Can Curaleaf Holdings' (TSX:CURA) Q2 Revenue Slide Challenge Its Premium Product Ambitions?

Reviewed by Simply Wall St

- Curaleaf Holdings released its second-quarter 2025 results, reporting revenue of US$314.52 million and a net loss of US$53.16 million, both lower than the previous year.

- Losses per share increased year-over-year, highlighting ongoing operational pressures and a challenging revenue environment for the company.

- We’ll examine how Curaleaf’s widened losses and declining revenues may alter the outlook for international and premium product plans.

Find companies with promising cash flow potential yet trading below their fair value.

Curaleaf Holdings Investment Narrative Recap

Curaleaf Holdings shareholders need to believe in the company’s ability to return to growth and restore profitability, despite increased losses and falling revenue shown in the latest quarter. The Q2 2025 results reinforce questions around price compression as the most immediate risk, while ongoing industry headwinds may continue to weigh on any meaningful revenue rebound; at this stage, the recent report does not materially alter the biggest short-term catalyst, which remains successful implementation of operational efficiency programs.

The April 2025 launch of the Anthem pre-roll brand is one of the more relevant announcements tied to recent performance, as expanding premium offerings directly addresses the need to improve sales mix and margins. The effectiveness of such product introductions will be closely observed, especially as revenues trend downward and competition in core markets remains intense.

By contrast, investors should be aware that price compression in large state markets remains a significant factor that could erode future revenue if not stabilized...

Read the full narrative on Curaleaf Holdings (it's free!)

Curaleaf Holdings is projected to achieve $1.5 billion in revenue and $56.9 million in earnings by 2028. This outlook is based on analysts expecting 3.9% annual revenue growth and a $309.3 million increase in earnings from the current loss of $-252.4 million.

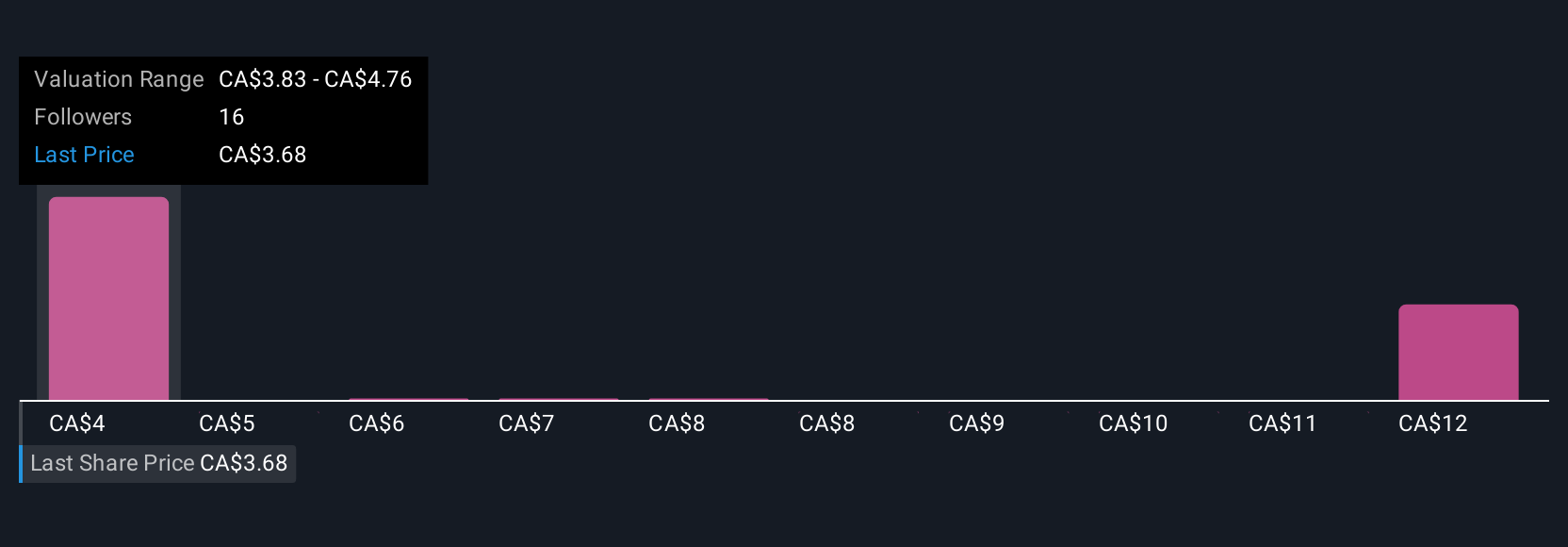

Uncover how Curaleaf Holdings' forecasts yield a CA$3.72 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Community fair value estimates for Curaleaf range from US$3.72 to US$13.04, based on five separate forecasts from the Simply Wall St Community. With price compression presenting a near-term risk, you can explore diverse viewpoints and weigh multiple scenarios shaping Curaleaf’s potential.

Explore 5 other fair value estimates on Curaleaf Holdings - why the stock might be worth 12% less than the current price!

Build Your Own Curaleaf Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Curaleaf Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Curaleaf Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Curaleaf Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives