- Canada

- /

- Metals and Mining

- /

- TSXV:GT

3 TSX Penny Stocks With At Least CA$3M Market Cap

Reviewed by Simply Wall St

As we navigate 2025, the Canadian market is experiencing shifts driven by rising government bond yields and political changes, which have influenced stock valuations across various sectors. In this context, identifying promising investment opportunities requires a focus on fundamentals and financial strength. Penny stocks, though often seen as speculative due to their smaller size or newer status, can still offer significant value when backed by robust financials and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.02 | CA$392.54M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$125.06M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.22 | CA$948.57M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.49 | CA$13.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$629.3M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.32 | CA$225.41M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$180.43M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.95 | CA$133.43M | ★★★★★☆ |

Click here to see the full list of 929 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Consolidated Lithium Metals (TSXV:CLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Consolidated Lithium Metals Inc. focuses on acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$3.68 million.

Operations: Consolidated Lithium Metals Inc. has not reported any revenue segments.

Market Cap: CA$3.68M

Consolidated Lithium Metals Inc., with a market cap of CA$3.68 million, is pre-revenue and focuses on mineral exploration in Quebec. The company recently identified promising lithium soil anomalies at its Baillarge Property, positioning it as a high-priority target for 2025 exploration. Despite being debt-free, CLM faces challenges like shareholder dilution and increased volatility, with shares outstanding growing by 3.4% and weekly volatility rising to 63%. The management team is relatively new, averaging 1.1 years in tenure. While the company has raised additional capital to extend its cash runway beyond one month, profitability remains elusive.

- Click to explore a detailed breakdown of our findings in Consolidated Lithium Metals' financial health report.

- Examine Consolidated Lithium Metals' past performance report to understand how it has performed in prior years.

GT Resources (TSXV:GT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GT Resources Inc. is involved in the exploration and development of mineral resource properties, with a market cap of CA$9.72 million.

Operations: GT Resources Inc. currently does not report any revenue segments.

Market Cap: CA$9.72M

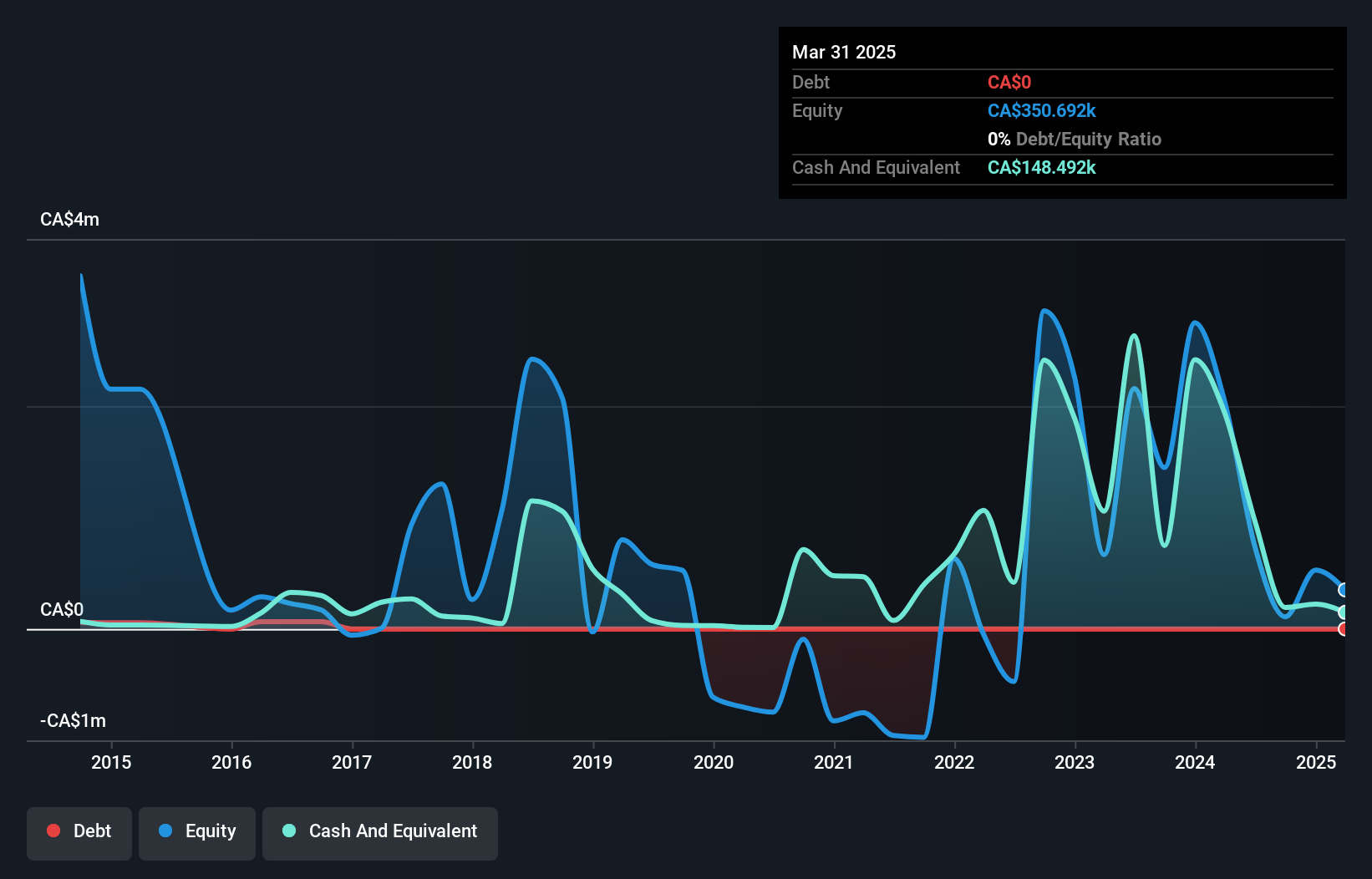

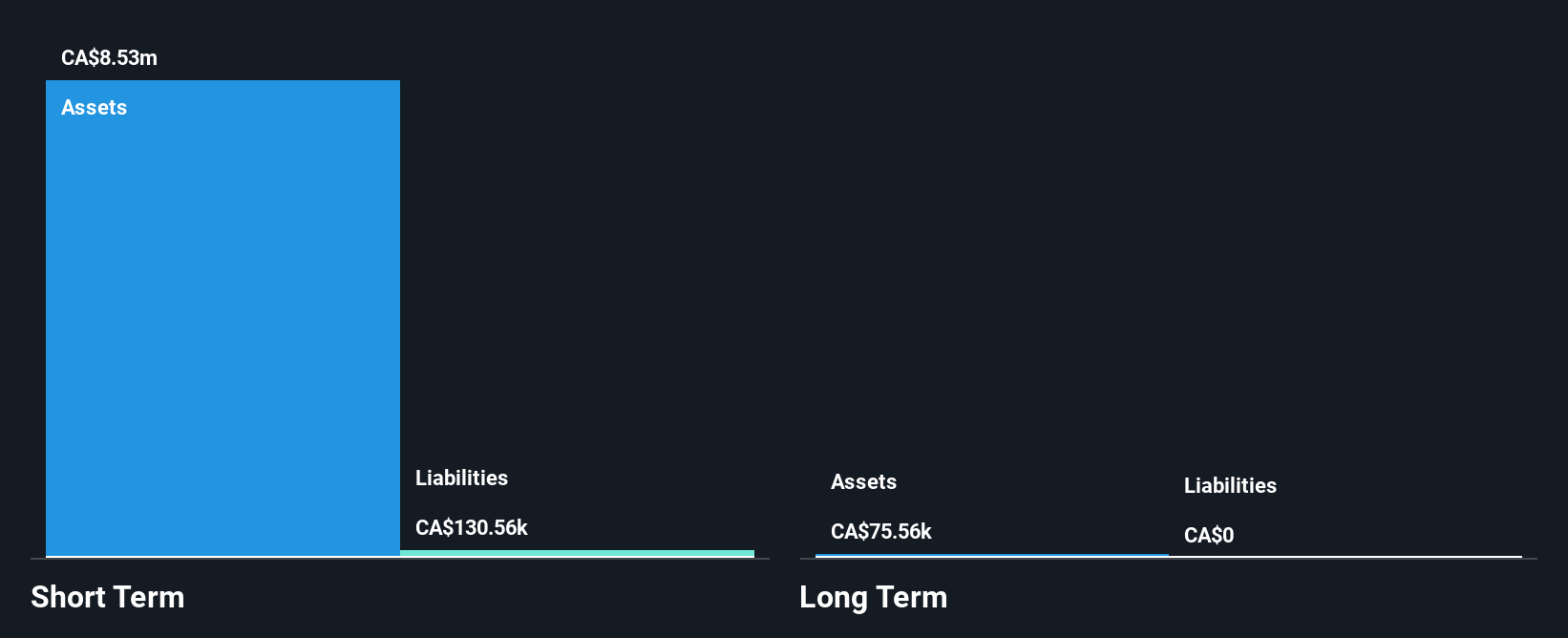

GT Resources Inc., with a market cap of CA$9.72 million, is pre-revenue and focuses on mineral exploration in Canada. Recent drilling at the Canalask Nickel-Copper Project revealed promising copper-gold mineralization and significant nickel deposits, indicating potential resource expansion. However, GT remains unprofitable with losses increasing over the past five years. The company is debt-free and has sufficient cash runway for nearly two years despite shareholder dilution of 8.2% last year. Its management team is experienced, but the volatile share price presents challenges for investors seeking stability in penny stocks within this sector.

- Click here and access our complete financial health analysis report to understand the dynamics of GT Resources.

- Examine GT Resources' earnings growth report to understand how analysts expect it to perform.

Voyageur Pharmaceuticals (TSXV:VM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Voyageur Pharmaceuticals Ltd., along with its subsidiaries, focuses on acquiring, exploring, and developing raw materials for pharmaceutical products in British Columbia, Canada, and Utah, with a market cap of CA$19.53 million.

Operations: Voyageur Pharmaceuticals Ltd. has not reported any specific revenue segments.

Market Cap: CA$19.53M

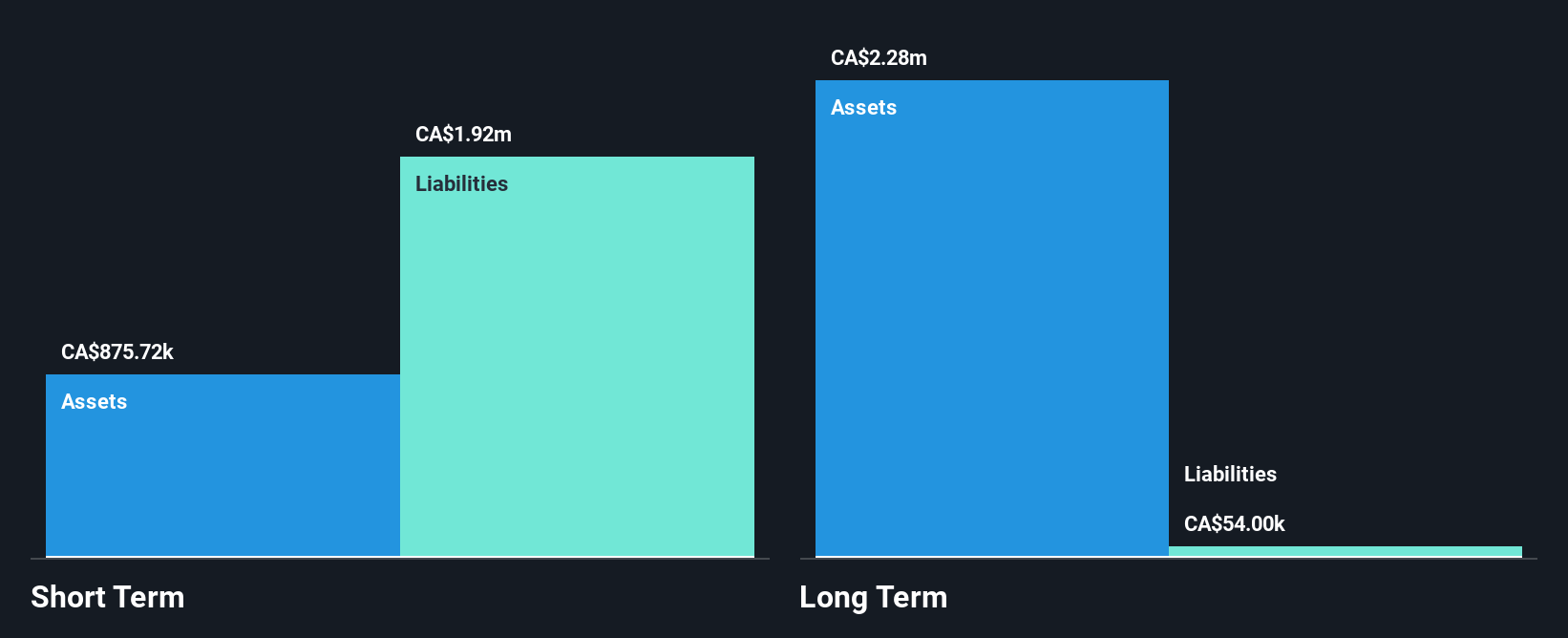

Voyageur Pharmaceuticals Ltd., with a market cap of CA$19.53 million, is pre-revenue and focuses on raw material development for pharmaceuticals. The company recently announced a Letter of Intent with a large multinational, aiming to enhance production efficiency for contrast media products, potentially diversifying its portfolio. Despite this strategic move, Voyageur remains unprofitable with increasing losses over recent years and has faced shareholder dilution. Its short-term liabilities exceed assets, but the company has raised additional capital through private placements to support operations. Management is experienced; however, the board's inexperience may impact strategic execution.

- Get an in-depth perspective on Voyageur Pharmaceuticals' performance by reading our balance sheet health report here.

- Gain insights into Voyageur Pharmaceuticals' past trends and performance with our report on the company's historical track record.

Key Takeaways

- Get an in-depth perspective on all 929 TSX Penny Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GT

GT Resources

Engages in the exploration and development of mineral resource properties in Canada and Finland.

Flawless balance sheet moderate.

Market Insights

Community Narratives