- Canada

- /

- Metals and Mining

- /

- TSXV:ELE

Spotlight On 3 TSX Penny Stocks With Market Caps Over CA$90M

Reviewed by Simply Wall St

The Canadian market has shown impressive growth, climbing 1.4% over the last week and 28% over the past year, with earnings expected to grow by 16% annually in the coming years. For investors willing to look beyond well-known companies, penny stocks—often representing smaller or newer enterprises—can present intriguing opportunities. Although 'penny stock' might seem like an outdated term, these investments remain relevant today as they can offer hidden value and potential for substantial returns when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.16 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.83 | CA$303.72M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Satellos Bioscience (TSX:MSCL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Satellos Bioscience Inc. is a biotechnology company focused on developing regenerative therapeutics for degenerative muscle diseases, primarily operating in Canada and Australia, with a market cap of CA$90.52 million.

Operations: Currently, there are no reported revenue segments for the biotechnology company focused on regenerative therapeutics for muscle diseases.

Market Cap: CA$90.52M

Satellos Bioscience Inc., with a market cap of CA$90.52 million, is pre-revenue and currently in the early stages of clinical development for its drug SAT-3247 targeting Duchenne muscular dystrophy. Recent announcements highlight promising preclinical results and the commencement of Phase 1 trials, which are crucial steps for a biotech firm at this stage. Despite being unprofitable with increasing losses, Satellos has no debt and maintains sufficient short-term assets to cover liabilities. However, it faces challenges such as limited cash runway if expenses continue to grow at historical rates and an inexperienced management team.

- Take a closer look at Satellos Bioscience's potential here in our financial health report.

- Explore Satellos Bioscience's analyst forecasts in our growth report.

Elemental Altus Royalties (TSXV:ELE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elemental Altus Royalties Corp. is a precious metals royalty company focused on acquiring royalties and streams over producing or near-producing assets, with a market cap of CA$249.83 million.

Operations: The company's revenue is derived from the acquisition of royalties, streams, and similar production-based interests, totaling $13.42 million.

Market Cap: CA$249.83M

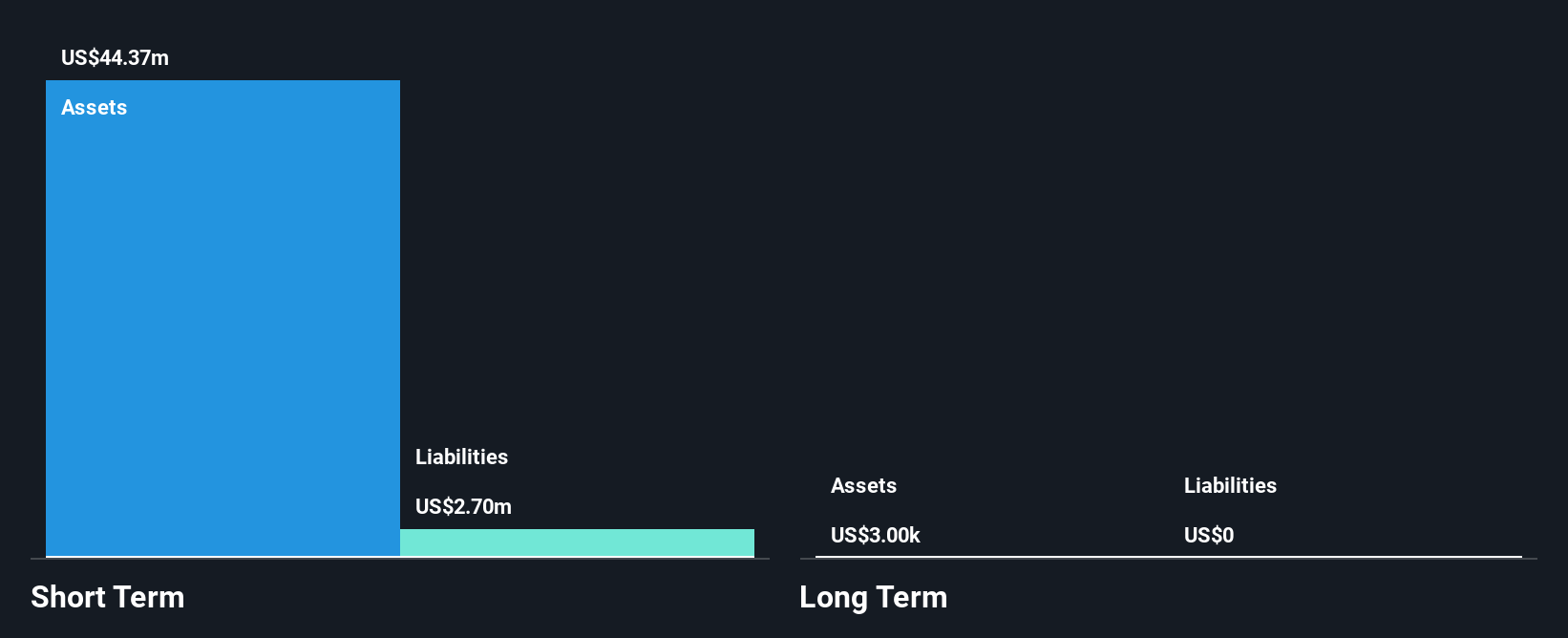

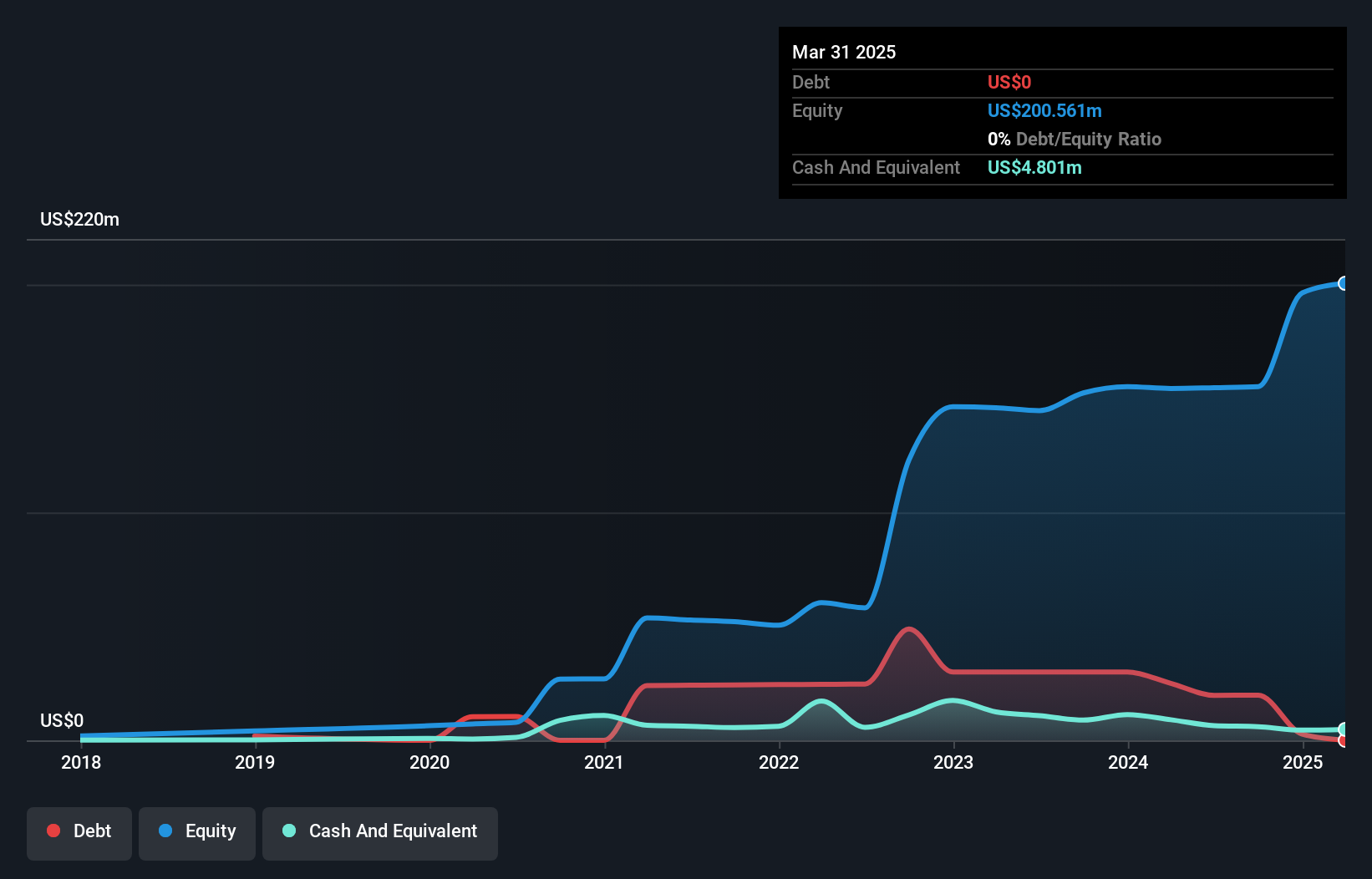

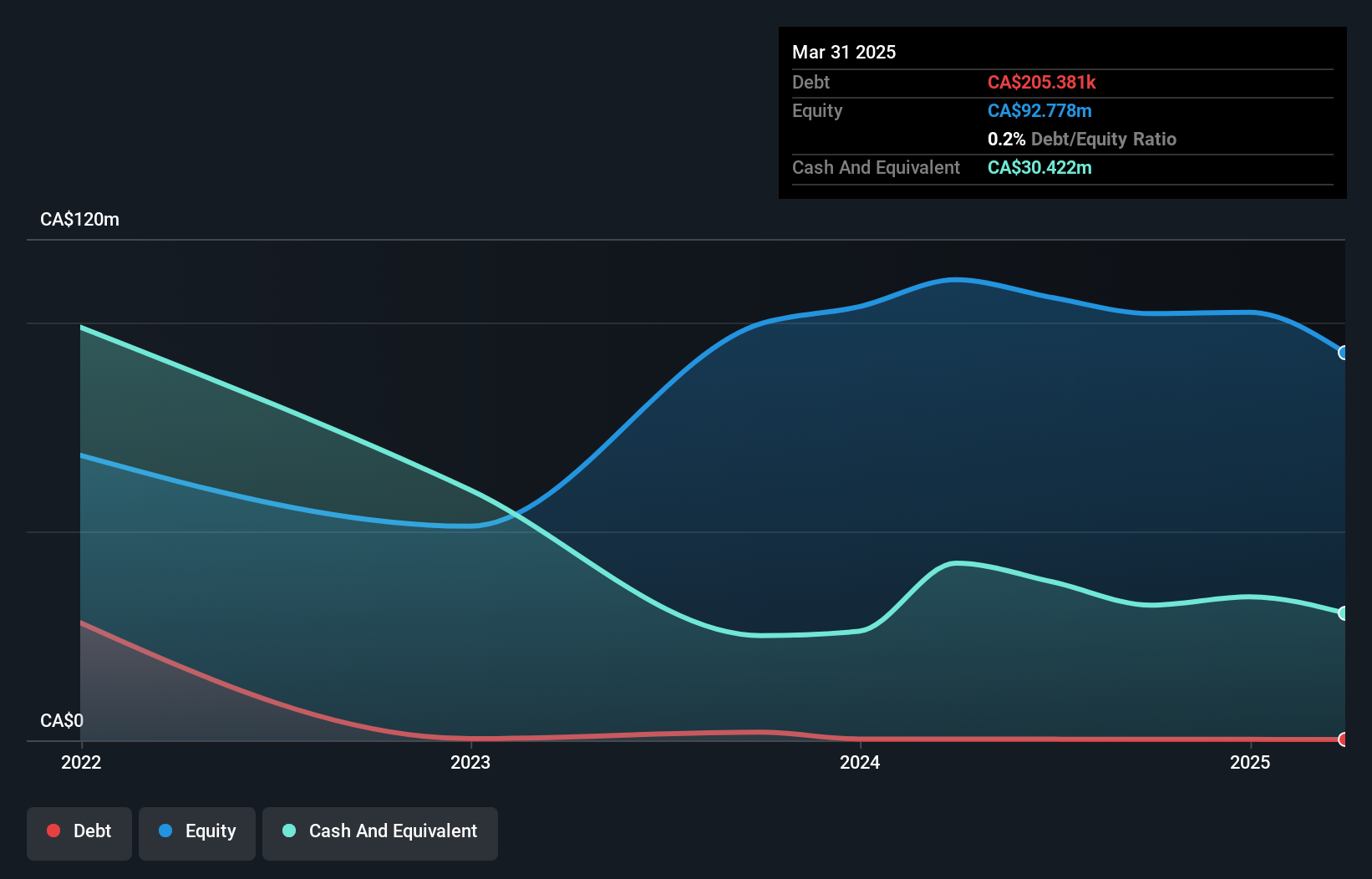

Elemental Altus Royalties Corp., with a market cap of CA$249.83 million, focuses on acquiring royalties and streams from precious metals assets. The company has reported revenue growth, with US$7.08 million in the first half of 2024 compared to US$5.41 million in the previous year, despite remaining unprofitable. Elemental Altus benefits from a stable cash runway exceeding three years due to positive free cash flow growth and minimal debt levels. Recent developments include securing royalty agreements on Allied Gold's Diba deposit in Mali, providing potential future income streams as production milestones are achieved and approved for development.

- Dive into the specifics of Elemental Altus Royalties here with our thorough balance sheet health report.

- Examine Elemental Altus Royalties' earnings growth report to understand how analysts expect it to perform.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WonderFi Technologies Inc. focuses on developing and acquiring technology platforms to support investments in digital assets, with a market cap of CA$98.99 million.

Operations: The company's revenue is primarily derived from its Trading segment, which generated CA$48.33 million.

Market Cap: CA$98.99M

WonderFi Technologies Inc., with a market cap of CA$98.99 million, has shown significant revenue growth, reporting CA$30.55 million in sales for the first half of 2024 compared to CA$5.45 million the previous year. The company remains unprofitable but benefits from a stable cash runway exceeding three years due to its current free cash flow position and more cash than total debt. Recent initiatives include launching enhanced mobile apps for Bitbuy and Coinsquare, alongside an international marketing campaign targeting sports fans, potentially broadening user engagement and brand visibility in Canada and Australia through strategic partnerships with DAZN.

- Click here and access our complete financial health analysis report to understand the dynamics of WonderFi Technologies.

- Learn about WonderFi Technologies' future growth trajectory here.

Make It Happen

- Click this link to deep-dive into the 947 companies within our TSX Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elemental Altus Royalties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ELE

Elemental Altus Royalties

Engages in the acquisition and generation of precious metal royalties.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives