A Look at Aurora Cannabis (TSX:ACB) Valuation Following German Facility Upgrade Plans

Reviewed by Kshitija Bhandaru

Aurora Cannabis (TSX:ACB) is committing to a multi-year investment focused on upgrading its EU-GMP certified facility in Leuna, Germany. The initiative will enhance flower growth capacity, production quality, and operational efficiency by adopting best practices established in Canada.

See our latest analysis for Aurora Cannabis.

Aurora Cannabis’s commitment to the Leuna facility follows a period of steady but subdued momentum. While the company’s five-year total shareholder return is still deep in the red, some stability is emerging. The most recent 1-year total shareholder return eked out a modest gain, and the latest share price is holding at $7.93. Investors seem cautiously more optimistic as operational improvements point to potential growth instead of further volatility.

If strategic moves like this have you thinking about where else momentum might be building, you may want to discover fast growing stocks with high insider ownership.

But with the share price nearly matching analyst targets and recent stability emerging, is Aurora Cannabis trading at a rare discount now, or are investors already pricing in every bit of coming growth?

Most Popular Narrative: 10% Overvalued

The most widely followed narrative puts Aurora Cannabis’s fair value at CA$7.92, which is slightly below the last close at CA$7.93. This sets up a debate over whether future growth is already priced in or not.

Ongoing transition of portfolio mix toward higher-margin international medical cannabis and away from lower-margin consumer channels is driving sustained improvement in consolidated gross margins, setting up a structurally stronger, earnings-rich business model. Investments in new cultivation technology, yield improvements, and operational efficiencies are enabling cost reductions and higher output of premium products, directly supporting increased profitability, improved EBITDA, and stronger free cash flow conversion.

Want to crack the story behind the premium price tag? The narrative relies on sharply rising margins, ambitious international expansion, and operational outperformance. Curious what big numbers are hiding under this bullish scenario? Dive in to expose the logic behind these high expectations.

Result: Fair Value of $7.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in Europe and higher operating costs could still put pressure on margins and limit Aurora Cannabis’s long-term profit growth.

Find out about the key risks to this Aurora Cannabis narrative.

Another View: What Does the SWS DCF Model Say?

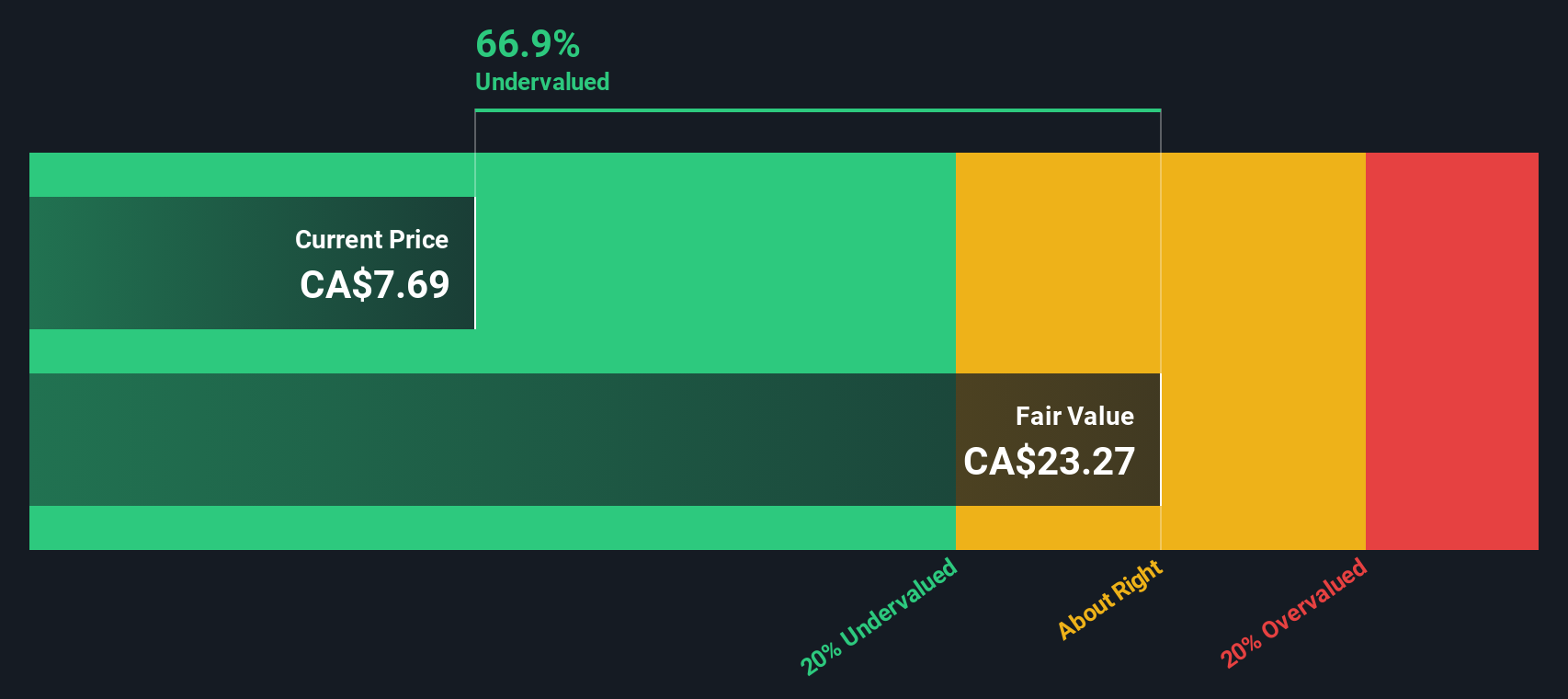

Looking at Aurora Cannabis through our SWS DCF model instead of market multiples, the story changes. The DCF estimate puts fair value at CA$23.27 per share, suggesting the current price may be deeply undervalued if those long-term cash flow projections hold up. Is the market missing something, or just skeptical?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aurora Cannabis Narrative

If you see things differently or want to put the numbers to the test yourself, try building your own narrative in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Aurora Cannabis.

Looking for more investment ideas?

Smart investors constantly scan the market for unmissable trends. Give yourself the edge and move fast on stocks shaping tomorrow’s world before others catch on.

- Supercharge your portfolio with high-yield potential by checking out these 19 dividend stocks with yields > 3% for companies offering more than 3% annual returns.

- Position yourself at the cutting edge by jumping into these 24 AI penny stocks, where artificial intelligence breakthroughs create future growth opportunities.

- Take advantage of attractive valuations with these 909 undervalued stocks based on cash flows based on strong cash flow fundamentals so you never overpay for great businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ACB

Aurora Cannabis

Engages in the production, distribution, and sale of cannabis and cannabis-derivative products in Canada and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives