The Canadian market has shown resilience, supported by strong consumer spending and positive real wage gains, despite challenges like elevated inflation and higher interest rates. In light of these economic conditions, investors often seek stocks with robust financial health that can offer growth potential. Penny stocks, though an outdated term, continue to attract attention for their ability to provide value and growth opportunities in smaller or newer companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$118.05M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$556.63M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$223.45M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.475 | CA$968.15M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.23 | CA$32.24M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.08 | CA$3.22B | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.87 | CA$185.31M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.85 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ThreeD Capital (CNSX:IDK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ThreeD Capital Inc. is a venture capital firm that focuses on seed/startup, early venture, and growth capital opportunistic investments, with a market cap of CA$10.20 million.

Operations: The company generates CA$7.95 million in revenue from its investing activities.

Market Cap: CA$10.2M

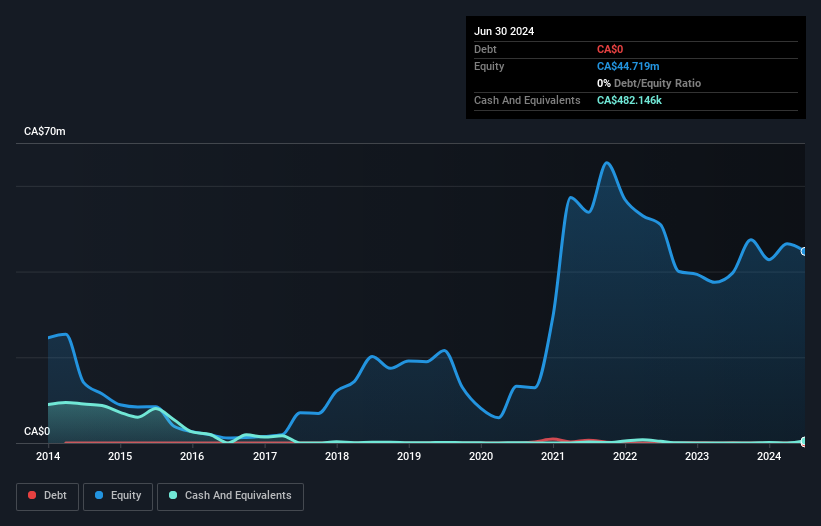

ThreeD Capital Inc., with a market cap of CA$10.20 million, is currently pre-revenue, reporting only CA$0.12 million in revenue for the recent quarter compared to CA$7.72 million a year ago, resulting in a net loss of CA$1.1 million. Despite its unprofitability and shareholder dilution over the past year, ThreeD Capital maintains financial resilience with short-term assets covering both short and long-term liabilities and no debt on its balance sheet. The company has also completed share buybacks representing 4.82% of shares outstanding, indicating strategic efforts to manage equity value amidst volatile earnings performance.

- Dive into the specifics of ThreeD Capital here with our thorough balance sheet health report.

- Evaluate ThreeD Capital's historical performance by accessing our past performance report.

illumin Holdings (TSX:ILLM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: illumin Holdings Inc. is a technology company that offers digital media solutions across the United States, Canada, Europe, Latin America, and internationally with a market cap of CA$99.63 million.

Operations: The company generates CA$127.47 million in revenue from its Internet Information Providers segment.

Market Cap: CA$99.63M

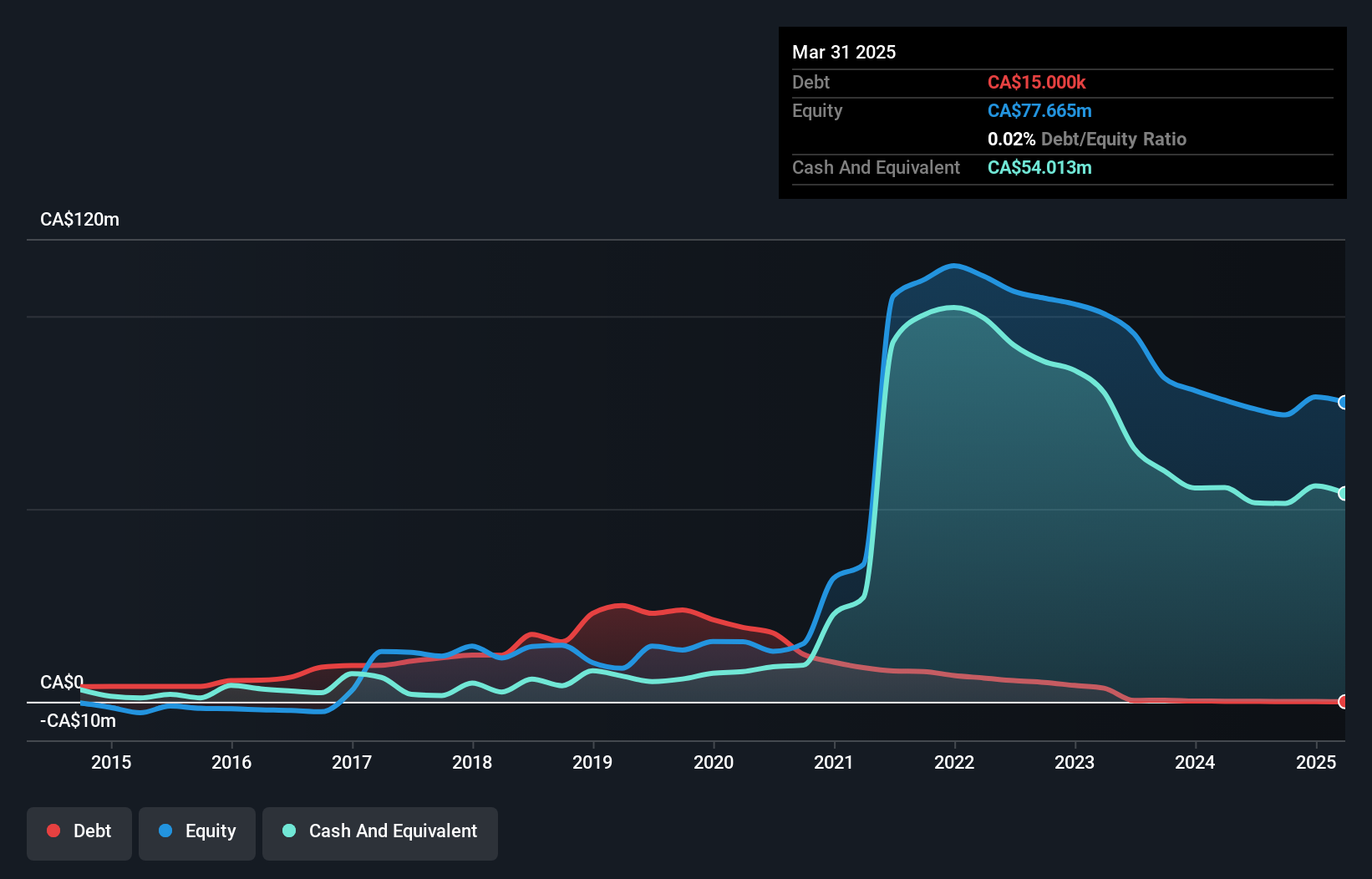

illumin Holdings, with a market cap of CA$99.63 million, is currently unprofitable but shows promising revenue growth, reporting CA$36.31 million for Q3 2024 compared to CA$29.63 million a year ago. The company has more cash than total debt and its short-term assets cover both short and long-term liabilities, suggesting financial stability despite ongoing losses. Analysts expect significant earnings growth of 123.33% annually, although past losses have increased by 21.4% per year over five years. Recent share buybacks totaling 7.26% indicate efforts to enhance shareholder value amid stable weekly volatility at 6%.

- Click here to discover the nuances of illumin Holdings with our detailed analytical financial health report.

- Review our growth performance report to gain insights into illumin Holdings' future.

Telo Genomics (TSXV:TELO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Telo Genomics Corp., a molecular diagnostics company, focuses on developing and commercializing predictive technological products to personalize treatment plans for patients with specific conditions primarily in Canada, with a market cap of CA$9.69 million.

Operations: Currently, there are no reported revenue segments for the molecular diagnostics firm that develops predictive technological products in Canada.

Market Cap: CA$9.69M

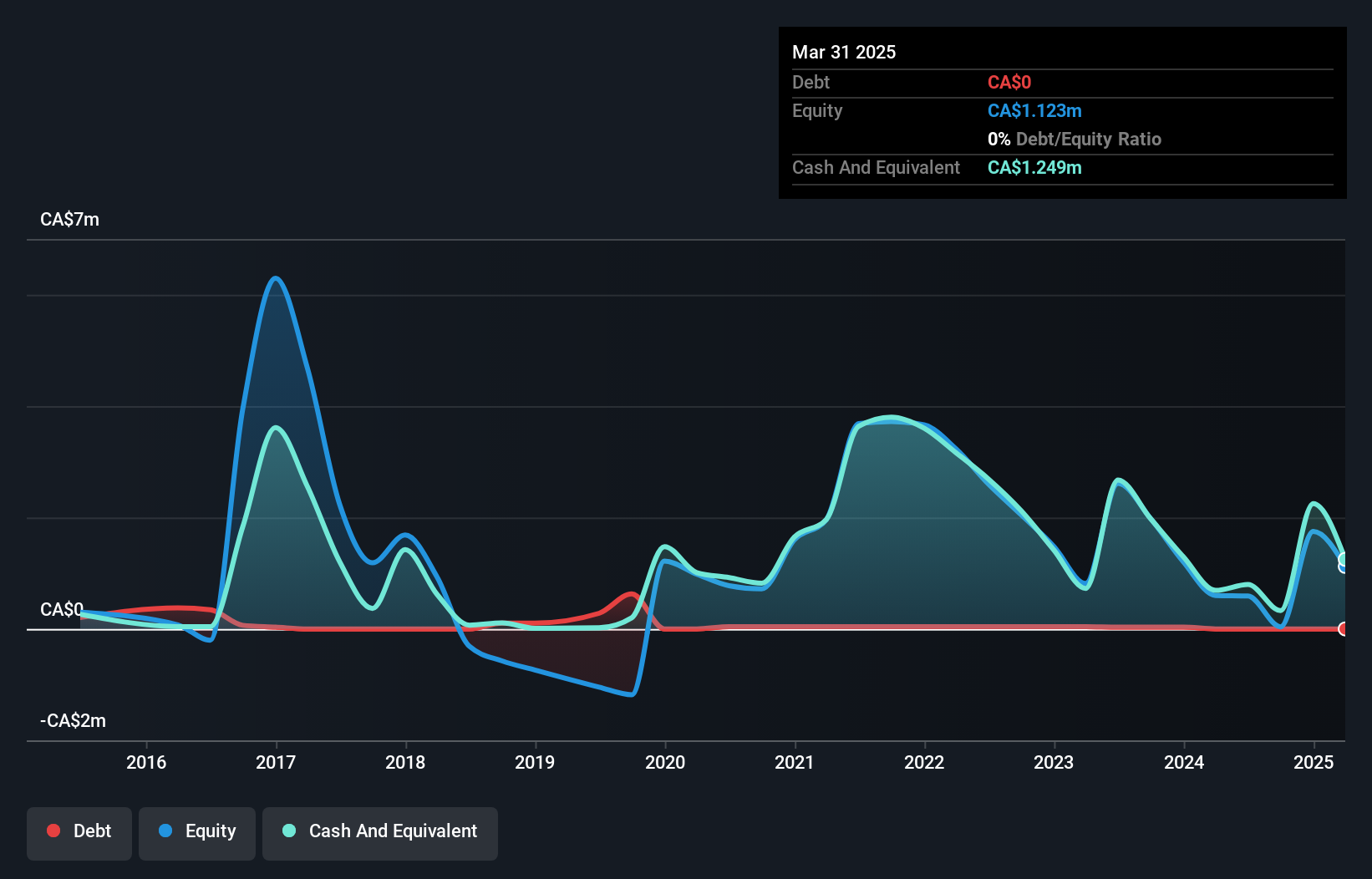

Telo Genomics Corp., with a market cap of CA$9.69 million, remains pre-revenue and unprofitable, facing challenges such as high share price volatility and a negative return on equity. Recent efforts to bolster finances include a private placement raising CA$2 million through unit sales, potentially extending its cash runway beyond the current two months. The company has no debt but struggles with short-term liabilities slightly exceeding assets. Despite these financial hurdles, Telo's collaboration with Mayo Clinic advances its prognostic tests for multiple myeloma, presenting potential long-term growth opportunities in the diagnostics market.

- Jump into the full analysis health report here for a deeper understanding of Telo Genomics.

- Gain insights into Telo Genomics' historical outcomes by reviewing our past performance report.

Key Takeaways

- Discover the full array of 930 TSX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telo Genomics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TELO

Telo Genomics

A molecular diagnostics company, engages in the development and commercialization of predictive technological products to personalize treatment plans for patients with specific conditions primarily in Canada.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives