- Canada

- /

- Metals and Mining

- /

- TSX:JAG

Discovering Canada's Undiscovered Gems in August 2024

Reviewed by Simply Wall St

As the Canadian market rides a wave of positive sentiment following easing inflation and encouraging economic data, small-cap stocks are beginning to attract more attention from investors. With central banks potentially shifting towards rate cuts, the conditions seem ripe for uncovering hidden opportunities in this often-overlooked segment of the market. In this context, identifying stocks with strong fundamentals and growth potential becomes crucial for capitalizing on these favorable trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Jaguar Mining | 1.19% | 5.49% | 5.12% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Tenaz Energy | NA | 33.64% | 50.62% | ★★★★★☆ |

| Reconnaissance Energy Africa | NA | 31.73% | -6.92% | ★★★★★☆ |

| Firan Technology Group | 17.91% | 3.75% | 23.32% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Cipher Pharmaceuticals (TSX:CPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Cipher Pharmaceuticals Inc. is a specialty pharmaceutical company based in Canada with a market cap of CA$391.25 million.

Operations: Cipher Pharmaceuticals generates revenue primarily from its Specialty Pharmaceuticals segment, amounting to CA$22.16 million.

Cipher Pharmaceuticals, a small cap Canadian firm, is trading at 60.5% below its estimated fair value and boasts high-quality earnings. Despite negative earnings growth of -19.4% over the past year, it remains debt-free with a forecasted annual earnings growth of 3.81%. Recent financials show Q2 revenue at US$5.3 million and net income at US$3 million, consistent with last year's figures. The company also reported six-month revenue of US$11.17 million and net income of US$7.92 million for 2024.

- Delve into the full analysis health report here for a deeper understanding of Cipher Pharmaceuticals.

Understand Cipher Pharmaceuticals' track record by examining our Past report.

Jaguar Mining (TSX:JAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Jaguar Mining Inc. is a junior gold mining company focused on the acquisition, exploration, development, and operation of gold mineral properties in Brazil with a market cap of CA$379.11 million.

Operations: Jaguar Mining generates CA$144.85 million in revenue from its gold producing properties in Brazil. The company's market cap stands at CA$379.11 million.

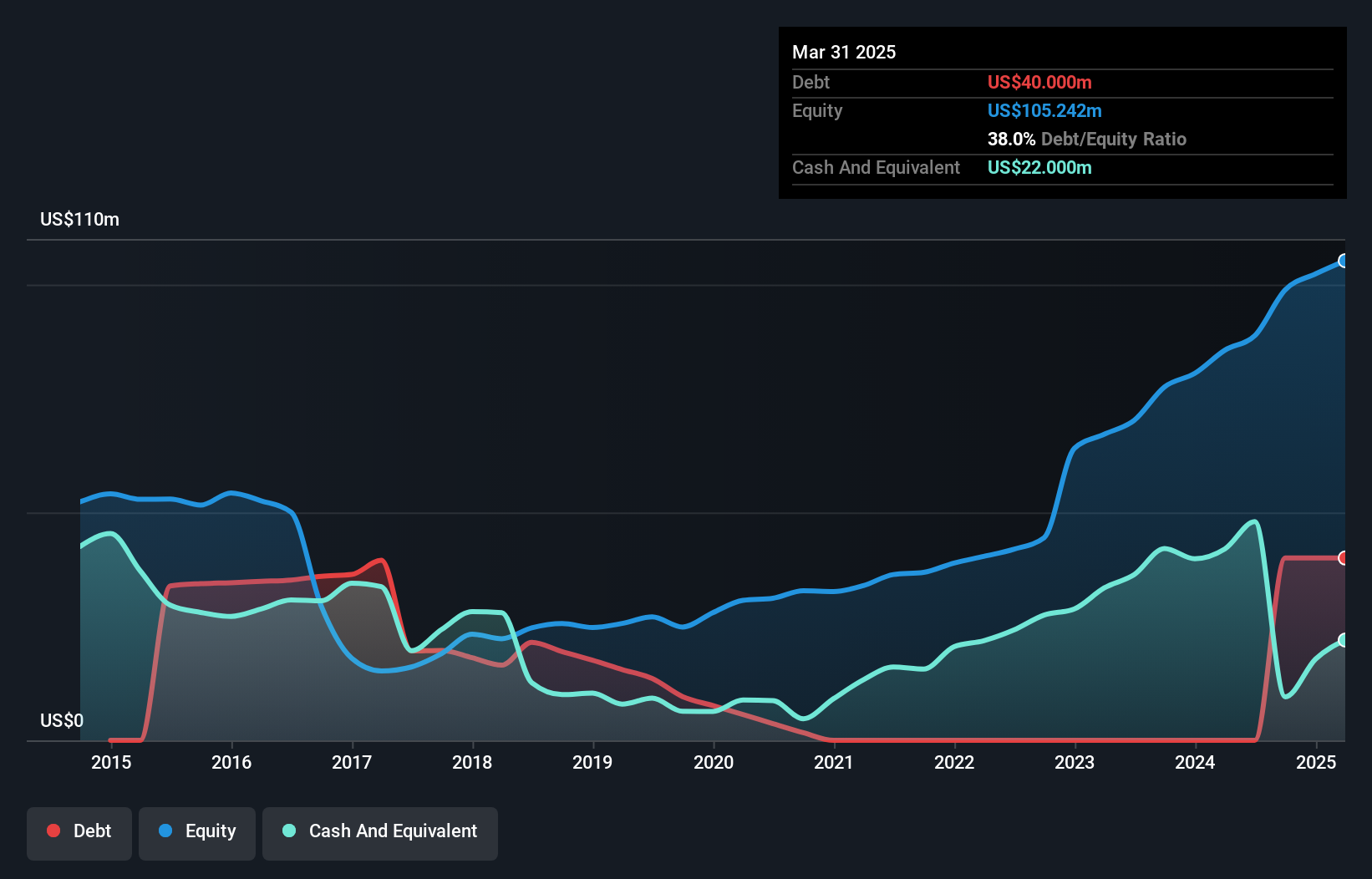

Jaguar Mining has shown impressive growth, with earnings surging by 58.9% over the past year, outperforming the Metals and Mining industry's 10.4%. The company’s debt to equity ratio improved significantly from 20.9% to 1.2% in five years, and it now holds more cash than its total debt. Recent results highlight a strong performance with Q2 sales at US$44.78 million compared to US$33.19 million last year, and net income of US$13.47 million versus a net loss of US$1.1 million previously.

- Click here to discover the nuances of Jaguar Mining with our detailed analytical health report.

Gain insights into Jaguar Mining's historical performance by reviewing our past performance report.

Leon's Furniture (TSX:LNF)

Simply Wall St Value Rating: ★★★★★★

Overview: Leon's Furniture Limited, together with its subsidiaries, operates as a retailer of home furnishings, mattresses, appliances, and electronics in Canada with a market cap of CA$1.96 billion.

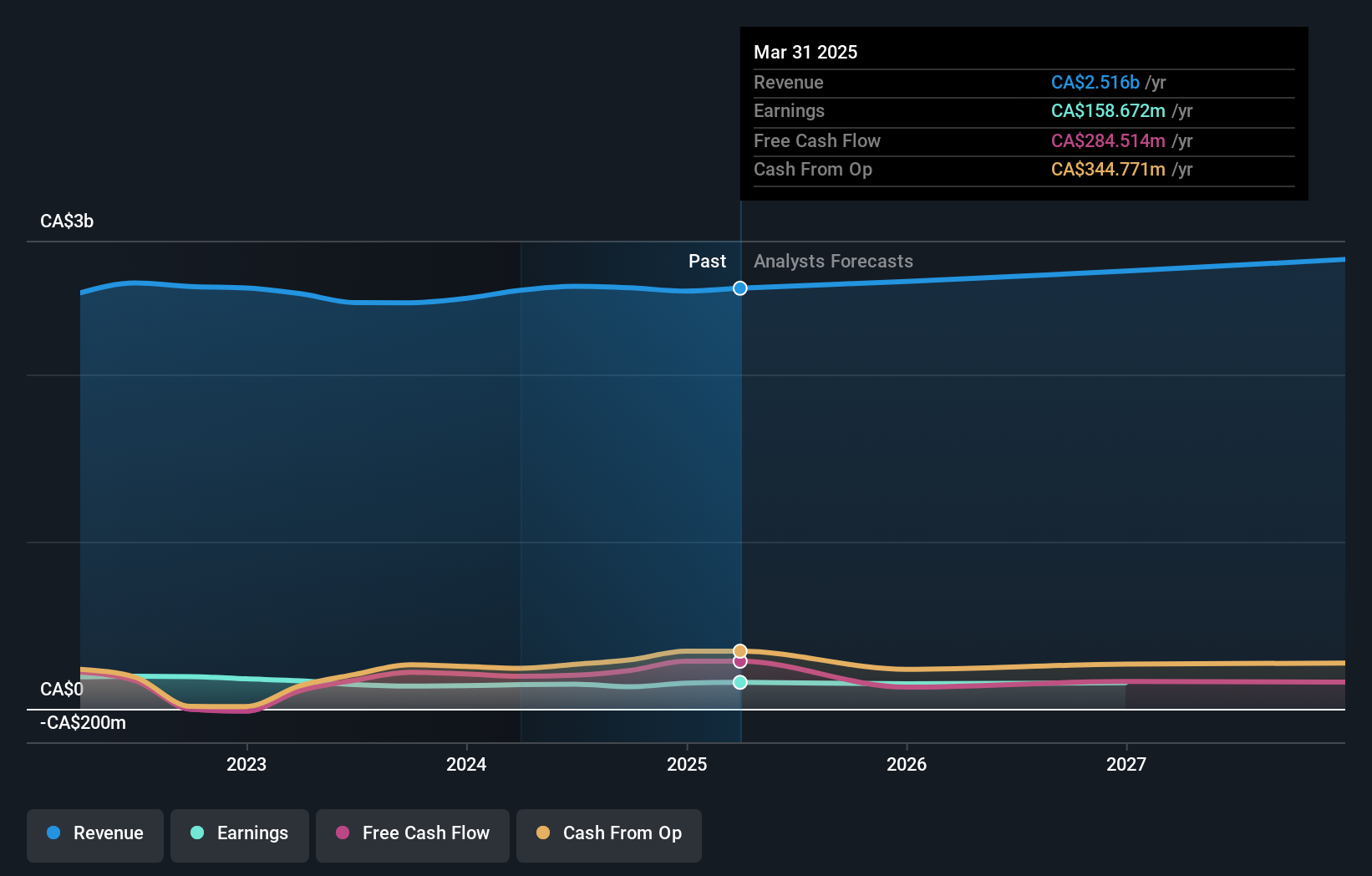

Operations: Leon's Furniture generates CA$2.53 billion in revenue primarily from the sale of home furnishings, mattresses, appliances, and electronics. The company has a market cap of CA$1.96 billion.

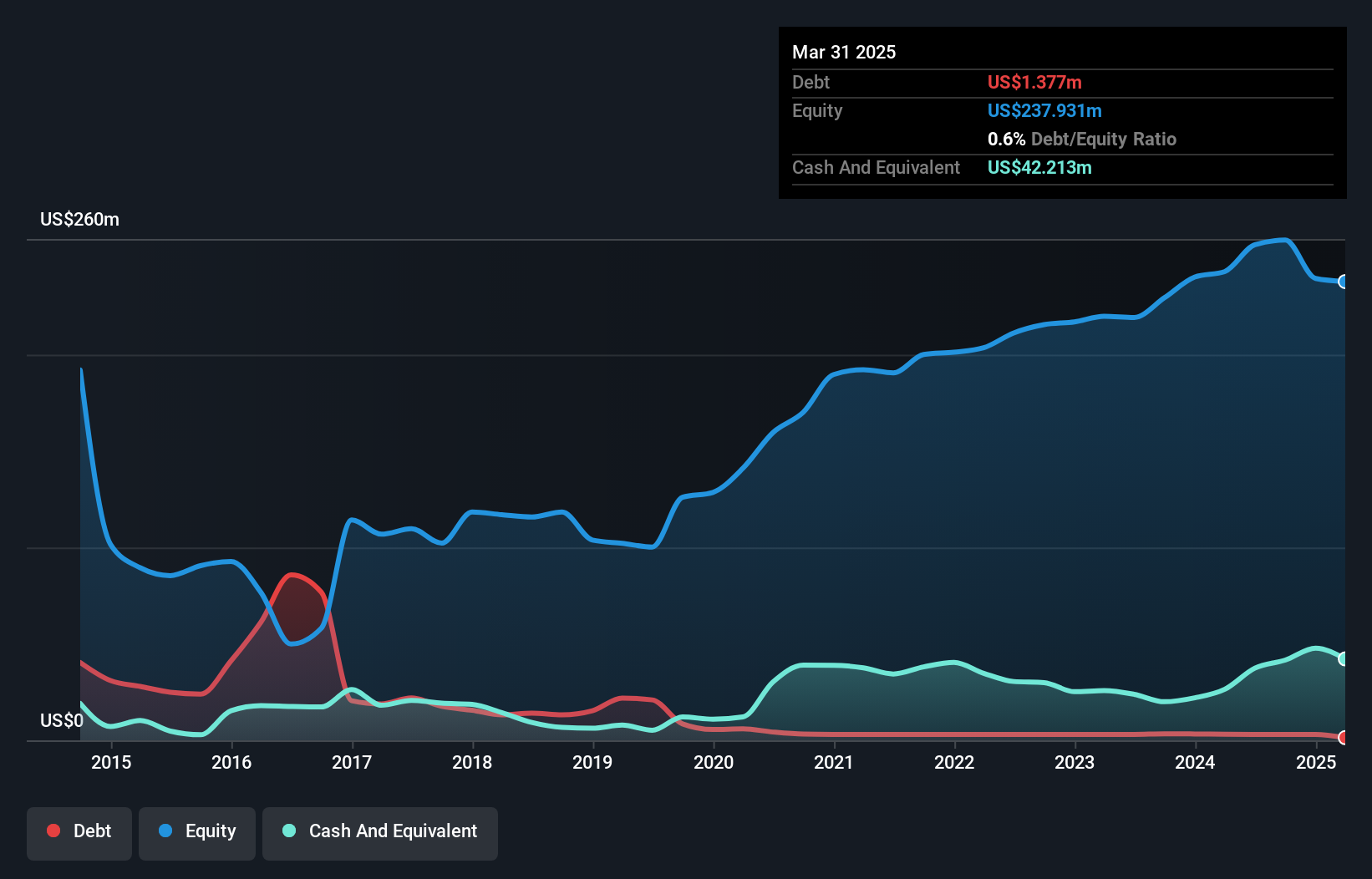

Leon's Furniture, known for its high-quality earnings, has seen its debt to equity ratio drop from 20.4% to 10.4% over the past five years. Trading at 61.6% below estimated fair value, it offers good relative value compared to peers and industry standards. Recent earnings showed a net income of CAD 30.17 million for Q2 2024, up from CAD 27.42 million last year, with basic EPS rising from CAD 0.40 to CAD 0.44 per share.

- Unlock comprehensive insights into our analysis of Leon's Furniture stock in this health report.

Explore historical data to track Leon's Furniture's performance over time in our Past section.

Make It Happen

- Explore the 42 names from our TSX Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:JAG

Jaguar Mining

A junior gold mining company, engages in the acquisition, exploration, development, and operation of gold mineral properties in Brazil.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives