It's Down 33% But Numinus Wellness Inc. (TSE:NUMI) Could Be Riskier Than It Looks

To the annoyance of some shareholders, Numinus Wellness Inc. (TSE:NUMI) shares are down a considerable 33% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 76% loss during that time.

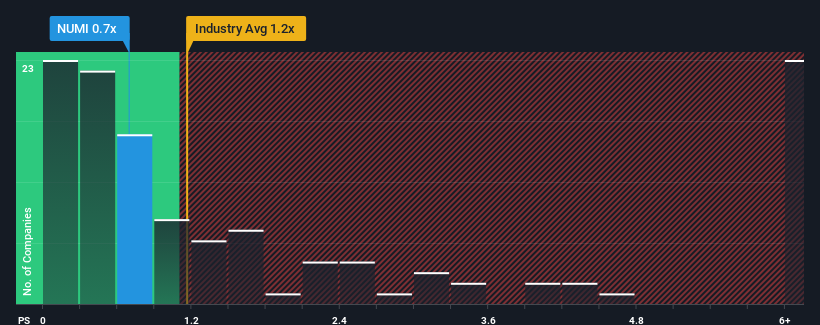

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Numinus Wellness' P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in Canada is also close to 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Numinus Wellness

What Does Numinus Wellness' P/S Mean For Shareholders?

Recent times have been advantageous for Numinus Wellness as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Numinus Wellness will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Numinus Wellness would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 45% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 33% per annum during the coming three years according to the only analyst following the company. With the industry only predicted to deliver 8.7% per year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Numinus Wellness is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Following Numinus Wellness' share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Numinus Wellness' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 4 warning signs for Numinus Wellness (1 doesn't sit too well with us!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Numinus Wellness might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NUMI

Numinus Wellness

Provides psychedelic-assisted therapy training, lab testing, and psychotherapy services in Canada and the United States.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.