- Canada

- /

- Metals and Mining

- /

- TSXV:GPH

3 TSX Penny Stocks With Market Caps Over CA$10M

Reviewed by Simply Wall St

Amidst the backdrop of tariff uncertainties and political shifts, Canadian markets have shown a cautious yet resilient stance, with the TSX slightly up for the year. Investors are increasingly looking beyond traditional sectors and exploring opportunities in less conventional areas like penny stocks. Though often associated with smaller or newer companies, these stocks can offer affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.61 | CA$168.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.80 | CA$454.52M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.87 | CA$78.41M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$577.33M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.00 | CA$39.87M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.91 | CA$70.12M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.12 | CA$31.16M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.33 | CA$3.17B | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 937 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Verano Holdings (NEOE:VRNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verano Holdings Corp. is a vertically integrated multi-state cannabis operator in the United States with a market cap of approximately CA$333.82 million.

Operations: The company's revenue is primarily derived from its Retail segment, which generated $672.25 million, and its Cultivation (Wholesale) segment, contributing $353.48 million.

Market Cap: CA$333.82M

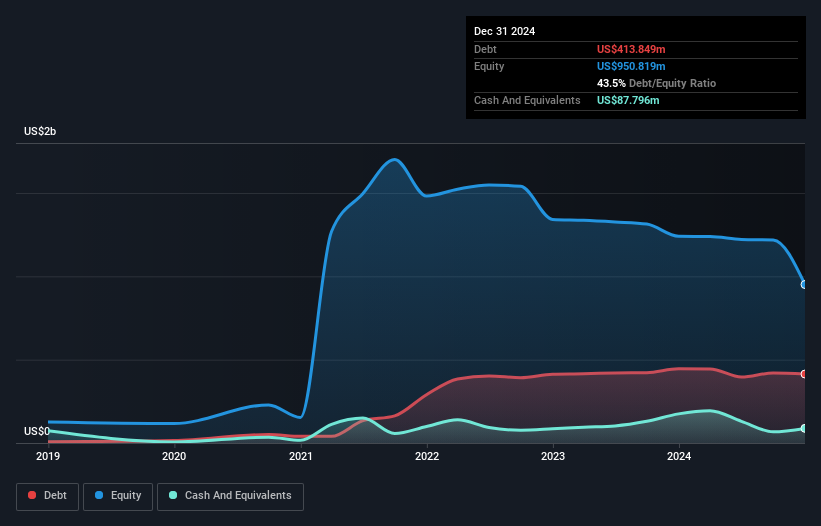

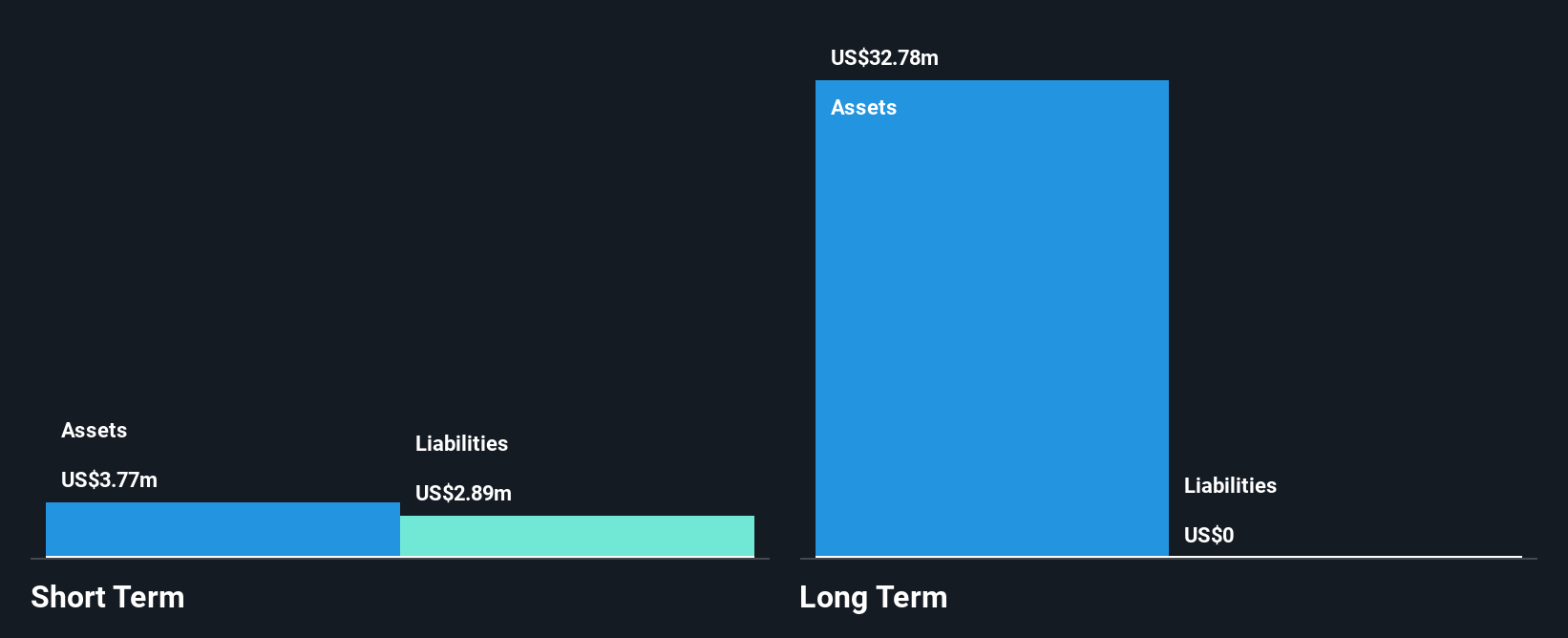

Verano Holdings, with a market cap of approximately CA$333.82 million, operates as a vertically integrated cannabis company in the U.S. Despite being unprofitable and having increased losses over the past five years, Verano maintains a sufficient cash runway for over three years due to positive free cash flow. The company's short-term assets cover its short-term liabilities but fall short of long-term obligations. Recent earnings reports show declining sales and widening net losses year-over-year. However, Verano continues expanding its retail footprint with 153 dispensaries nationwide and is actively seeking M&A opportunities to enhance growth amidst industry consolidation challenges.

- Click to explore a detailed breakdown of our findings in Verano Holdings' financial health report.

- Review our growth performance report to gain insights into Verano Holdings' future.

Silver Mountain Resources (TSXV:AGMR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Silver Mountain Resources Inc. focuses on acquiring, exploring, and developing precious metal resource properties in Peru with a market cap of CA$18.36 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$18.36M

Silver Mountain Resources, with a market cap of CA$18.36 million, is pre-revenue and focused on developing its mining operations in Peru. Recent confirmation from Peru's Ministry of Energy and Mines allows the company to restart production at its Reliquias Mine and Caudalosa Plant, potentially revitalizing local economies. The company remains debt-free but faces challenges with a high share price volatility and limited cash runway under one year. Management's short tenure suggests an evolving leadership team, while shareholders have not faced significant dilution recently despite potential share consolidation plans.

- Dive into the specifics of Silver Mountain Resources here with our thorough balance sheet health report.

- Explore historical data to track Silver Mountain Resources' performance over time in our past results report.

Graphite One (TSXV:GPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Graphite One Inc. is a mineral exploration company operating in the United States with a market cap of CA$139.53 million.

Operations: Graphite One Inc. has not reported any revenue segments.

Market Cap: CA$139.53M

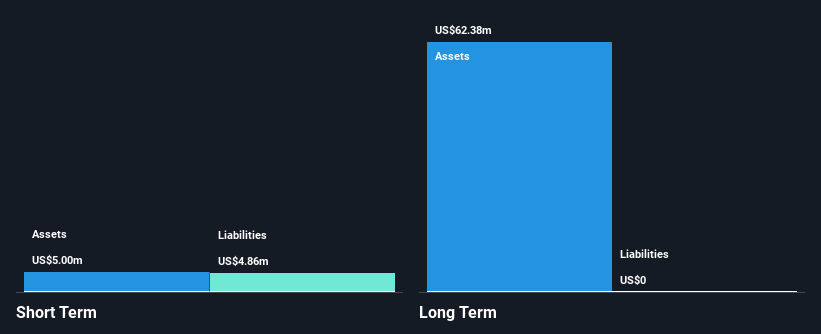

Graphite One Inc., with a market cap of CA$139.53 million, is a pre-revenue mineral exploration company operating in the U.S. Despite being debt-free and having an experienced board, the company faces challenges with limited cash runway, though recent capital raises have provided some relief. Its management team has stable tenure, but the company's unprofitability and declining earnings over five years highlight financial hurdles. Recent private placements raised significant funds through unit offerings to bolster its financial position while maintaining shareholder equity without meaningful dilution. Graphite One's participation in industry conferences underscores its effort to engage investors and stakeholders actively.

- Click here to discover the nuances of Graphite One with our detailed analytical financial health report.

- Understand Graphite One's track record by examining our performance history report.

Seize The Opportunity

- Explore the 937 names from our TSX Penny Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GPH

Graphite One

Operates as mineral exploration company in the United States.

Adequate balance sheet slight.

Market Insights

Community Narratives