Medexus Pharmaceuticals Inc.'s (TSE:MDP) Shares Leap 89% Yet They're Still Not Telling The Full Story

Medexus Pharmaceuticals Inc. (TSE:MDP) shares have had a really impressive month, gaining 89% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 40%.

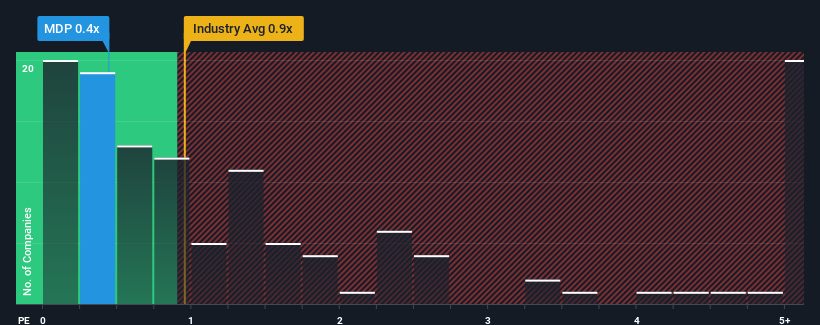

Even after such a large jump in price, given about half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 0.9x, you may still consider Medexus Pharmaceuticals as an attractive investment with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Medexus Pharmaceuticals

How Medexus Pharmaceuticals Has Been Performing

Medexus Pharmaceuticals could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Medexus Pharmaceuticals.Is There Any Revenue Growth Forecasted For Medexus Pharmaceuticals?

The only time you'd be truly comfortable seeing a P/S as low as Medexus Pharmaceuticals' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. The latest three year period has also seen an excellent 73% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 10% each year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 8.6% per year, which is not materially different.

With this in consideration, we find it intriguing that Medexus Pharmaceuticals' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Medexus Pharmaceuticals' P/S

The latest share price surge wasn't enough to lift Medexus Pharmaceuticals' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Medexus Pharmaceuticals currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Medexus Pharmaceuticals (1 is a bit unpleasant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MDP

Medexus Pharmaceuticals

Operates as a pharmaceutical company in Canada and the United States.

Moderate with reasonable growth potential.

Market Insights

Community Narratives