis. 📊 Read the full FirstService Consensus Narrative.

Industry-Leading Revenue Trajectory

- FirstService is projected to grow revenue at 6.5% annually, outpacing the broader Canadian market’s 4.9% and supporting a long-term expansion story that builds on sustained contract wins and recurring demand.

- Analysts' consensus view emphasizes that rising demand for property maintenance and renovation, along with the company’s steady net contract wins in residential management, underpins expected revenue gains and a promising outlook for sequential improvement towards historical growth rates.

- Consensus cites that increased outsourcing by property owners has enabled FirstService to expand national contracts and capture more share in restoration and service-based businesses, directly fueling the higher forecast revenue pace.

- Ongoing acquisitions in markets like Fire Protection and Roofing are expanding the company’s reach and capabilities, which consensus sees as driving both top-line growth and operating leverage.

Valuation Premium Versus Industry Peers

- FirstService trades at a price-to-earnings (P/E) ratio of 53.5x, a stark premium to the Canadian real estate industry average of 8.1x, though just below similar peers at 55.9x. Its current share price of CA$230.39 sits below the analyst target price of CA$305.06.

- Analysts' consensus view interprets this lofty multiple as a reflection of both strong historical earnings growth and expectations for future margin and revenue gains. They also flag that sustaining this valuation will depend on achieving forecast improvements and navigating risks like integration challenges from acquisitions and volatile profits tied to weather events.

- Consensus highlights that while FirstService’s DCF fair value stands at CA$192.60, this is well below the current share price, which increases the importance of continued outperformance to justify the premium versus industry norms.

- Bears focus on flat or declining organic growth segments and large macro uncertainties as factors that could cap upside and compress the valuation over time if not resolved.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for FirstService on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your take in just a few minutes and shape your own narrative: Do it your way

A great starting point for your FirstService research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite solid growth, FirstService’s elevated valuation and reliance on sustained outperformance may expose investors to downside if targets are not met or if industry conditions worsen.

If you’re concerned about paying a premium, discover stronger value opportunities meeting more reasonable cash flow criteria with our these 868 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FSV

FirstService

Provides residential property management and other essential property services to residential and commercial customers in the United States and Canada.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion