Key Takeaways

- Growing international presence and facility expansions position Cronos for increased revenue, reduced regional dependency, and improved operating leverage.

- Focus on innovative wellness products and disciplined financial management supports sustained margin improvement and long-term growth flexibility.

- Reliance on volatile international markets, operational risks, increased competition, and capital pressures threaten Cronos’s profitability, market share, and ability to sustain future earnings growth.

Catalysts

About Cronos Group- A cannabinoid company, engages in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally.

- Global expansion initiatives, especially the growth of Peace Naturals in Israel (achieving over 20% market share and 40%+ YoY revenue growth) and increasing demand in Germany and the UK, position Cronos to benefit from the rising international acceptance and legalization of cannabis, increasing future revenue and reducing dependency on the North American market.

- The ongoing GrowCo facility expansion will unlock significant new cultivation capacity in H2 2025, addressing current product shortages and pent-up demand in key categories, potentially accelerating revenue growth and improving operating leverage for higher future net margins.

- Strong consumer demand for wellness-oriented and innovative cannabinoid products—exemplified by new rare cannabinoid-infused edibles and vapes—positions Cronos to capture a larger share of shifting demographics (Millennial and Gen Z) seeking cannabis-based health alternatives, supporting long-term top-line growth.

- Significant improvements in gross margin (from 18% to 44% YoY) driven by production efficiency gains and cost discipline, along with anticipated fixed cost leverage from capacity expansion, set the stage for sustained gross margin improvement and increased near

- and long-term earnings.

- Robust cash reserves and prudent capital allocation, highlighted by a $50 million share repurchase authorization and continued investment in R&D, provide Cronos with flexibility to pursue further innovation, acquisitions, and international partnerships that could drive future revenue and long-term EPS growth.

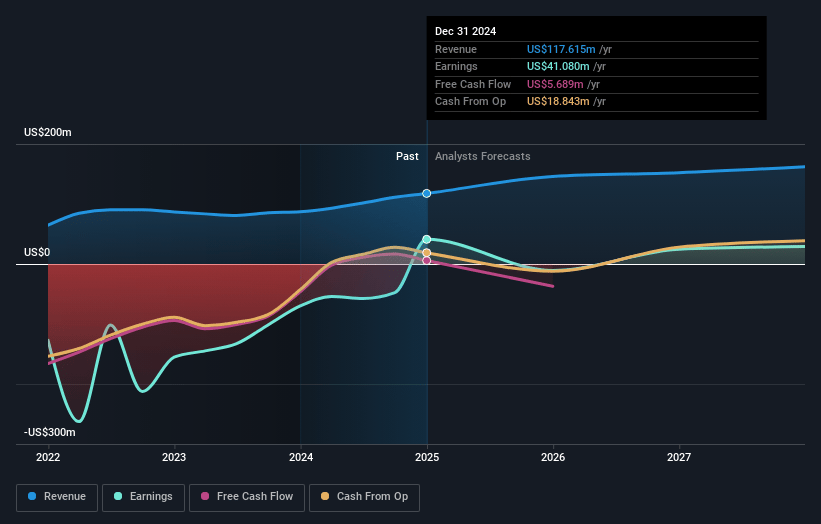

Cronos Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cronos Group's revenue will grow by 11.1% annually over the next 3 years.

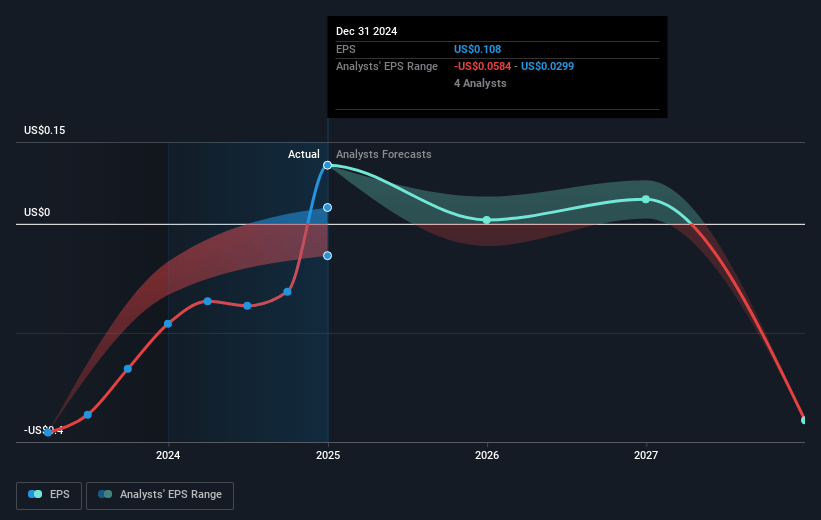

- Analysts assume that profit margins will shrink from 39.7% today to 11.7% in 3 years time.

- Analysts expect earnings to reach $20.0 million (and earnings per share of $-0.27) by about July 2028, down from $49.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 64.5x on those 2028 earnings, up from 16.2x today. This future PE is greater than the current PE for the CA Pharmaceuticals industry at 19.1x.

- Analysts expect the number of shares outstanding to grow by 0.82% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.95%, as per the Simply Wall St company report.

Cronos Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The imposition of up to 165% tariffs by Israeli authorities on Canadian cannabis, even with recent vetoes, creates ongoing regulatory and political risk in what is a vital, fast-growing international market for Cronos; any approval or persistence of such tariffs could significantly reduce Cronos’s Israeli sales volumes and revenue and pressure margins.

- Current strong gross margin improvement partly stems from temporary timing effects, regional mix, and one-off accounting adjustments; as these normalize, underlying profitability may weaken, putting at risk the sustainability of recent improvements in net margins and earnings.

- Persistent supply constraints and an overreliance on the upcoming GrowCo expansion to resolve them exposes Cronos to execution risk; any operational delay or underperformance could limit the company’s ability to meet demand, thereby restricting near-term and potentially long-term revenue growth.

- The drop in Spinach flower market share from #2 to #3 in Canada, together with the ongoing challenge of maintaining premium pricing and differentiation in a crowded market, highlights heightened competition and the threat of commoditization, which can erode market share, compress revenue, and squeeze margins.

- Elevated capital expenditures tied to the GrowCo facility expansion and ongoing working capital outflows, at a time when cash generation from operations remains modest, could pressure Cronos's financial flexibility and limit internal funding for innovation or international M&A, ultimately impacting future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$3.767 for Cronos Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$5.0, and the most bearish reporting a price target of just CA$2.82.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $171.0 million, earnings will come to $20.0 million, and it would be trading on a PE ratio of 64.5x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$2.84, the analyst price target of CA$3.77 is 24.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.