Trulieve Cannabis' (CSE:TRUL) three-year total shareholder returns outpace the underlying earnings growth

Trulieve Cannabis Corp. (CSE:TRUL) shareholders might be concerned after seeing the share price drop 17% in the last quarter. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In fact, the share price is up a full 170% compared to three years ago. So the recent fall in the share price should be viewed in that context. Only time will tell if there is still too much optimism currently reflected in the share price.

In light of the stock dropping 7.9% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

Check out our latest analysis for Trulieve Cannabis

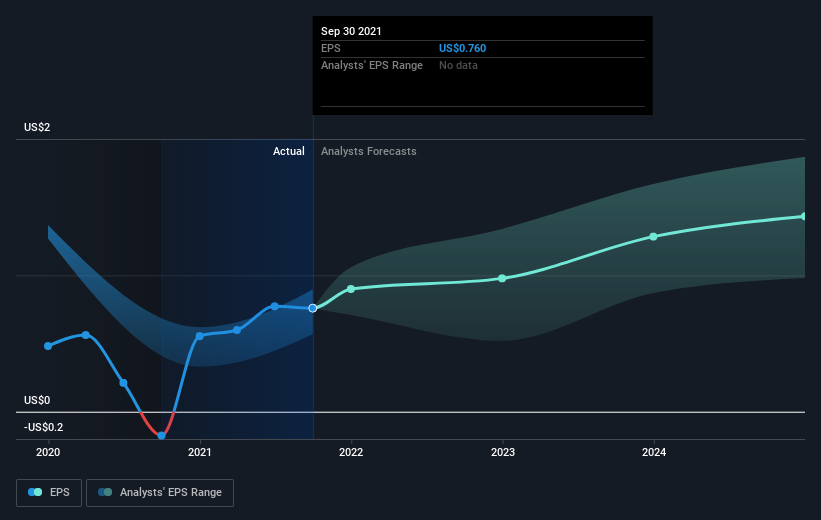

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Trulieve Cannabis became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Trulieve Cannabis' earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Trulieve Cannabis shares, which cost holders 37%, while the market was up about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 39% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Trulieve Cannabis better, we need to consider many other factors. For example, we've discovered 3 warning signs for Trulieve Cannabis (2 are concerning!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Trulieve Cannabis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:TRUL

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives