David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Rubicon Organics Inc. (CVE:ROMJ) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Rubicon Organics

How Much Debt Does Rubicon Organics Carry?

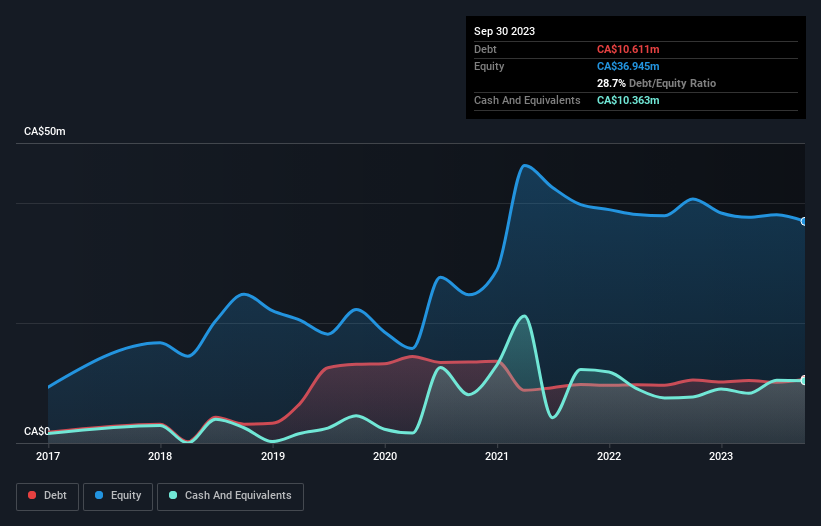

The chart below, which you can click on for greater detail, shows that Rubicon Organics had CA$10.6m in debt in September 2023; about the same as the year before. However, because it has a cash reserve of CA$10.4m, its net debt is less, at about CA$248.2k.

How Healthy Is Rubicon Organics' Balance Sheet?

We can see from the most recent balance sheet that Rubicon Organics had liabilities of CA$7.53m falling due within a year, and liabilities of CA$9.90m due beyond that. Offsetting this, it had CA$10.4m in cash and CA$3.64m in receivables that were due within 12 months. So its liabilities total CA$3.43m more than the combination of its cash and short-term receivables.

Since publicly traded Rubicon Organics shares are worth a total of CA$22.5m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Carrying virtually no net debt, Rubicon Organics has a very light debt load indeed. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Rubicon Organics can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Rubicon Organics reported revenue of CA$41m, which is a gain of 31%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Rubicon Organics managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Its EBIT loss was a whopping CA$4.7m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of CA$5.5m into a profit. In the meantime, we consider the stock very risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Rubicon Organics you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ROMJ

Rubicon Organics

Engages in the production, processing, and sale of organic cannabis for the recreational and medical-use markets in Canada and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026