Investors ignore increasing losses at Trulieve Cannabis (CSE:TRUL) as stock jumps 8.2% this past week

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right stock, you can make a lot more than 100%. For example, the Trulieve Cannabis Corp. (CSE:TRUL) share price has soared 137% return in just a single year. And in the last month, the share price has gained 17%. Unfortunately the longer term returns are not so good, with the stock falling 68% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Trulieve Cannabis

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Trulieve Cannabis actually saw its earnings per share drop 125%. This was, in part, due to extraordinary items impacting earning in the last twelve months.

Given the share price gain, we doubt the market is measuring progress with EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Unfortunately Trulieve Cannabis' fell 4.3% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

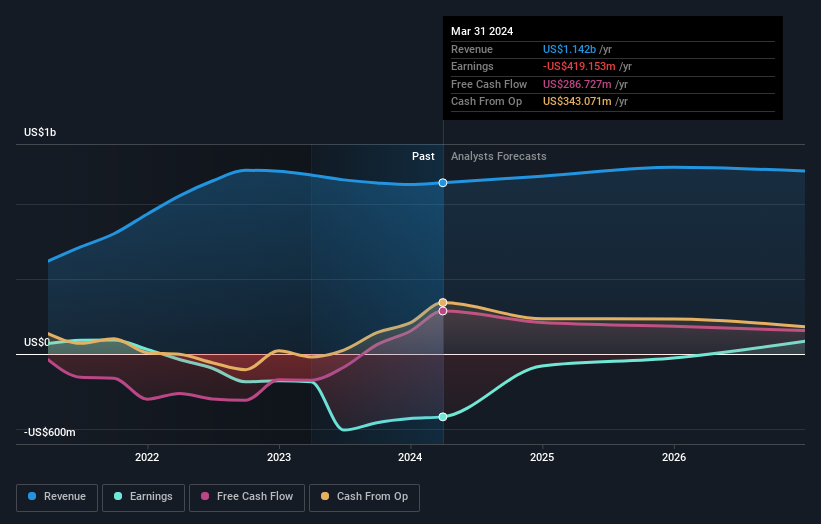

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Trulieve Cannabis is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Trulieve Cannabis will earn in the future (free analyst consensus estimates)

A Different Perspective

We're pleased to report that Trulieve Cannabis shareholders have received a total shareholder return of 137% over one year. That's better than the annualised return of 1.4% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Trulieve Cannabis is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Trulieve Cannabis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:TRUL

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives