Canopy Growth Corporation's (TSE:WEED) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Canopy Growth Corporation (TSE:WEED) shares have had a horrible month, losing 26% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 71% loss during that time.

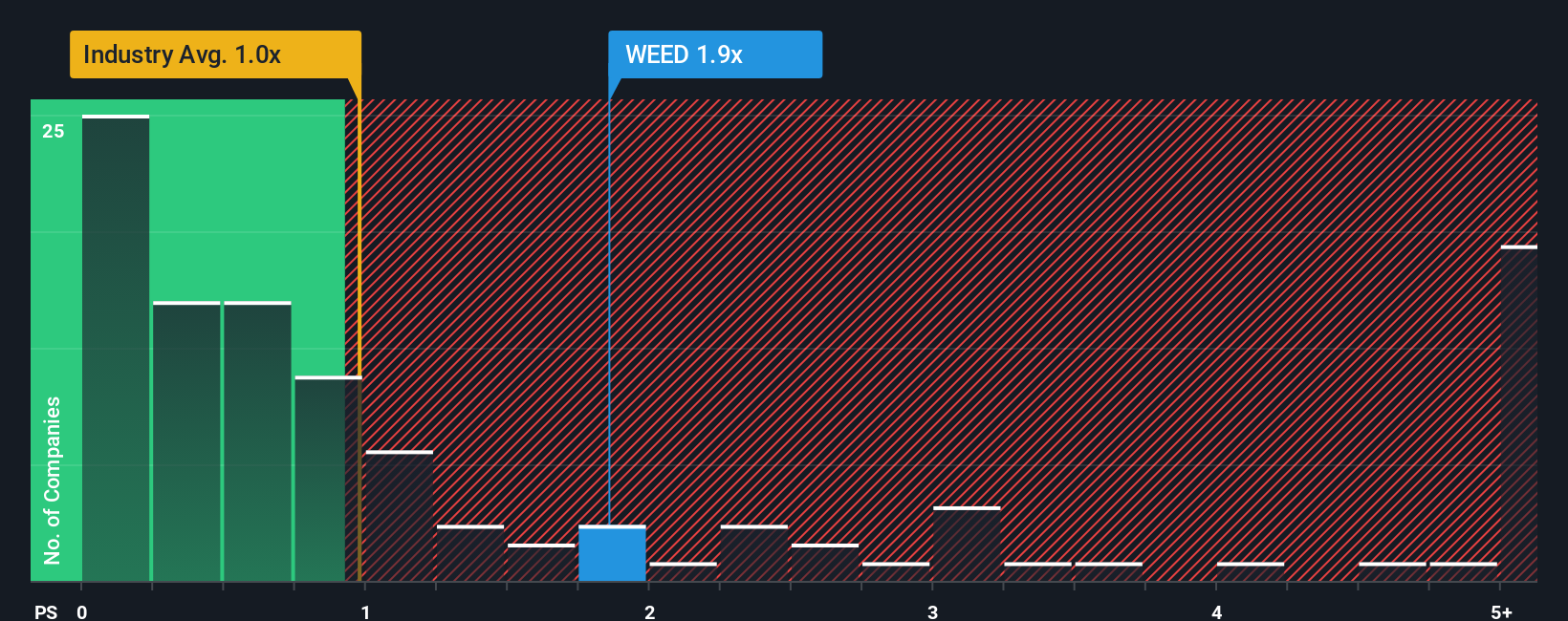

In spite of the heavy fall in price, you could still be forgiven for thinking Canopy Growth is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.9x, considering almost half the companies in Canada's Pharmaceuticals industry have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Canopy Growth

What Does Canopy Growth's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Canopy Growth's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Canopy Growth's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Canopy Growth?

Canopy Growth's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 34% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 5.4% each year over the next three years. That's shaping up to be similar to the 5.7% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Canopy Growth's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Canopy Growth's P/S Mean For Investors?

Canopy Growth's P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Canopy Growth currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Canopy Growth (1 makes us a bit uncomfortable) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WEED

Canopy Growth

Engages in the production, distribution, and sale of cannabis, hemp, and cannabis-related products in Canada, Germany, and Australia.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives