Not Many Are Piling Into Charlotte's Web Holdings, Inc. (TSE:CWEB) Stock Yet As It Plummets 28%

To the annoyance of some shareholders, Charlotte's Web Holdings, Inc. (TSE:CWEB) shares are down a considerable 28% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 71% share price decline.

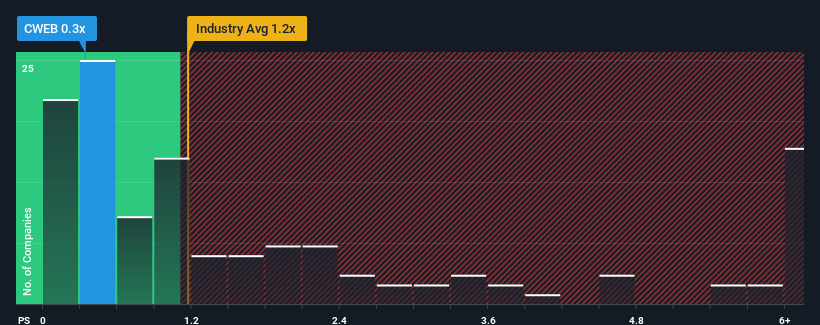

Following the heavy fall in price, when close to half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Charlotte's Web Holdings as an enticing stock to check out with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Charlotte's Web Holdings

What Does Charlotte's Web Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Charlotte's Web Holdings' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Charlotte's Web Holdings will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Charlotte's Web Holdings?

Charlotte's Web Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. As a result, revenue from three years ago have also fallen 27% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 15% over the next year. With the industry only predicted to deliver 4.2%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Charlotte's Web Holdings' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Charlotte's Web Holdings' P/S?

Charlotte's Web Holdings' recently weak share price has pulled its P/S back below other Pharmaceuticals companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Charlotte's Web Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Charlotte's Web Holdings you should know about.

If these risks are making you reconsider your opinion on Charlotte's Web Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CWEB

Charlotte's Web Holdings

Engages in the farming, manufacturing, marketing, and sale of hemp-derived cannabidiol (CBD) and other botanical-based wellness products.

Low risk and overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion