- Canada

- /

- Real Estate

- /

- TSX:CIGI

Colliers International Group (TSX:CIGI) Is Up 6.5% After Raising 2025 Guidance on Acquisitions and Revenue Growth

Reviewed by Simply Wall St

- Colliers International Group raised its 2025 earnings guidance, citing improved year-to-date operating results and the initial impact of recent acquisitions, including RoundShield, and outlined expectations for low-teens consolidated revenue growth supported by business expansion and leadership changes.

- The company’s updated outlook is contingent on reduced global trade uncertainty and more stable interest rates in the second half, signaling its reliance on an improving macroeconomic backdrop for sustained performance.

- We’ll now explore how Colliers’ increased earnings outlook and acquisition-driven strategy may influence its investment narrative and growth trajectory.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Colliers International Group Investment Narrative Recap

To be a shareholder in Colliers International Group, you need confidence in its ability to grow through acquisitions and business expansion, despite near-term headwinds in net earnings. The recent upgrade to 2025 earnings guidance amplifies market optimism, but the outlook remains closely tied to easing global trade uncertainties and interest rate stability, which are still the most important near-term catalyst and risk. This update does not materially alter the biggest risk of macroeconomic volatility impacting capital markets and leasing momentum.

Of the recent announcements, the launch of Harrison Street Private Wealth stands out, as it extends Colliers’ reach into differentiated alternative investments and broadens its client base. This initiative supports Colliers’ efforts to capture new revenue streams and reinforces the company’s focus on business expansion, which aligns with the raised guidance and provides a potential offset to cyclical risks facing its core segments.

Yet, in contrast to this positive outlook, investors should be aware of how persistent interest rate fluctuations could still threaten earnings in the second half of the year...

Read the full narrative on Colliers International Group (it's free!)

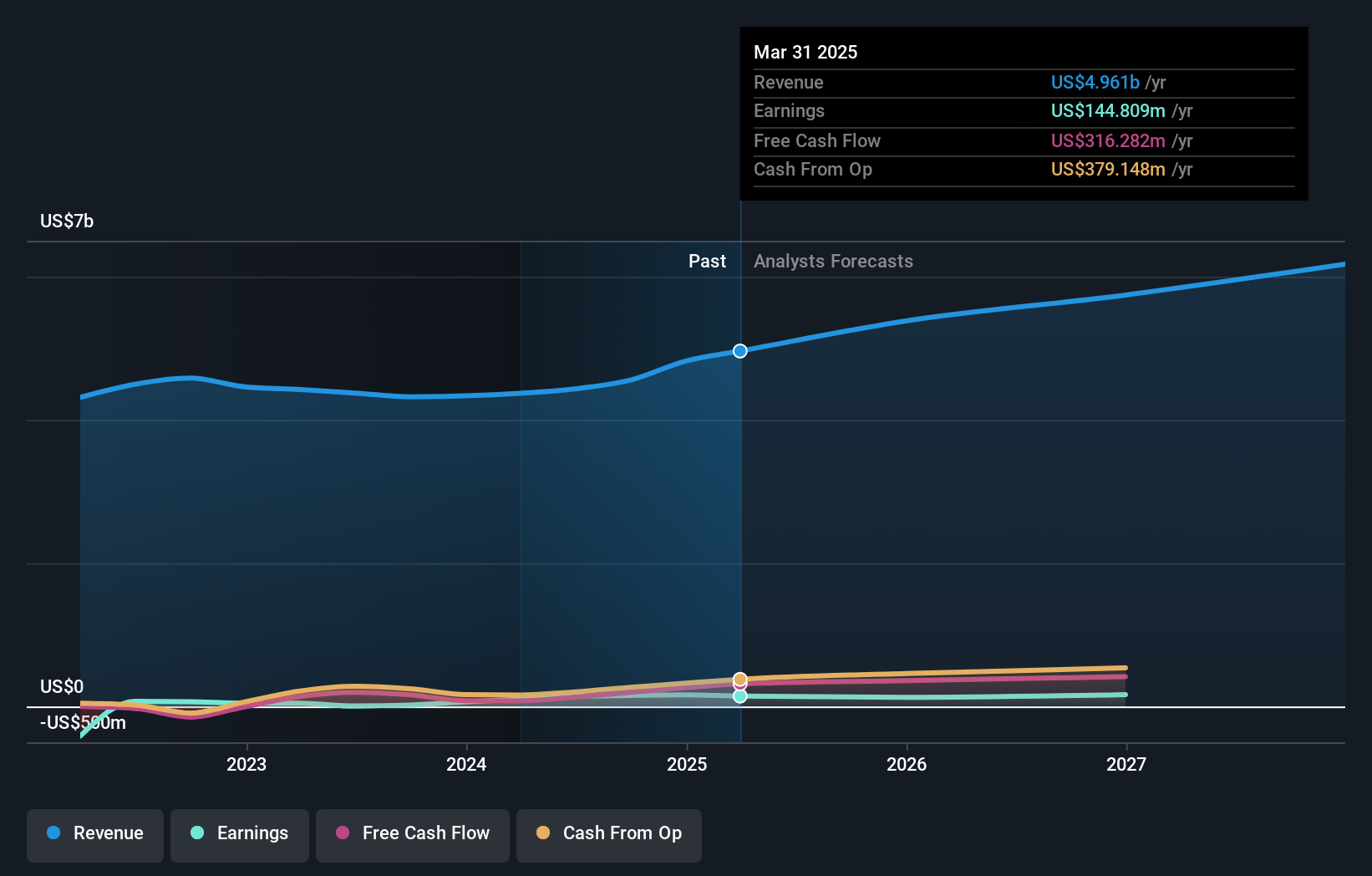

Colliers International Group's narrative projects $6.3 billion revenue and $163.8 million earnings by 2028. This requires 8.5% yearly revenue growth and a $19 million earnings increase from $144.8 million today.

Uncover how Colliers International Group's forecasts yield a CA$202.62 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for Colliers range widely from CA$202.62 to CA$337.85 across two analyses. While some expect outsized earnings growth, the persistent risk of macroeconomic uncertainty continues to influence opinions on the company’s performance, explore several viewpoints to inform your own.

Explore 2 other fair value estimates on Colliers International Group - why the stock might be worth just CA$202.62!

Build Your Own Colliers International Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Colliers International Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Colliers International Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Colliers International Group's overall financial health at a glance.

No Opportunity In Colliers International Group?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives