3 TSX Growth Stocks With Insider Ownership And Up To 65% Earnings Growth

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of potential rate cuts and economic stabilization, investors are keeping a close eye on growth opportunities amid heightened volatility. In this environment, stocks with strong insider ownership and significant earnings growth potential can be particularly appealing, as they may offer resilience and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 21.1% | 87.6% |

| Robex Resources (TSXV:RBX) | 24.3% | 93.4% |

| Propel Holdings (TSX:PRL) | 36.5% | 31.8% |

| Orla Mining (TSX:OLA) | 11% | 76.9% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| Enterprise Group (TSX:E) | 32.1% | 30.4% |

| CEMATRIX (TSX:CEMX) | 10.5% | 76.6% |

| Aritzia (TSX:ATZ) | 17.2% | 29.6% |

| Almonty Industries (TSX:AII) | 12.6% | 63.6% |

| Allied Gold (TSX:AAUC) | 16% | 86.5% |

Let's review some notable picks from our screened stocks.

Green Thumb Industries (CNSX:GTII)

Simply Wall St Growth Rating: ★★★★☆☆

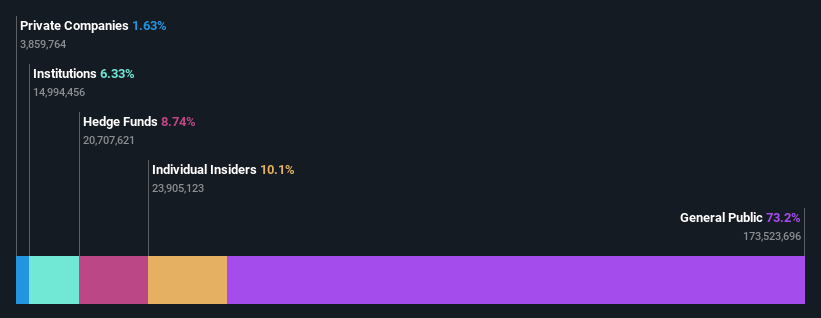

Overview: Green Thumb Industries Inc. operates in the United States, focusing on the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult use with a market cap of CA$2.44 billion.

Operations: The company's revenue segments include Retail, generating $820.25 million, and Consumer Packaged Goods, contributing $681.87 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 34.4% p.a.

Green Thumb Industries is positioned for growth with forecasted earnings increasing significantly at 34.4% annually, outpacing the Canadian market. Despite recent profit margin declines and a net loss of US$0.645 million in Q2 2025, the company trades at a substantial discount to its estimated fair value. Recent strategic moves include a US$50 million share buyback program, signaling confidence from management and potentially enhancing shareholder value through reduced share count.

- Unlock comprehensive insights into our analysis of Green Thumb Industries stock in this growth report.

- Our valuation report unveils the possibility Green Thumb Industries' shares may be trading at a discount.

Curaleaf Holdings (TSX:CURA)

Simply Wall St Growth Rating: ★★★★☆☆

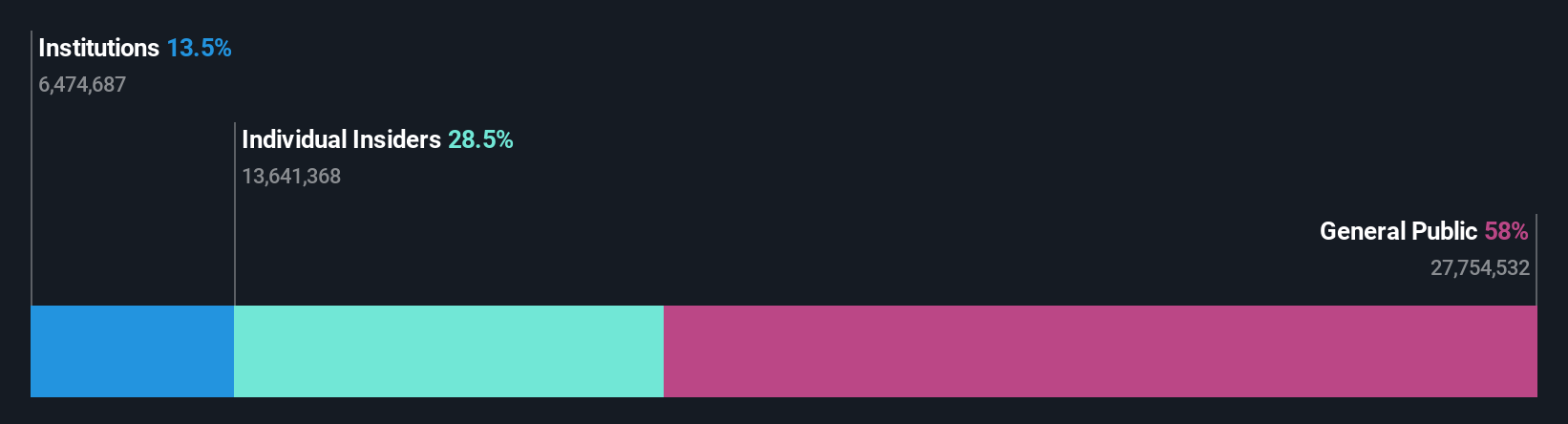

Overview: Curaleaf Holdings, Inc. is involved in the production and distribution of cannabis products both in the United States and internationally, with a market cap of approximately CA$2.62 billion.

Operations: The company's revenue from its cannabis operations, including cultivation, production, distribution, and sales, totals $1.29 billion.

Insider Ownership: 18.6%

Earnings Growth Forecast: 65.3% p.a.

Curaleaf Holdings is expanding its footprint with a new dispensary in Ohio, adding to its 155 locations nationwide. Despite a net loss of US$53.16 million in Q2 2025 and revenue decline to US$314.52 million, the company is forecasted to become profitable within three years, surpassing average market growth rates. Insider activity shows more shares sold than bought recently, but Curaleaf trades at a significant discount to estimated fair value, suggesting potential long-term investment appeal.

- Navigate through the intricacies of Curaleaf Holdings with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Curaleaf Holdings implies its share price may be lower than expected.

Electrovaya (TSX:ELVA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electrovaya Inc. designs, develops, manufactures, and sells lithium-ion batteries and related products for energy storage and clean electric transportation in North America, with a market cap of CA$364.57 million.

Operations: Electrovaya Inc. generates revenue of $54.88 million from its segment focused on developing, manufacturing, and marketing power technology products for energy storage, clean electric transportation, and specialized applications in North America.

Insider Ownership: 33.9%

Earnings Growth Forecast: 50.4% p.a.

Electrovaya is poised for substantial growth, with earnings forecasted to grow significantly faster than the Canadian market. The company recently launched next-generation Energy Storage Systems, leveraging proprietary technology for enhanced safety and durability. Despite past shareholder dilution and interest coverage concerns, Electrovaya trades below its estimated fair value and anticipates revenue growth exceeding market averages. Recent expansions in manufacturing capabilities support scalability in North America's energy storage sector, aligning with strategic supply agreements to bolster future demand.

- Take a closer look at Electrovaya's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Electrovaya shares in the market.

Turning Ideas Into Actions

- Delve into our full catalog of 41 Fast Growing TSX Companies With High Insider Ownership here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives