BioSyent Inc. (CVE:RX) Reported Earnings Last Week And Analysts Are Already Upgrading Their Estimates

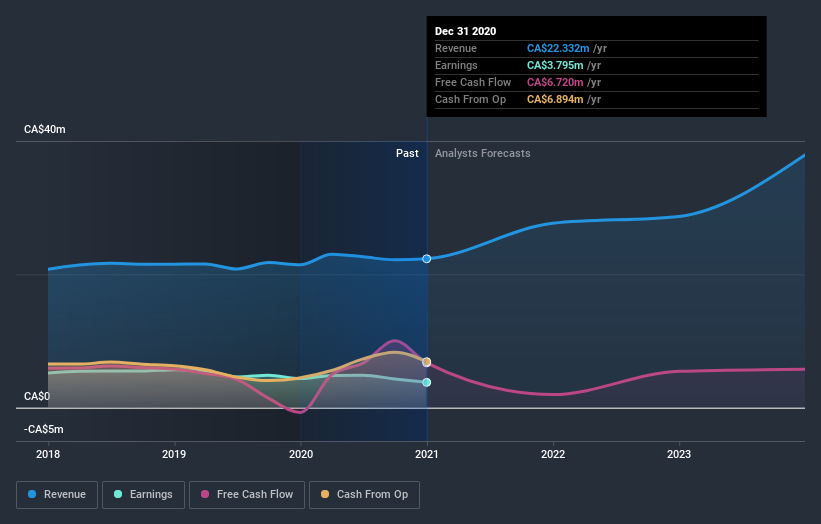

It's been a good week for BioSyent Inc. (CVE:RX) shareholders, because the company has just released its latest yearly results, and the shares gained 2.5% to CA$7.33. It looks like the results were a bit of a negative overall. While revenues of CA$22m were in line with analyst predictions, statutory earnings were less than expected, missing estimates by 3.3% to hit CA$0.29 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

View our latest analysis for BioSyent

Taking into account the latest results, the most recent consensus for BioSyent from dual analysts is for revenues of CA$27.7m in 2021 which, if met, would be a sizeable 24% increase on its sales over the past 12 months. Per-share earnings are expected to jump 37% to CA$0.40. In the lead-up to this report, the analysts had been modelling revenues of CA$25.4m and earnings per share (EPS) of CA$0.33 in 2021. So it seems there's been a definite increase in optimism about BioSyent's future following the latest results, with a great increase in the earnings per share forecasts in particular.

Althoughthe analysts have upgraded their earnings estimates, there was no change to the consensus price target of CA$7.50, suggesting that the forecast performance does not have a long term impact on the company's valuation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that BioSyent's rate of growth is expected to accelerate meaningfully, with the forecast 24% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 7.0% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 32% per year. It seems obvious that, while the future growth outlook is brighter than the recent past, BioSyent is expected to grow slower than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards BioSyent following these results. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for BioSyent going out as far as 2023, and you can see them free on our platform here.

It is also worth noting that we have found 1 warning sign for BioSyent that you need to take into consideration.

If you decide to trade BioSyent, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BioSyent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:RX

BioSyent

Acquires or licenses, develops, and sells pharmaceutical and other healthcare products in Canada and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026