Reflecting on Aeterna Zentaris' (TSE:AEZS) Share Price Returns Over The Last Five Years

It is a pleasure to report that the Aeterna Zentaris Inc. (TSE:AEZS) is up 189% in the last quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 69% in the period. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

View our latest analysis for Aeterna Zentaris

Aeterna Zentaris recorded just US$1,304,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Aeterna Zentaris comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Aeterna Zentaris has already given some investors a taste of the bitter losses that high risk investing can cause.

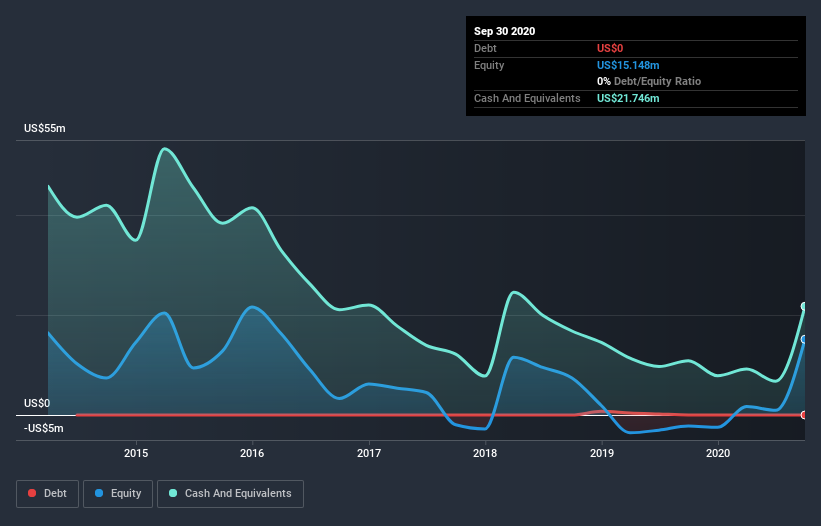

When it reported in September 2020 Aeterna Zentaris had minimal cash in excess of all liabilities consider its expenditure: just US$4.6m to be specific. So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. With that in mind, you can understand why the share price dropped 11% per year, over 5 years. The image below shows how Aeterna Zentaris' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

Investors in Aeterna Zentaris had a tough year, with a total loss of 22%, against a market gain of about 5.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Aeterna Zentaris has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade Aeterna Zentaris, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:CSCI

COSCIENS Biopharma

A life science company, develops and commercializes products for the cosmeceutical, nutraceutical and pharmaceutical markets in the United States, Germany, Colombia, the United Kingdom, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives