Market Might Still Lack Some Conviction On Delta 9 Cannabis Inc. (TSE:DN) Even After 122% Share Price Boost

Delta 9 Cannabis Inc. (TSE:DN) shareholders have had their patience rewarded with a 122% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

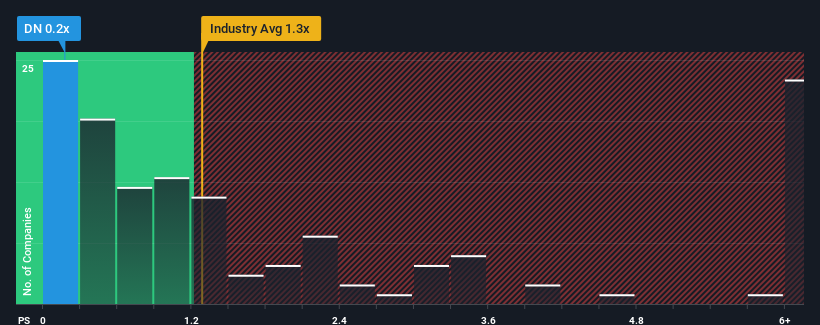

Even after such a large jump in price, Delta 9 Cannabis may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Pharmaceuticals industry in Canada have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Delta 9 Cannabis

How Has Delta 9 Cannabis Performed Recently?

Delta 9 Cannabis certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Delta 9 Cannabis' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Delta 9 Cannabis?

Delta 9 Cannabis' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The latest three year period has also seen an excellent 47% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 5.5% over the next year. With the industry predicted to deliver 5.3% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Delta 9 Cannabis is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Delta 9 Cannabis' P/S

Despite Delta 9 Cannabis' share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Delta 9 Cannabis currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - Delta 9 Cannabis has 5 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Delta 9 Cannabis, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Delta 9 Cannabis, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DN

Moderate and good value.

Similar Companies

Market Insights

Community Narratives