The Canadian market is navigating a complex landscape, with tariffs posing potential risks to economic growth and inflation. Despite these challenges, opportunities for investors remain, particularly in the realm of penny stocks. While the term may seem outdated, these smaller or newer companies can offer significant growth potential when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.85 | CA$177.31M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.60 | CA$1B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.68 | CA$439.49M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$120.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$236.24M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$628.96M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$0.97 | CA$26.06M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.18 | CA$228.22M | ★★★★☆☆ |

Click here to see the full list of 938 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

MediPharm Labs (TSX:LABS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MediPharm Labs Corp. is a pharmaceutical company that produces and sells purified, pharmaceutical-quality cannabis extracts and related products in Canada, Australia, Germany, and internationally, with a market cap of CA$28.78 million.

Operations: The company generates CA$39.05 million in revenue from the production and sale of cannabis extracts and derivative products.

Market Cap: CA$28.78M

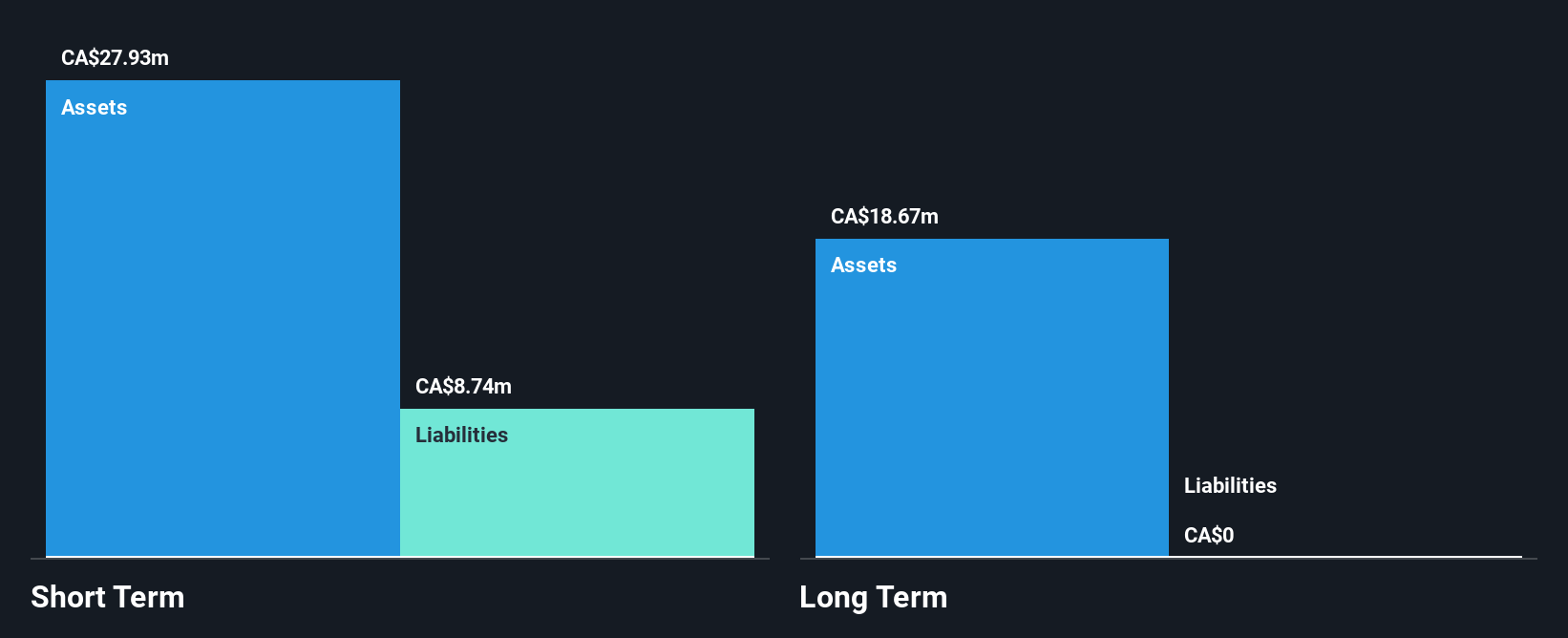

MediPharm Labs Corp. is navigating the penny stock landscape with a market cap of CA$28.78 million and recent revenue of CA$39.05 million from cannabis extracts and derivatives. Despite being unprofitable, it has reduced losses over five years by 7.8% annually, maintaining a stable cash runway exceeding three years due to positive free cash flow trends. The company has more cash than debt, with short-term assets covering liabilities comfortably. A significant recent development is its commercial agreement with Laboratorio Teuto in Brazil, marking regulatory compliance achievements that could enhance its global footprint in medical cannabis markets.

- Get an in-depth perspective on MediPharm Labs' performance by reading our balance sheet health report here.

- Examine MediPharm Labs' earnings growth report to understand how analysts expect it to perform.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that focuses on acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$85.49 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$85.49M

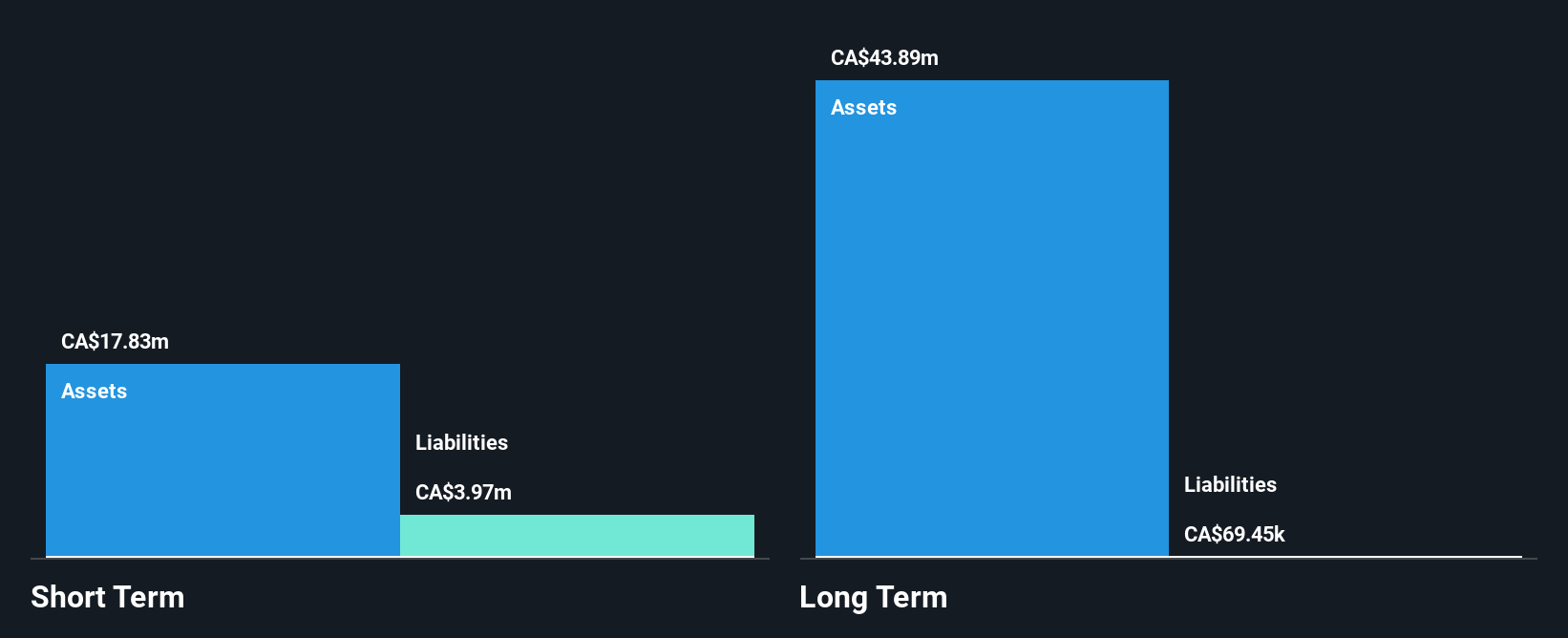

Chesapeake Gold Corp., with a market cap of CA$85.49 million, is pre-revenue and currently unprofitable. The company has seen its losses increase annually by 25.7% over the past five years, reflecting challenges in achieving profitability. Despite this, it maintains a strong financial position with no debt and short-term assets of CA$14.3 million exceeding both short- and long-term liabilities. The management team is relatively new, averaging 1.8 years in tenure, which might impact strategic continuity. Recently dropped from the S&P/TSX Venture Composite Index, Chesapeake continues to navigate its development phase amidst financial volatility.

- Dive into the specifics of Chesapeake Gold here with our thorough balance sheet health report.

- Gain insights into Chesapeake Gold's past trends and performance with our report on the company's historical track record.

New Found Gold (TSXV:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: New Found Gold Corp. is a mineral exploration company focused on identifying, evaluating, acquiring, and exploring mineral properties in Newfoundland and Labrador and Ontario, with a market cap of approximately CA$489.31 million.

Operations: New Found Gold Corp. does not report any revenue segments as it is focused on mineral exploration activities in Newfoundland and Labrador and Ontario.

Market Cap: CA$489.31M

New Found Gold Corp., with a market cap of CA$489.31 million, is pre-revenue and unprofitable, reflecting its focus on mineral exploration in Newfoundland and Labrador and Ontario. The company has no debt, with short-term assets of CA$46.6 million exceeding liabilities, yet it faces a cash runway of less than a year based on current free cash flow trends. Recent executive changes include the appointment of Keith Boyle as CEO, bringing extensive industry experience that could influence future project developments. Despite losses narrowing to CA$36.86 million for the first nine months of 2024, profitability remains elusive amidst ongoing exploration activities.

- Jump into the full analysis health report here for a deeper understanding of New Found Gold.

- Learn about New Found Gold's future growth trajectory here.

Make It Happen

- Navigate through the entire inventory of 938 TSX Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LABS

MediPharm Labs

A pharmaceutical company, engages in the production and sale of purified, pharmaceutical-quality cannabis extracts, concentrates, active pharmaceutical ingredients, and advanced derivative products in Canada, Australia, Germany, and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives