- Canada

- /

- Real Estate

- /

- TSX:AIF

Altus Group (TSX:AIF) Rises 6.5% After Jarislowsky, Fraser Lifts Stake to 13.68%

Reviewed by Sasha Jovanovic

- In June 2025, Jarislowsky, Fraser Limited publicly disclosed its acquisition of 1,353,581 common shares of Altus Group Limited, bringing its stake to approximately 13.68% of the company's outstanding shares. This substantial holding highlights heightened institutional interest and signals increased investor attention toward Altus Group’s role in commercial real estate analytics.

- We’ll examine how significant institutional buying activity could shape Altus Group’s investment narrative and longer-term growth expectations.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Altus Group Investment Narrative Recap

To be a shareholder in Altus Group, you need to believe in the growing digitization and data-driven transformation of commercial real estate, which supports structural demand for Altus’ analytics platforms and recurring software revenue. The recent increased stake by Jarislowsky, Fraser Limited signals deepened institutional confidence but does not fundamentally alter the most immediate catalyst, successful adoption of new products and ongoing client migration to upgraded platforms, or the key risk of prolonged softness in CRE activity impacting revenue and earnings visibility.

The company’s ongoing share buyback program, which saw over 1.9 million shares repurchased in Q2 2025 alone, stands out as especially relevant in this context. Continued buybacks can help support earnings per share and send a message of financial resilience, even as management contends with sector headwinds and revised guidance due to macroeconomic uncertainty.

However, investors should contrast this with the underlying risk if adoption of new platforms like Portfolio Manager proves slower than expected…

Read the full narrative on Altus Group (it's free!)

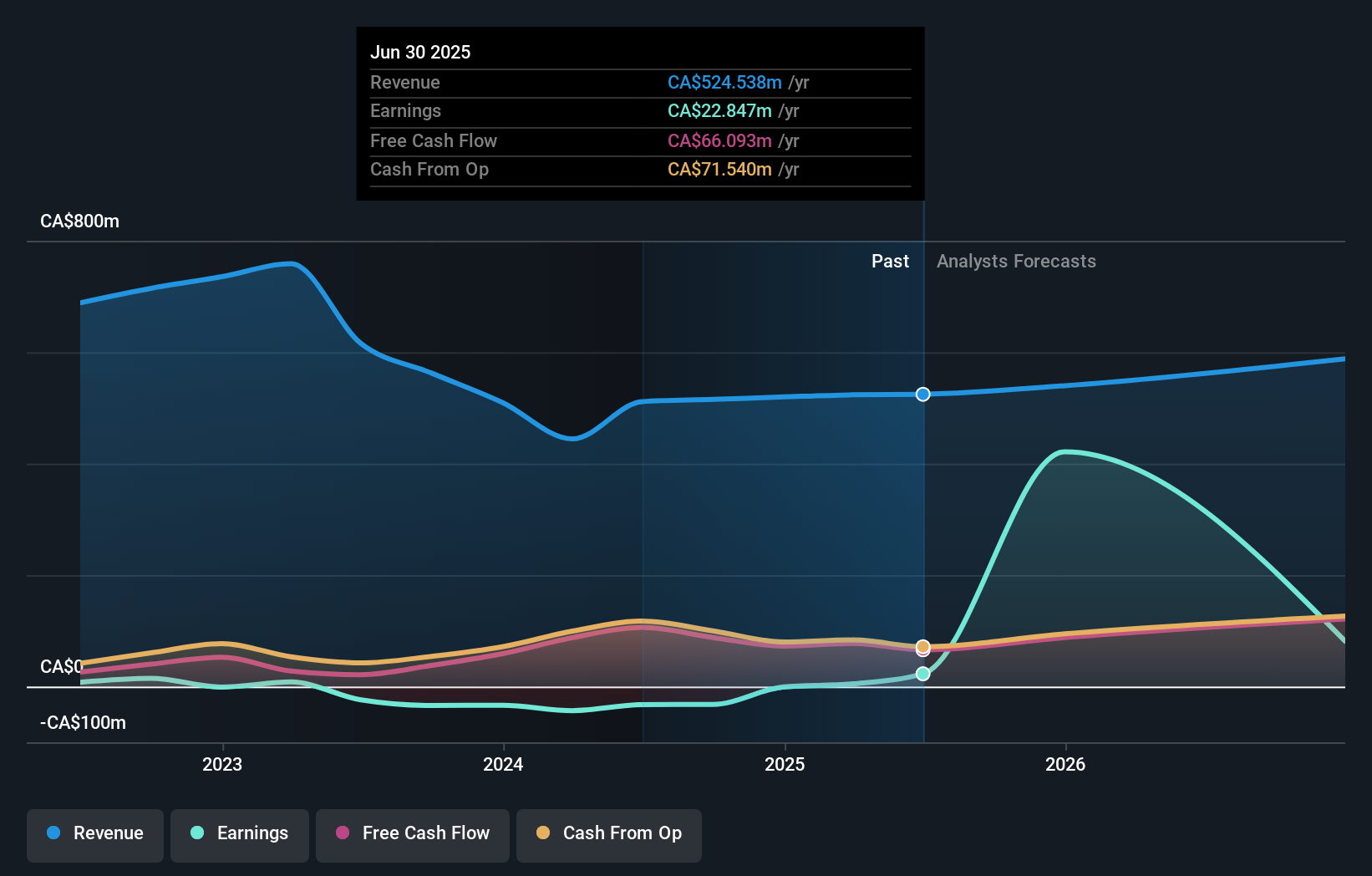

Altus Group's narrative projects CA$655.8 million revenue and CA$212.3 million earnings by 2028. This requires 7.7% yearly revenue growth and a CA$189.5 million earnings increase from CA$22.8 million today.

Uncover how Altus Group's forecasts yield a CA$64.29 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate Altus Group’s fair value between CA$62.73 and CA$64.29 per share. Several community views exist, yet a slower client shift to new analytics offerings could limit revenue momentum ahead.

Explore 2 other fair value estimates on Altus Group - why the stock might be worth as much as CA$64.29!

Build Your Own Altus Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Altus Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Altus Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Altus Group's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AIF

Altus Group

Provides asset and funds intelligence solutions for commercial real estate (CRE) in Canada, the United States, the United Kingdom, France, Europe, the Middle East, Africa, Australia, and the Asia Pacific.

Flawless balance sheet unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives