Will Curaleaf’s (TSX:CURA) Expanded Credit Facility Transform Its Approach to Capital Efficiency?

Reviewed by Sasha Jovanovic

- Earlier this month, Curaleaf Holdings announced it had expanded its secured revolving credit facility with Needham Bank from US$40 million to US$100 million, while extending the potential maturity to up to five years and reducing interest costs on refinancing certain acquisition-related debt.

- This significant enhancement of Curaleaf's credit facility aims to lower financing costs and provide greater flexibility for both debt repayment and working capital support.

- Now, we will explore how this improved borrowing capacity and capital efficiency could reshape Curaleaf's investment narrative and outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Curaleaf Holdings Investment Narrative Recap

To be a Curaleaf shareholder, you need to believe the company can unlock profitable growth through both international expansion and improvements in capital efficiency. While the expanded US$100 million credit facility lowers financing costs and increases working flexibility, the most important short-term catalyst remains regulatory reforms, particularly in key European and U.S. markets, while persistent pricing pressure from competition continues to be the greatest near-term risk. Overall, the credit facility’s impact on these fundamental drivers appears supportive but not transformative.

Of the company’s recent developments, Curaleaf’s September entry into New Albany, Ohio stands out, expanding its access to medical and adult-use customers in a regulated growth market. While this complements efforts to strengthen the balance sheet, the ultimate significance ties back to broader catalysts, such as regulatory change and adoption rates, that can fundamentally reshape revenue potential and justify renewed investment.

By contrast, ongoing margin compression driven by pricing pressure remains a material risk that investors should keep top of mind as...

Read the full narrative on Curaleaf Holdings (it's free!)

Curaleaf Holdings' outlook anticipates $1.5 billion in revenue and $38.9 million in earnings by 2028. This scenario requires an annual revenue growth rate of 4.3% and an earnings increase of $305.8 million from current earnings of -$266.9 million.

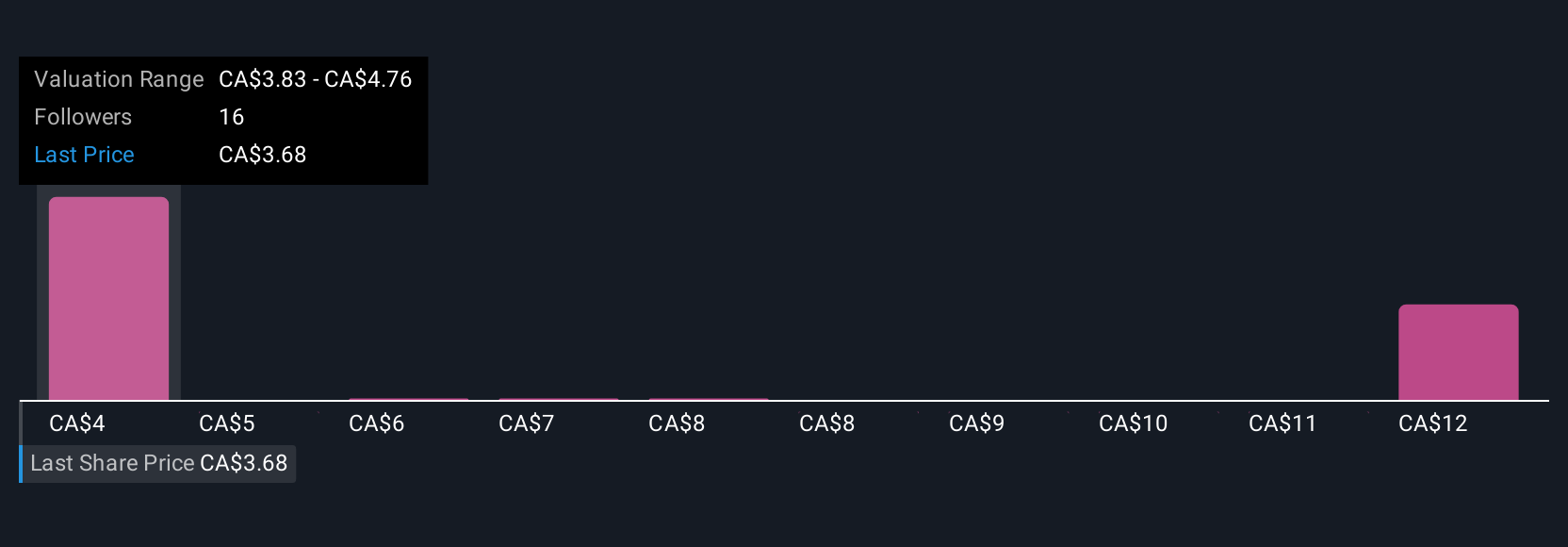

Uncover how Curaleaf Holdings' forecasts yield a CA$4.06 fair value, in line with its current price.

Exploring Other Perspectives

Individual fair value estimates from the Simply Wall St Community span US$4.06 to US$13.24 per share, reflecting five distinct analyses. With competition and pricing still under pressure, wider opinions show just how differently peers assess the company’s long-term earnings potential.

Explore 5 other fair value estimates on Curaleaf Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Curaleaf Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Curaleaf Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Curaleaf Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Curaleaf Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives