Stock Analysis

What Type Of Returns Would Khiron Life Sciences'(CVE:KHRN) Shareholders Have Earned If They Purchased Their SharesYear Ago?

Khiron Life Sciences Corp. (CVE:KHRN) shareholders should be happy to see the share price up 19% in the last week. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 43% in the last year, well below the market return.

Check out our latest analysis for Khiron Life Sciences

Khiron Life Sciences wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Khiron Life Sciences grew its revenue by 0.4% over the last year. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 43% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. But if you buy a loss making company then you could become a loss making investor.

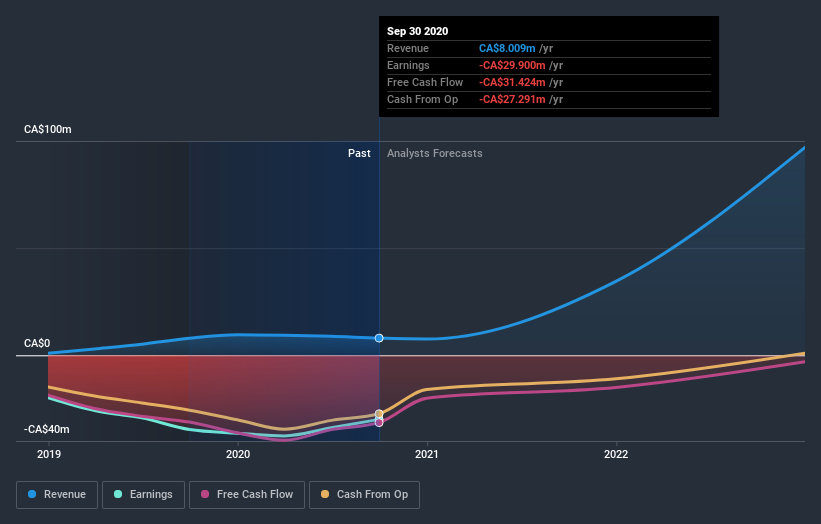

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Khiron Life Sciences stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While Khiron Life Sciences shareholders are down 43% for the year, the market itself is up 6.9%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 22%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Khiron Life Sciences (1 is a bit concerning!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

When trading Khiron Life Sciences or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Khiron Life Sciences is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:KHRN

Khiron Life Sciences

Operates as an integrated medical and cannabis company in Latin America and Europe.

Mediocre balance sheet and overvalued.