The Canadian market has shown resilience, with the TSX gaining over 2% recently despite ongoing tariff uncertainties impacting global economic conditions. Amid these fluctuations, investors often seek opportunities in penny stocks—companies typically characterized by their smaller size and lower share prices. Although the term might seem outdated, penny stocks can offer significant growth potential when backed by strong fundamentals and financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.69 | CA$71.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.63 | CA$419.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.31 | CA$685.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.70 | CA$198.39M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.69 | CA$279.1M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.57 | CA$521.62M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.66 | CA$71.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.75M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.21 | CA$44.67M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 925 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

TerrAscend (TSX:TSND)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TerrAscend Corp. is involved in the cultivation, production, and sale of cannabis products across Canada and the United States, with a market cap of approximately CA$138.60 million.

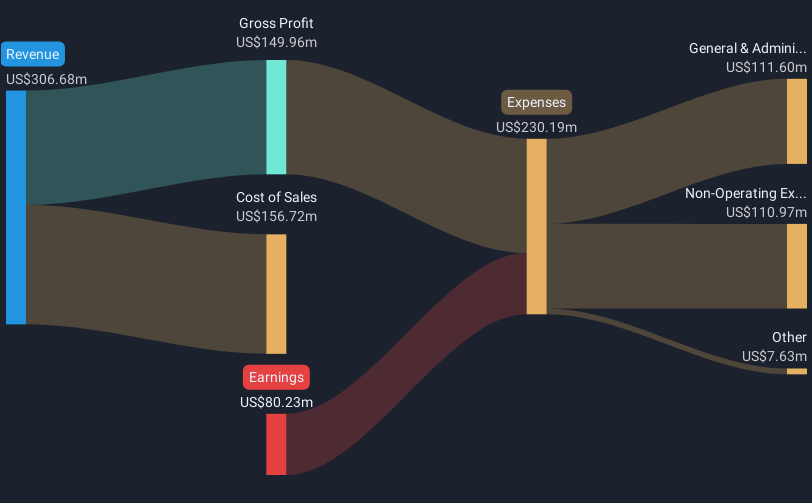

Operations: The company's revenue primarily comes from the cultivation and sale of cannabis, amounting to $306.68 million.

Market Cap: CA$138.6M

TerrAscend Corp., with a market cap of CA$138.60 million, is trading at a significant discount to its estimated fair value and boasts an experienced management team. While unprofitable and not expected to achieve profitability in the next three years, it has managed to reduce losses over the past five years by 3.1% annually and maintains a positive cash flow runway for over three years. Recent financials show revenue of US$306.68 million with net losses decreasing from US$95.55 million to US$80.23 million year-over-year, despite facing high debt levels and recent impairments totaling over $45 million in Q4 2024.

- Jump into the full analysis health report here for a deeper understanding of TerrAscend.

- Review our growth performance report to gain insights into TerrAscend's future.

Geomega Resources (TSXV:GMA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Geomega Resources Inc. focuses on the acquisition, evaluation, and exploration of mining properties in Canada, with a market cap of CA$21.51 million.

Operations: Geomega Resources Inc. currently does not report any specific revenue segments.

Market Cap: CA$21.51M

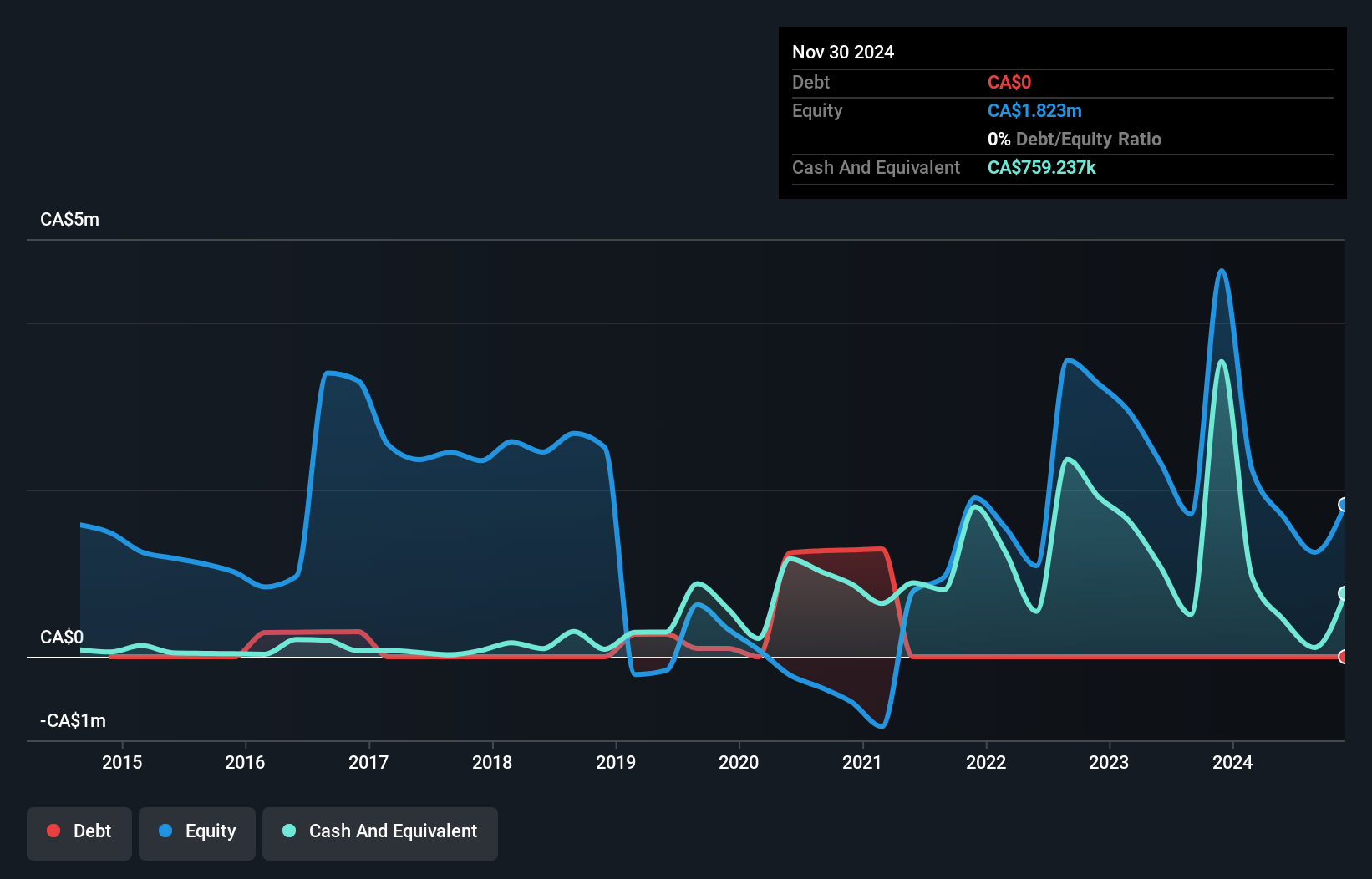

Geomega Resources Inc., with a market cap of CA$21.51 million, is pre-revenue and currently unprofitable. Despite this, its short-term assets exceed both long-term and short-term liabilities, providing some financial stability. The company has recently raised additional capital through a private placement of convertible debentures amounting to CA$2.02 million, which could extend its cash runway beyond the current six months based on free cash flow estimates. Geomega's collaboration with Rio Tinto on bauxite residue valorization technology shows potential for future revenue streams as it progresses in developing cost-efficient extraction circuits for valuable metals like rare earths and titanium.

- Navigate through the intricacies of Geomega Resources with our comprehensive balance sheet health report here.

- Gain insights into Geomega Resources' past trends and performance with our report on the company's historical track record.

NEO Battery Materials (TSXV:NBM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NEO Battery Materials Ltd. specializes in producing silicon anode materials for lithium-ion batteries used in electric vehicles, electronics, and energy storage systems in Canada, with a market cap of CA$86.99 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$86.99M

NEO Battery Materials Ltd., with a market cap of CA$86.99 million, is pre-revenue and currently unprofitable, with less than a year of cash runway based on current free cash flow. The company has made significant strides in developing its silicon anode technology, notably introducing the NBMSiDE P-300N product that promises high capacity retention and adaptability for mass production without modifying existing equipment. Despite having no debt and experienced board members, NEO's management team is relatively new. Recent expansions include scaling up production to 20 tons annually and advancing commercialization efforts for a Canadian manufacturing facility aimed at producing 5,000 tons annually.

- Click here and access our complete financial health analysis report to understand the dynamics of NEO Battery Materials.

- Understand NEO Battery Materials' track record by examining our performance history report.

Seize The Opportunity

- Gain an insight into the universe of 925 TSX Penny Stocks by clicking here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TerrAscend might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TSND

TerrAscend

TerrAscend Corp. cultivates, produces, and sells cannabis products in Canada and the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives