There's No Escaping Cipher Pharmaceuticals Inc.'s (TSE:CPH) Muted Earnings Despite A 26% Share Price Rise

Cipher Pharmaceuticals Inc. (TSE:CPH) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 173% in the last year.

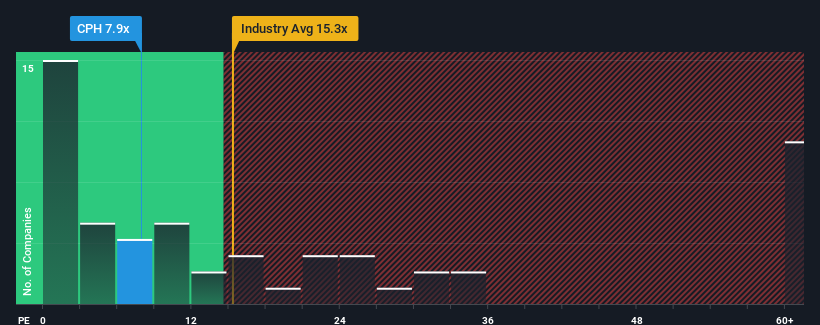

Although its price has surged higher, Cipher Pharmaceuticals may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.9x, since almost half of all companies in Canada have P/E ratios greater than 14x and even P/E's higher than 28x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Cipher Pharmaceuticals as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Cipher Pharmaceuticals

Is There Any Growth For Cipher Pharmaceuticals?

The only time you'd be truly comfortable seeing a P/E as low as Cipher Pharmaceuticals' is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 424% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 27% per year during the coming three years according to the three analysts following the company. With the market predicted to deliver 8.3% growth per year, that's a disappointing outcome.

With this information, we are not surprised that Cipher Pharmaceuticals is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Cipher Pharmaceuticals' P/E?

The latest share price surge wasn't enough to lift Cipher Pharmaceuticals' P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Cipher Pharmaceuticals' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Cipher Pharmaceuticals that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CPH

Cipher Pharmaceuticals

Operates as a specialty pharmaceutical company in Canada.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives