- Canada

- /

- Metals and Mining

- /

- TSXV:FYL

TSX Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

The Canadian stock market has shown resilience amid global tariff uncertainties, with the TSX rising over 2% recently, contrasting with declines in U.S. indices. In such a fluctuating environment, investors often look beyond major stocks to explore opportunities in penny stocks—smaller or newer companies that can still offer significant value despite their vintage label. By focusing on those with robust financials and potential for growth, investors may find promising opportunities within this niche segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.69 | CA$71.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.63 | CA$419.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.31 | CA$685.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.70 | CA$198.39M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.69 | CA$279.1M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.57 | CA$521.62M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.66 | CA$71.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.75M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.21 | CA$44.67M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 925 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Finlay Minerals (TSXV:FYL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Finlay Minerals Ltd. is engaged in the acquisition and exploration of base and precious metal deposits in northern British Columbia, Canada, with a market cap of CA$16.11 million.

Operations: Finlay Minerals Ltd. does not report any specific revenue segments as it focuses on the acquisition and exploration of mineral deposits in northern British Columbia, Canada.

Market Cap: CA$16.11M

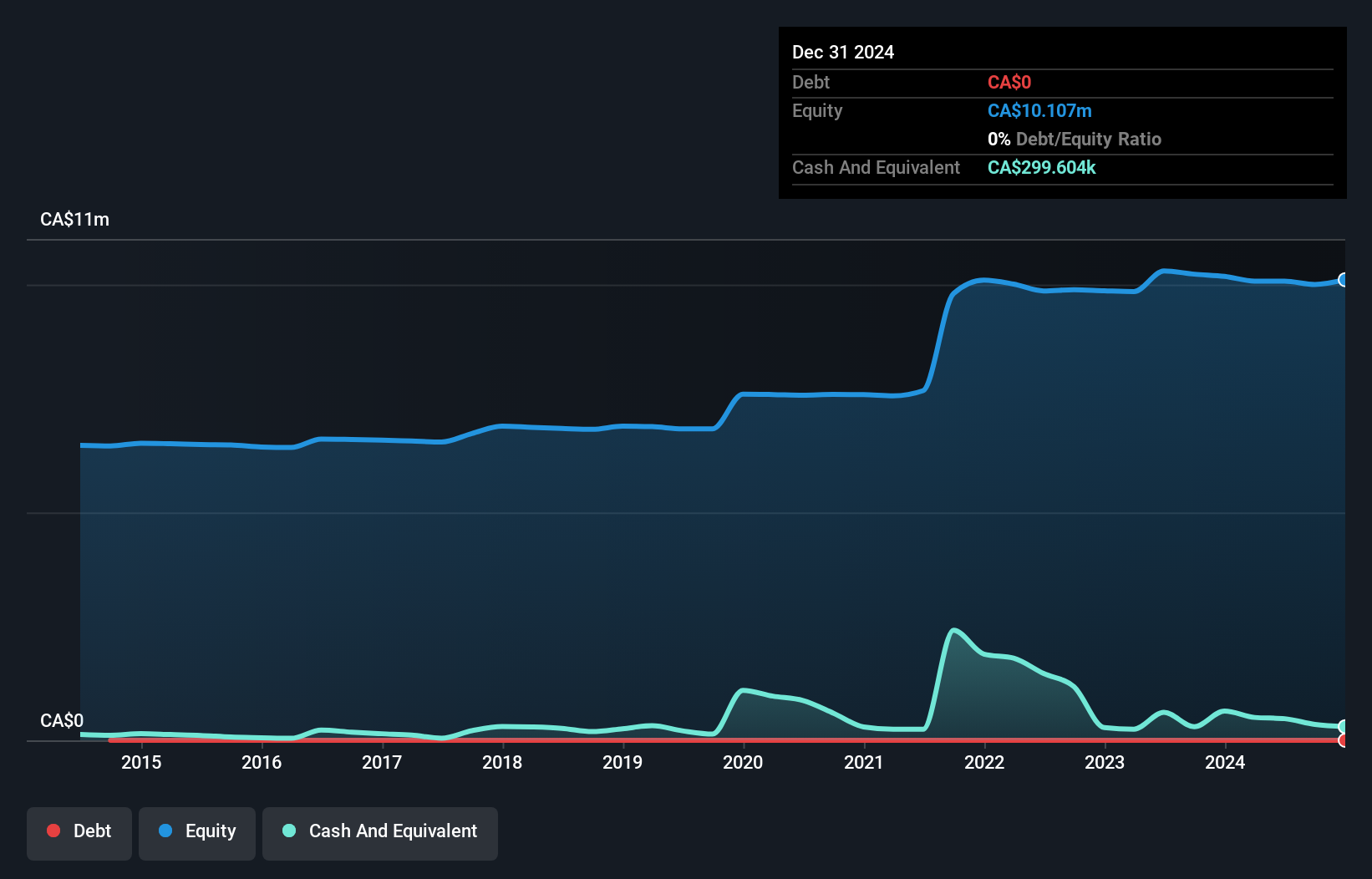

Finlay Minerals Ltd. operates as a pre-revenue company focused on mineral exploration in northern British Columbia, with a market cap of CA$16.11 million. Recently, it entered into earn-in agreements with Freeport-McMoRan for its PIL and ATTY Properties, potentially enhancing its exploration capabilities through joint ventures while retaining operational control during the earn-in period. Despite no significant revenue streams and ongoing unprofitability, Finlay remains debt-free and has not diluted shareholders recently. The company's cash runway extends over three years if free cash flow remains stable, though share price volatility persists above typical Canadian stocks levels.

- Click here to discover the nuances of Finlay Minerals with our detailed analytical financial health report.

- Understand Finlay Minerals' track record by examining our performance history report.

Atha Energy (TSXV:SASK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atha Energy Corp. is a mineral company focused on acquiring, exploring, and developing uranium assets in Canada, with a market cap of CA$119.49 million.

Operations: Atha Energy Corp. has not reported any revenue segments.

Market Cap: CA$119.49M

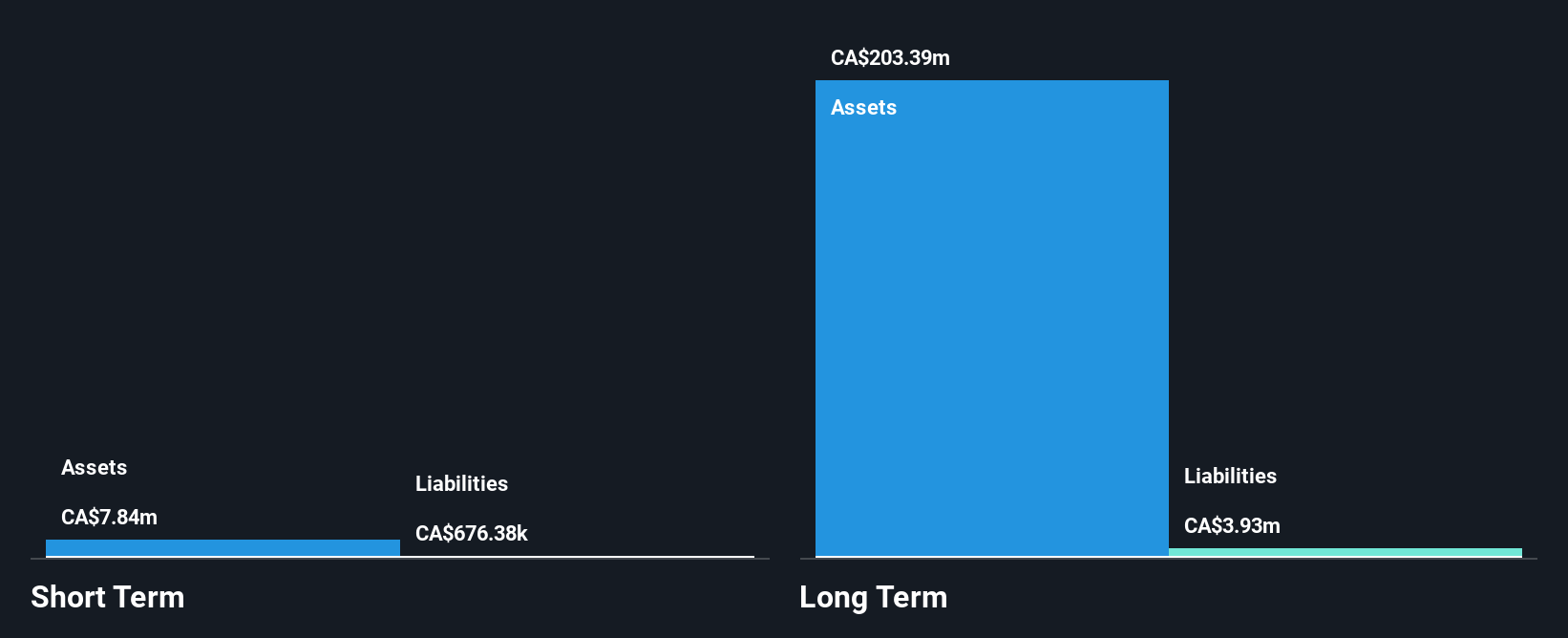

Atha Energy Corp., with a market cap of CA$119.49 million, is a pre-revenue mineral exploration company focused on uranium assets in Canada. The company recently announced a private placement to raise nearly CA$10 million, which could bolster its financial position. Atha's maiden exploration program at the Angilak Uranium Project showed promising results, with all drill holes intersecting uranium mineralization and some assays revealing high-grade deposits. Despite these developments, Atha remains unprofitable and faces share price volatility above typical Canadian stocks levels. However, it benefits from being debt-free and has not diluted shareholders recently.

- Click to explore a detailed breakdown of our findings in Atha Energy's financial health report.

- Gain insights into Atha Energy's outlook and expected performance with our report on the company's earnings estimates.

Auxly Cannabis Group (TSX:XLY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Auxly Cannabis Group Inc. is a consumer packaged goods company specializing in cannabis products in Canada, with a market capitalization of CA$105.34 million.

Operations: The company's revenue is derived from its venture capital segment, which generated CA$122.33 million.

Market Cap: CA$105.34M

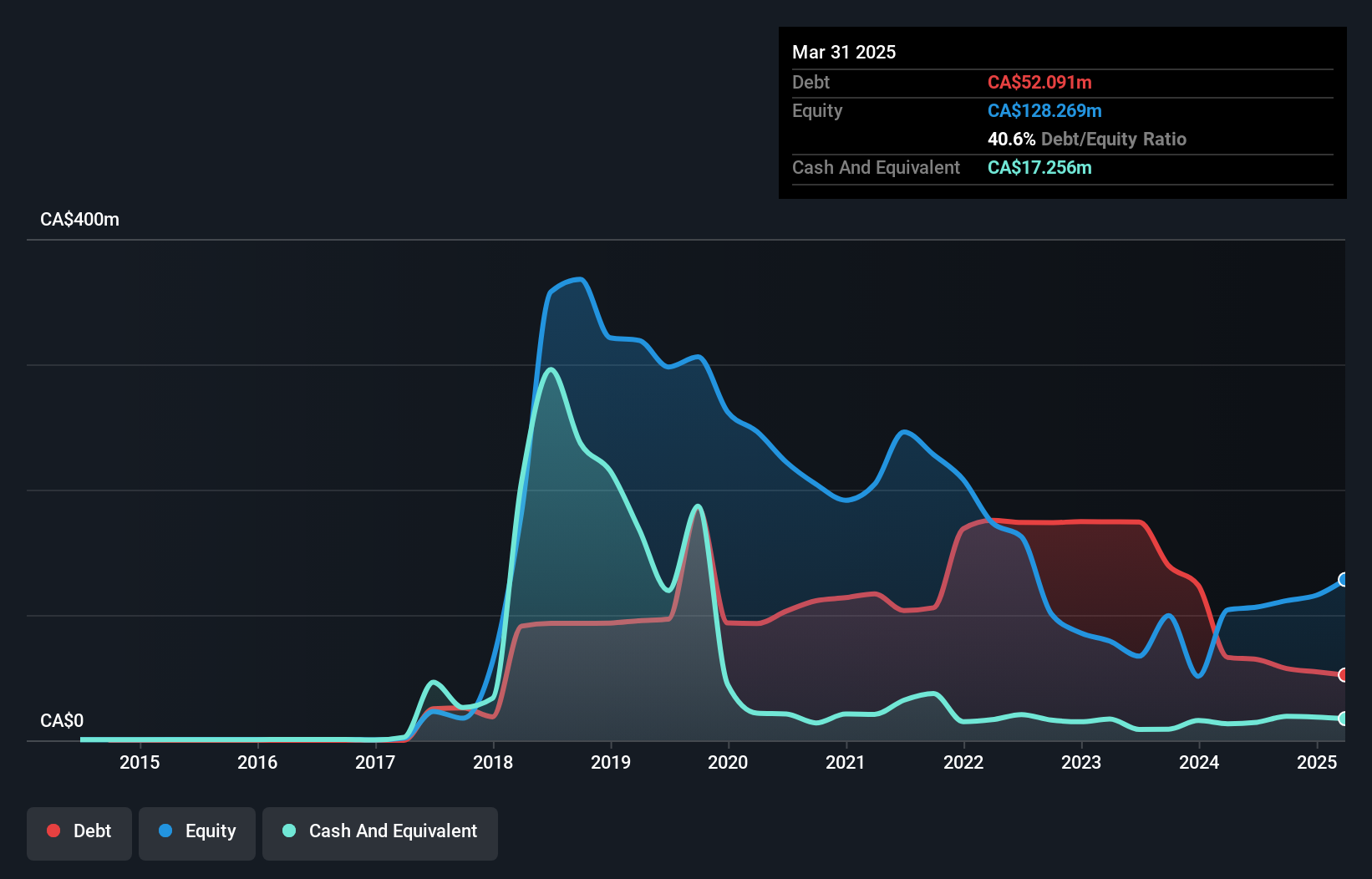

Auxly Cannabis Group Inc., with a market cap of CA$105.34 million, reported revenue growth to CA$122.33 million for 2024, reducing its net loss significantly from the previous year. Despite this improvement, the company remains unprofitable and faces challenges such as doubts about its ability to continue as a going concern expressed by auditors. Auxly's short-term liabilities exceed its assets, but it maintains a satisfactory net debt to equity ratio and has not diluted shareholders recently. The company's free cash flow is positive and growing, providing a cash runway exceeding three years despite high share price volatility.

- Dive into the specifics of Auxly Cannabis Group here with our thorough balance sheet health report.

- Gain insights into Auxly Cannabis Group's historical outcomes by reviewing our past performance report.

Key Takeaways

- Gain an insight into the universe of 925 TSX Penny Stocks by clicking here.

- Contemplating Other Strategies? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FYL

Finlay Minerals

Engages in the acquisition and exploration of base and precious metal deposits in northern British Columbia, Canada.

Excellent balance sheet slight.

Market Insights

Community Narratives