The Canadian market, like its U.S. counterpart, is experiencing shifts in inflation dynamics, with goods prices potentially rising due to tariffs while services inflation shows signs of moderation. Amid these economic conditions, investors may look towards penny stocks—smaller or newer companies that can offer unique opportunities. Although the term "penny stock" might seem outdated, it still represents a segment where informed investors can find value by focusing on companies with strong financial foundations and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.68 | CA$69.79M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$488.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.90 | CA$19.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.01 | CA$201.5M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.81 | CA$646.16M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.65 | CA$158.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.91 | CA$179.49M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.69 | CA$8.62M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 436 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Avino Silver & Gold Mines (TSX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avino Silver & Gold Mines Ltd. is involved in the acquisition, exploration, and development of mineral properties in Mexico, with a market cap of CA$646.16 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically focusing on Gold & Other Precious Metals, amounting to $72.62 million.

Market Cap: CA$646.16M

Avino Silver & Gold Mines Ltd. has demonstrated significant earnings growth, with a 778.6% increase over the past year, surpassing industry averages. The company's operating cash flow effectively covers its debt, and short-term assets exceed liabilities, indicating financial stability. Recent production results show increased outputs in copper and gold compared to the previous year. Despite insider selling in recent months, Avino's stock trades below fair value estimates and maintains high-quality earnings without shareholder dilution over the past year. Recent strategic moves include a $40 million follow-on equity offering and inclusion in the S&P/TSX Global Mining Index.

- Navigate through the intricacies of Avino Silver & Gold Mines with our comprehensive balance sheet health report here.

- Assess Avino Silver & Gold Mines' future earnings estimates with our detailed growth reports.

Cronos Group (TSX:CRON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products across Canada, Israel, and internationally with a market cap of CA$1.04 billion.

Operations: The company's revenue is derived from the cultivation, manufacture, and marketing of cannabis and cannabis-derived products, totaling $124.59 million.

Market Cap: CA$1.04B

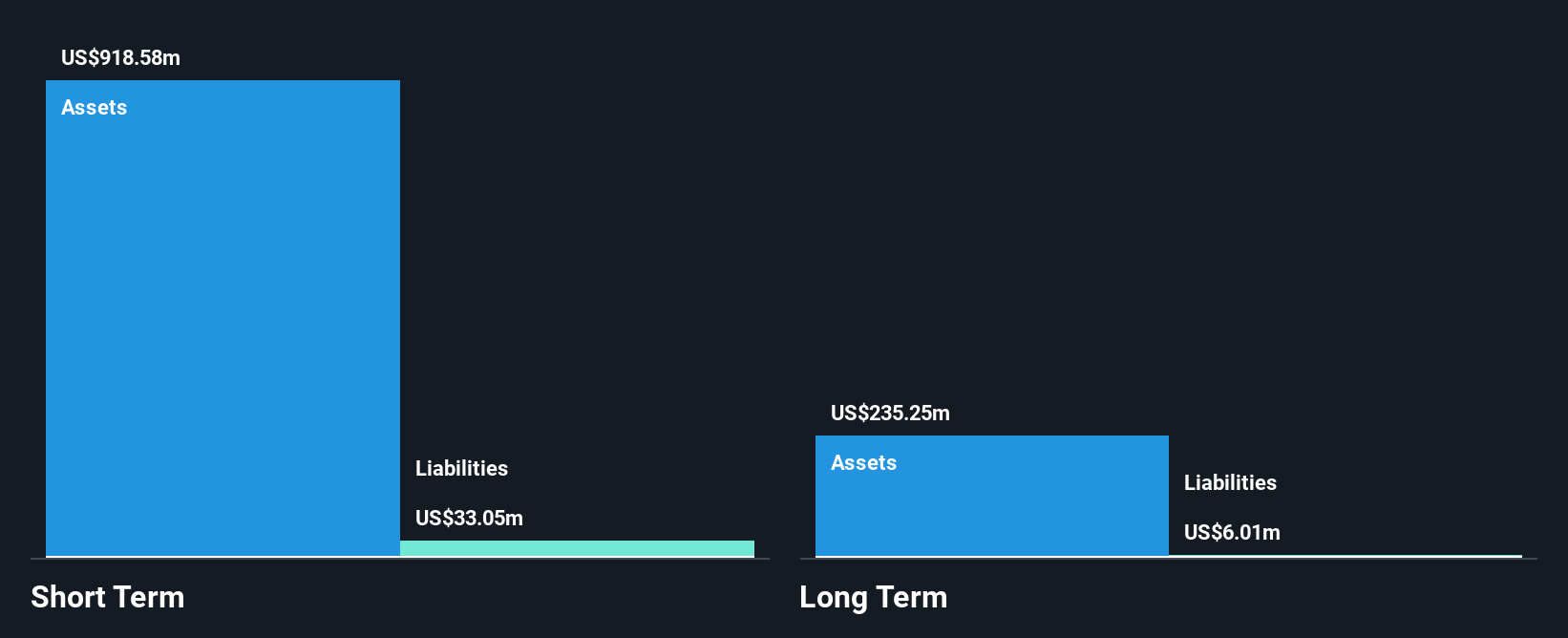

Cronos Group Inc. has recently turned profitable, reporting a net income of US$6.12 million for Q1 2025, compared to a loss the previous year. The company is debt-free with substantial short-term assets of $918.6 million covering liabilities effectively, indicating strong financial health despite declining earnings over five years. Cronos is expanding internationally through its PEACE NATURALS® brand in Switzerland via Dascoli Pharma AG, enhancing its global footprint in medical cannabis markets. Additionally, Cronos announced a share repurchase program worth $50 million to buy back up to 5% of its shares by May 2026, reflecting confidence in its valuation and future prospects.

- Unlock comprehensive insights into our analysis of Cronos Group stock in this financial health report.

- Evaluate Cronos Group's prospects by accessing our earnings growth report.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, production, and operation of mineral properties in Latin America and has a market cap of CA$412.11 million.

Operations: The company's revenue is derived from its operations at Porco ($42.35 million), Bolivar ($85.81 million), Zimapan ($90.38 million), SAN Lucas ($83.22 million), and Caballo Blanco Group ($73.23 million).

Market Cap: CA$412.11M

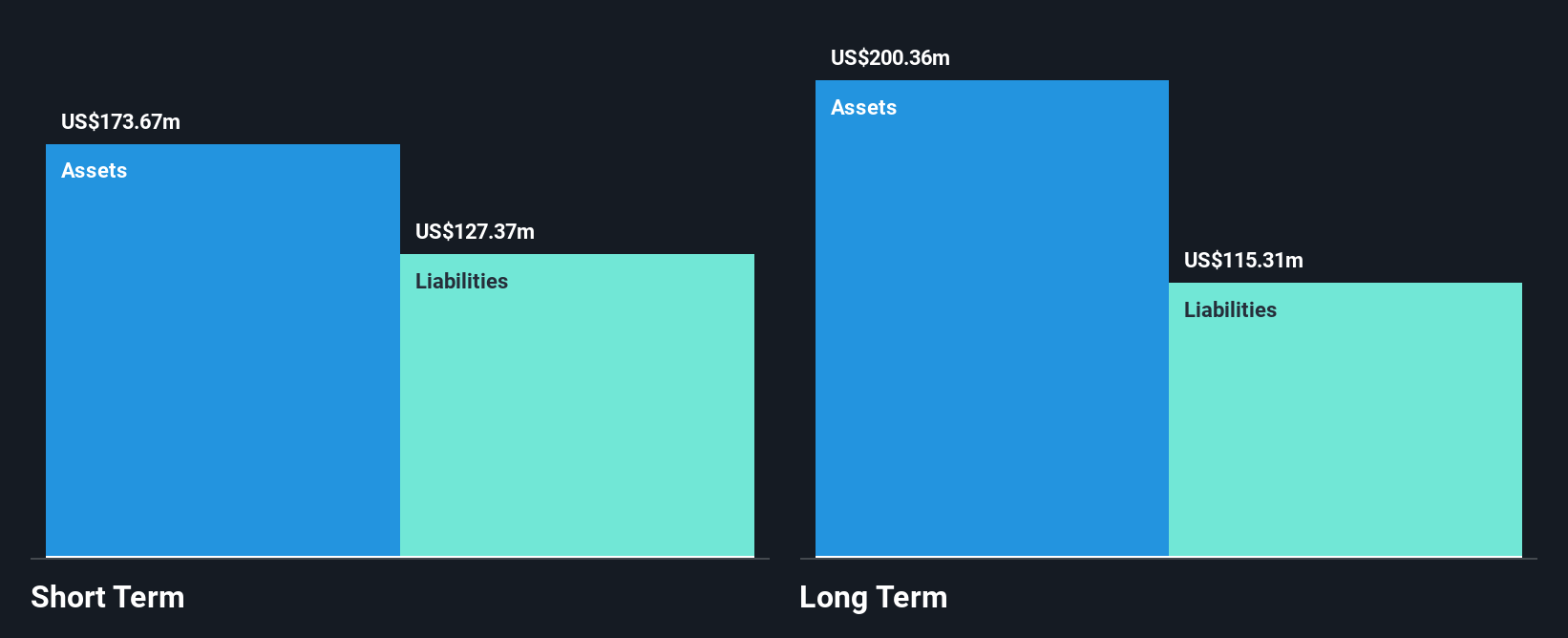

Santacruz Silver Mining Ltd. has demonstrated financial discipline with its structured payment plan for Bolivian asset acquisition, aiming for US$40 million in savings by October 2025. Despite a recent decline in production across key metals, the company maintains a solid financial position with cash exceeding total debt and strong interest coverage of 42 times EBIT. However, volatility remains high and insider selling has been significant recently. While Santacruz's revenue is forecasted to grow at 8.41% annually, profit margins have decreased from last year, reflecting challenges in sustaining previous profitability levels amidst industry fluctuations.

- Take a closer look at Santacruz Silver Mining's potential here in our financial health report.

- Learn about Santacruz Silver Mining's future growth trajectory here.

Taking Advantage

- Click through to start exploring the rest of the 433 TSX Penny Stocks now.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRON

Cronos Group

A cannabinoid company, engages in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives