Take Care Before Jumping Onto Auxly Cannabis Group Inc. (TSE:XLY) Even Though It's 38% Cheaper

The Auxly Cannabis Group Inc. (TSE:XLY) share price has fared very poorly over the last month, falling by a substantial 38%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

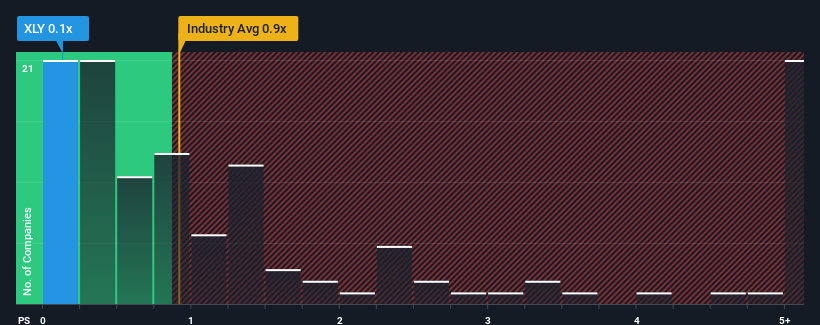

After such a large drop in price, when close to half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider Auxly Cannabis Group as an enticing stock to check out with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Auxly Cannabis Group

What Does Auxly Cannabis Group's Recent Performance Look Like?

Auxly Cannabis Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Auxly Cannabis Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Auxly Cannabis Group's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 213% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to climb by 7.6% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 5.0% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Auxly Cannabis Group's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Auxly Cannabis Group's P/S Mean For Investors?

Auxly Cannabis Group's recently weak share price has pulled its P/S back below other Pharmaceuticals companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Auxly Cannabis Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Auxly Cannabis Group (of which 2 make us uncomfortable!) you should know about.

If you're unsure about the strength of Auxly Cannabis Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:XLY

Auxly Cannabis Group

Operates as a consumer packaged goods company in the cannabis products market in Canada.

Good value with acceptable track record.

Market Insights

Community Narratives