Market Cool On Auxly Cannabis Group Inc.'s (TSE:XLY) Revenues Pushing Shares 40% Lower

The Auxly Cannabis Group Inc. (TSE:XLY) share price has softened a substantial 40% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 100%, which is great even in a bull market.

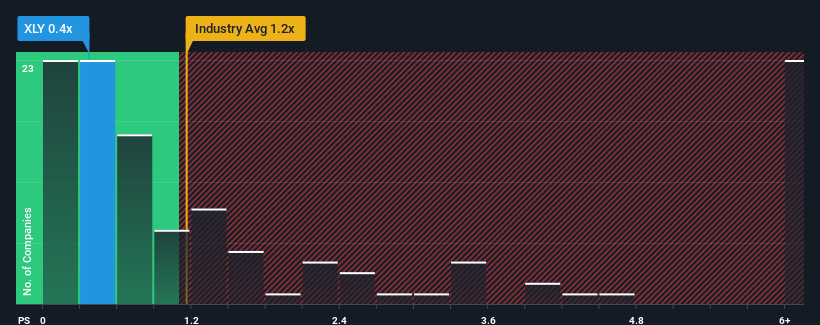

After such a large drop in price, it would be understandable if you think Auxly Cannabis Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Canada's Pharmaceuticals industry have P/S ratios above 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Auxly Cannabis Group

How Auxly Cannabis Group Has Been Performing

Revenue has risen at a steady rate over the last year for Auxly Cannabis Group, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Auxly Cannabis Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Auxly Cannabis Group's Revenue Growth Trending?

In order to justify its P/S ratio, Auxly Cannabis Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 6.8% gain to the company's revenues. Pleasingly, revenue has also lifted 123% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 6.5% shows it's noticeably more attractive.

With this information, we find it odd that Auxly Cannabis Group is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Auxly Cannabis Group's P/S Mean For Investors?

Auxly Cannabis Group's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Auxly Cannabis Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Auxly Cannabis Group (1 makes us a bit uncomfortable!) that you need to be mindful of.

If you're unsure about the strength of Auxly Cannabis Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:XLY

Auxly Cannabis Group

Operates as a consumer packaged goods company in the cannabis products market in Canada.

Good value with acceptable track record.

Market Insights

Community Narratives