Trulieve Cannabis Corp. Just Missed Earnings - But Analysts Have Updated Their Models

Investors in Trulieve Cannabis Corp. (CSE:TRUL) had a good week, as its shares rose 2.6% to close at CA$35.35 following the release of its third-quarter results. Sales of US$136m surpassed estimates by 3.3%, although statutory earnings per share missed badly, coming in 28% below expectations at US$0.15 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Check out our latest analysis for Trulieve Cannabis

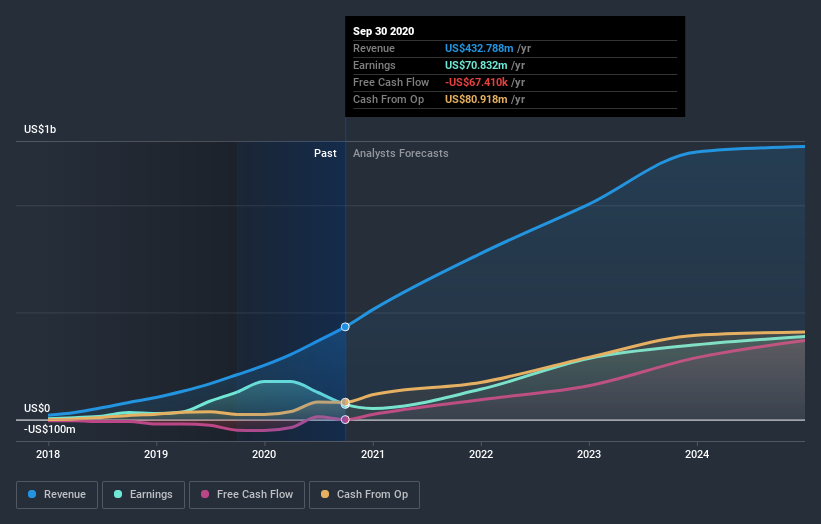

Following the latest results, Trulieve Cannabis' twelve analysts are now forecasting revenues of US$774.8m in 2021. This would be a substantial 79% improvement in sales compared to the last 12 months. Per-share earnings are expected to jump 81% to US$1.15. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$739.9m and earnings per share (EPS) of US$1.25 in 2021. So it's pretty clear consensus is mixed on Trulieve Cannabis after the latest results; whilethe analysts lifted revenue numbers, they also administered a small dip in per-share earnings expectations.

The analysts also upgraded Trulieve Cannabis' price target 18% to US$39.14, implying that the higher sales are expected to generate enough value to offset the forecast decline in earnings. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Trulieve Cannabis, with the most bullish analyst valuing it at US$64.00 and the most bearish at US$43.00 per share. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Trulieve Cannabis' past performance and to peers in the same industry. Next year brings more of the same, according to the analysts, with revenue forecast to grow 79%, in line with its 82% annual growth over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 32% per year. So although Trulieve Cannabis is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Trulieve Cannabis analysts - going out to 2024, and you can see them free on our platform here.

You still need to take note of risks, for example - Trulieve Cannabis has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you decide to trade Trulieve Cannabis, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Trulieve Cannabis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About CNSX:TRUL

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives