- Canada

- /

- Hospitality

- /

- TSX:TWC

Exploring Three Undiscovered Gems in Canada with Strong Potential

Reviewed by Simply Wall St

The Canadian market is currently navigating a landscape of improving labor productivity and robust corporate earnings growth, which are contributing to a resilient economic environment despite some challenges. With the Bank of Canada potentially poised to adjust interest rates to support the cooling economy, small-cap stocks in Canada may present intriguing opportunities for investors seeking growth. In this context, identifying stocks with strong fundamentals and potential for capital appreciation becomes crucial as we explore three undiscovered gems in Canada's market.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Heliostar Metals | NA | 106.15% | 25.32% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.21% | 62.25% | 64.39% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Cronos Group (TSX:CRON)

Simply Wall St Value Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products across Canada, Israel, and internationally with a market cap of CA$1.22 billion.

Operations: Cronos Group generates revenue primarily from the cultivation, manufacture, and marketing of cannabis and cannabis-derived products, totaling $130.28 million.

Cronos Group, with its focus on innovative wellness products and expanding international presence, is poised for growth despite facing challenges in the volatile cannabis market. The company reported a net loss of US$39.71 million for Q2 2025, a significant increase from the previous year's US$8.76 million loss, while sales rose to US$44.25 million from US$38.68 million year-over-year. Cronos's strategic expansion into Switzerland through PEACE NATURALS® and its facility enhancements like GrowCo aim to boost production capacity by late 2025, although analysts predict declining profit margins amidst intense competition and regulatory hurdles ahead.

Guardian Capital Group (TSX:GCG.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guardian Capital Group Limited operates through its subsidiaries to provide investment services across Canada, the United States, the United Kingdom, and internationally, with a market capitalization of CA$947.78 million.

Operations: Guardian Capital Group generates revenue primarily from investment management and advisory services. The company's net profit margin has been recorded at 15% for the latest period.

Guardian Capital Group, a small cap player in the Canadian financial scene, recently reported impressive earnings growth of 141.5% over the past year, outpacing the industry average of 14.5%. This surge was partly influenced by a significant one-off gain of CA$82 million. The company’s price-to-earnings ratio stands at 6.2x, notably lower than the broader Canadian market's 15.7x, suggesting potential value for investors. Despite an increase in its debt to equity ratio from 9.9% to 11.2% over five years, Guardian remains financially sound with more cash than total debt and strong EBIT coverage on interest payments at 3.7x.

- Click to explore a detailed breakdown of our findings in Guardian Capital Group's health report.

Understand Guardian Capital Group's track record by examining our Past report.

TWC Enterprises (TSX:TWC)

Simply Wall St Value Rating: ★★★★★★

Overview: TWC Enterprises Limited owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States, with a market cap of CA$557.30 million.

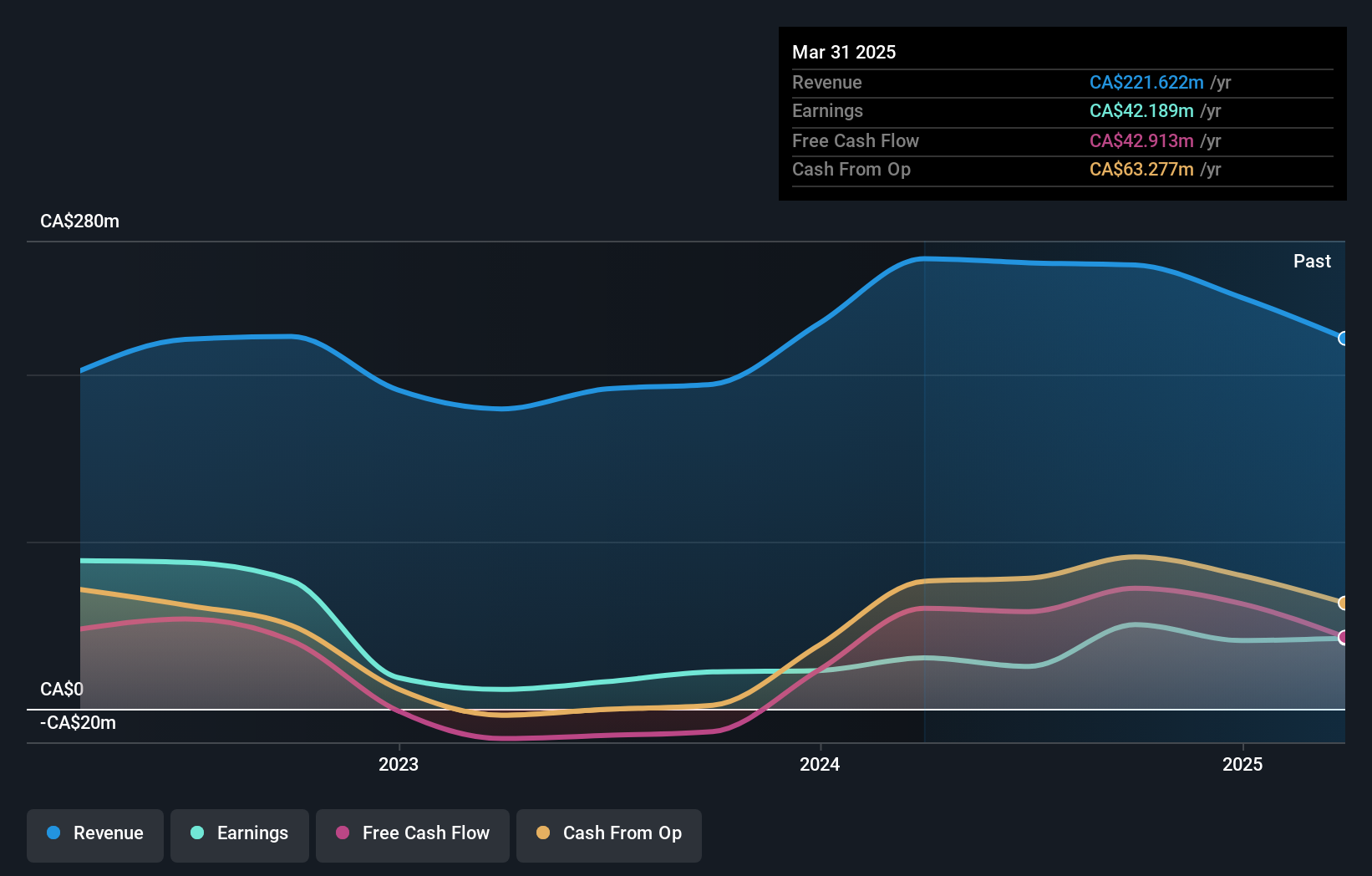

Operations: The primary revenue stream for TWC Enterprises comes from its Canadian Golf Club Operations, generating CA$162.99 million, followed by US Golf Club Operations at CA$24.81 million.

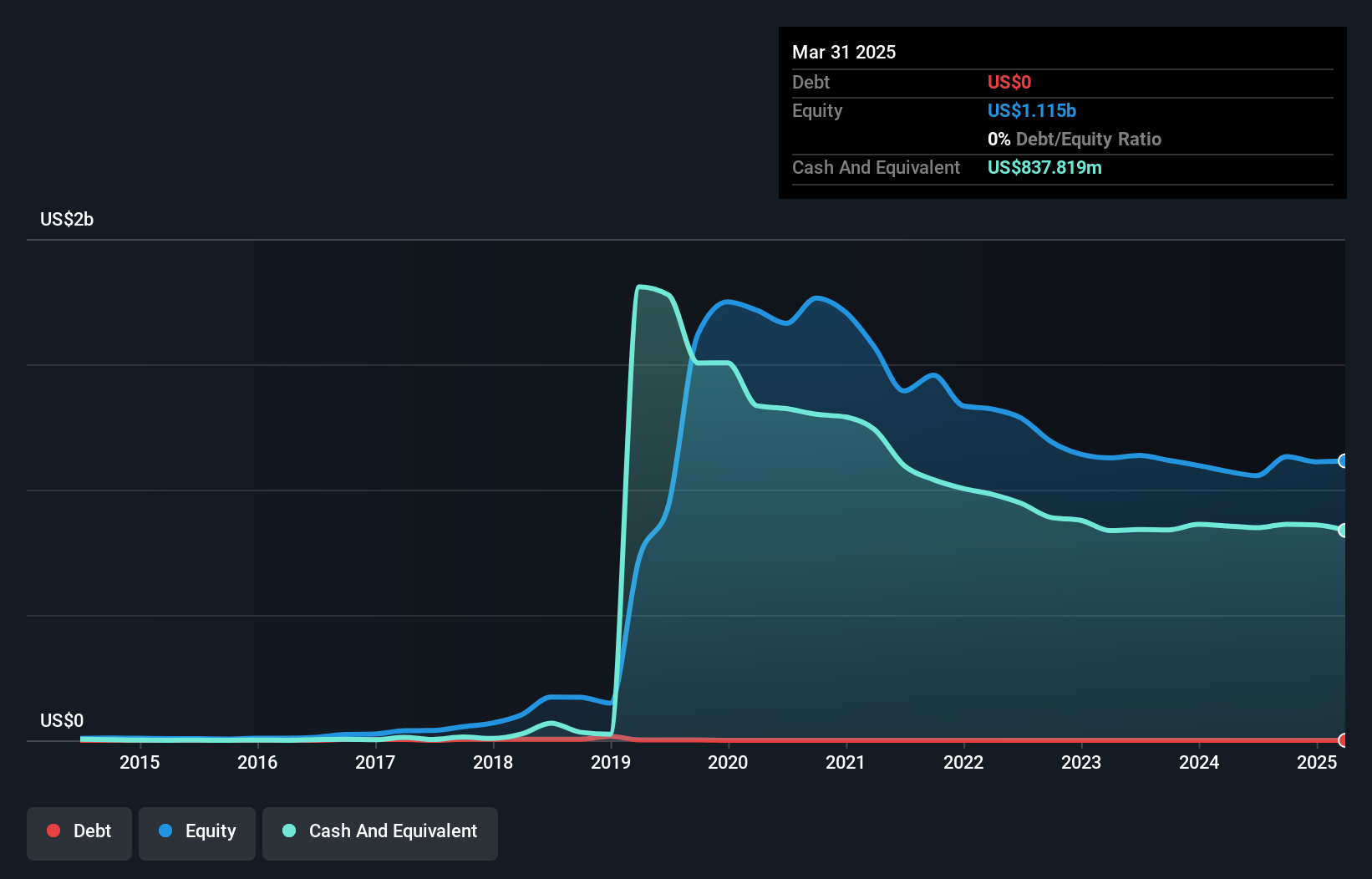

TWC Enterprises, a smaller player in the market, has seen its debt to equity ratio drop significantly from 30.4% to just 3.9% over five years, indicating stronger financial health. The company reported an impressive earnings growth of 140.7% last year, outpacing the hospitality industry’s modest 1.3%. A notable CA$23.9 million one-off gain influenced recent results but did not overshadow TWC's robust performance with net income jumping from CA$3.16 million to CA$21.48 million year-on-year for Q2 2025 and basic earnings per share rising from CA$0.13 to CA$0.88 during the same period.

- Delve into the full analysis health report here for a deeper understanding of TWC Enterprises.

Gain insights into TWC Enterprises' past trends and performance with our Past report.

Next Steps

- Take a closer look at our TSX Undiscovered Gems With Strong Fundamentals list of 50 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TWC Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TWC

TWC Enterprises

Owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives