A Piece Of The Puzzle Missing From Decibel Cannabis Company Inc.'s (CVE:DB) 29% Share Price Climb

Decibel Cannabis Company Inc. (CVE:DB) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 50%.

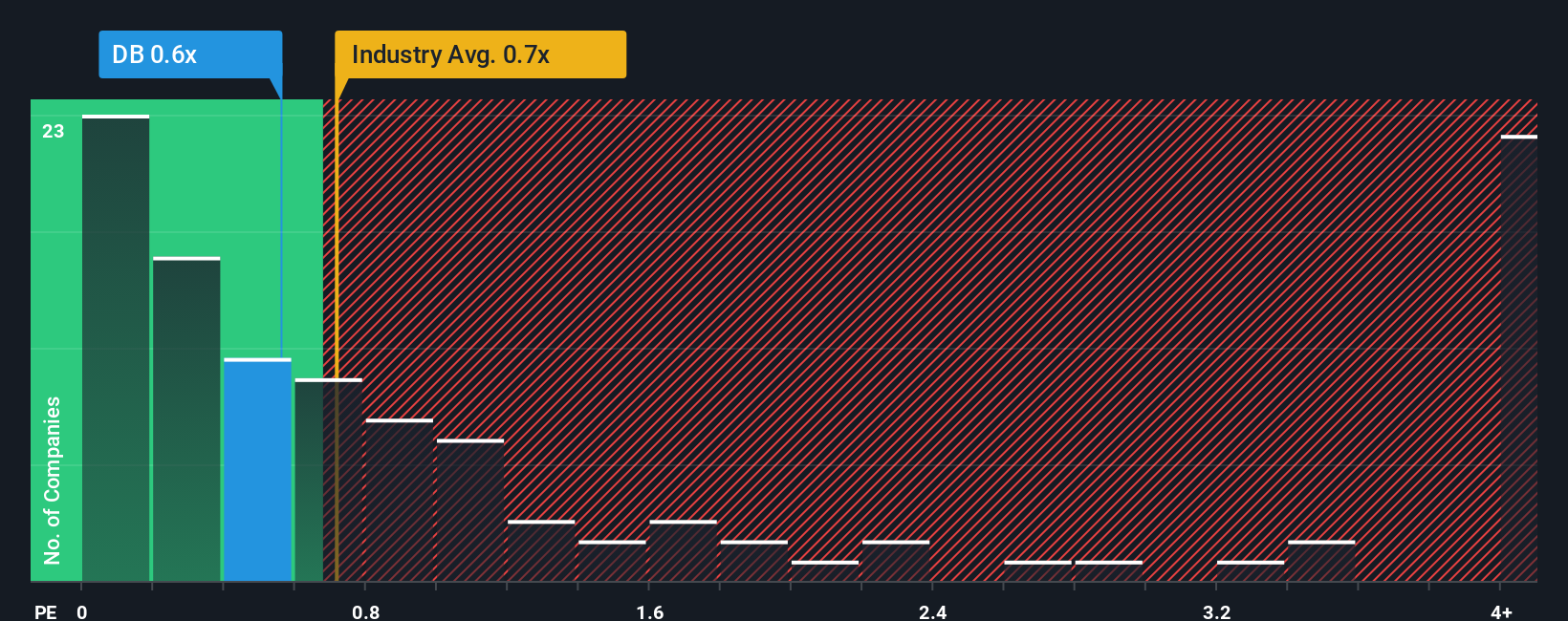

Although its price has surged higher, you could still be forgiven for feeling indifferent about Decibel Cannabis' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in Canada is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Decibel Cannabis

What Does Decibel Cannabis' P/S Mean For Shareholders?

Decibel Cannabis hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Decibel Cannabis will help you uncover what's on the horizon.How Is Decibel Cannabis' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Decibel Cannabis' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 9.2% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 64% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 12% each year over the next three years. With the industry only predicted to deliver 5.6% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Decibel Cannabis' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Decibel Cannabis' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Decibel Cannabis currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Decibel Cannabis you should be aware of, and 2 of them are a bit concerning.

If these risks are making you reconsider your opinion on Decibel Cannabis, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:DB

Decibel Cannabis

An integrated cannabis company, engages in the cannabis cultivation in Canada.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.