- Canada

- /

- Trade Distributors

- /

- TSX:BRY

TSX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The Canadian market has been navigating the implications of new U.S. policies, with a particular focus on energy and tariffs, while the TSX index has shown resilience since Inauguration Day. Amid these broader economic shifts, penny stocks remain an intriguing segment for investors seeking potential growth opportunities. Although often associated with smaller or newer companies, these stocks can offer significant value when backed by strong financials and strategic positioning in their respective industries.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.95 | CA$189.37M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.46 | CA$933.34M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.57 | CA$406.63M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.21 | CA$222.46M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$619.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$123.03M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$14.18M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Telescope Innovations (CNSX:TELI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Telescope Innovations Corp. is a chemical technology company focused on developing manufacturing processes and tools for the pharmaceutical and chemical industries in the United States and Canada, with a market cap of CA$22.55 million.

Operations: No revenue segments have been reported.

Market Cap: CA$22.55M

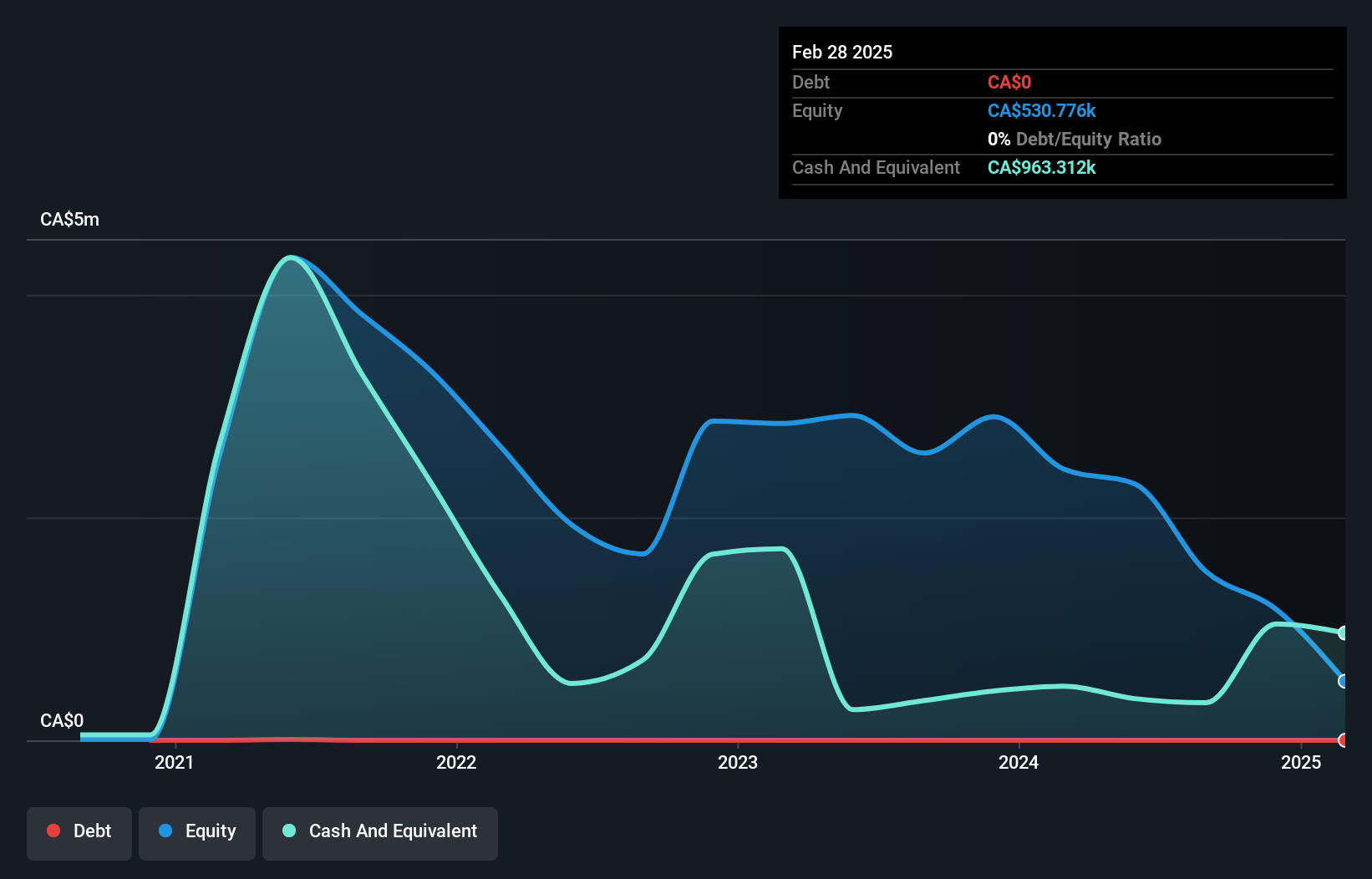

Telescope Innovations Corp., a pre-revenue chemical technology company, has demonstrated promising advancements with its ReCRFTTM technology, successfully producing high-purity lithium carbonate from diverse North American brines. Despite being unprofitable and having a negative return on equity, the company is debt-free and maintains a cash runway exceeding three years due to positive free cash flow growth. However, recent auditor concerns about its ability to continue as a going concern highlight financial risks. While trading below estimated fair value suggests potential upside, short-term liabilities exceed assets, posing challenges for financial stability.

- Click here and access our complete financial health analysis report to understand the dynamics of Telescope Innovations.

- Review our historical performance report to gain insights into Telescope Innovations' track record.

Bri-Chem (TSX:BRY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bri-Chem Corp., along with its subsidiaries, is involved in the wholesale distribution of oilfield chemicals for the oil and gas industry across North America, with a market cap of CA$9.52 million.

Operations: The company's revenue is derived from its Fluids Distribution segments in the USA (CA$51.85 million) and Canada (CA$12.83 million), as well as its Fluids Blending & Packaging operations in the USA (CA$7.88 million) and Canada (CA$22.19 million).

Market Cap: CA$9.52M

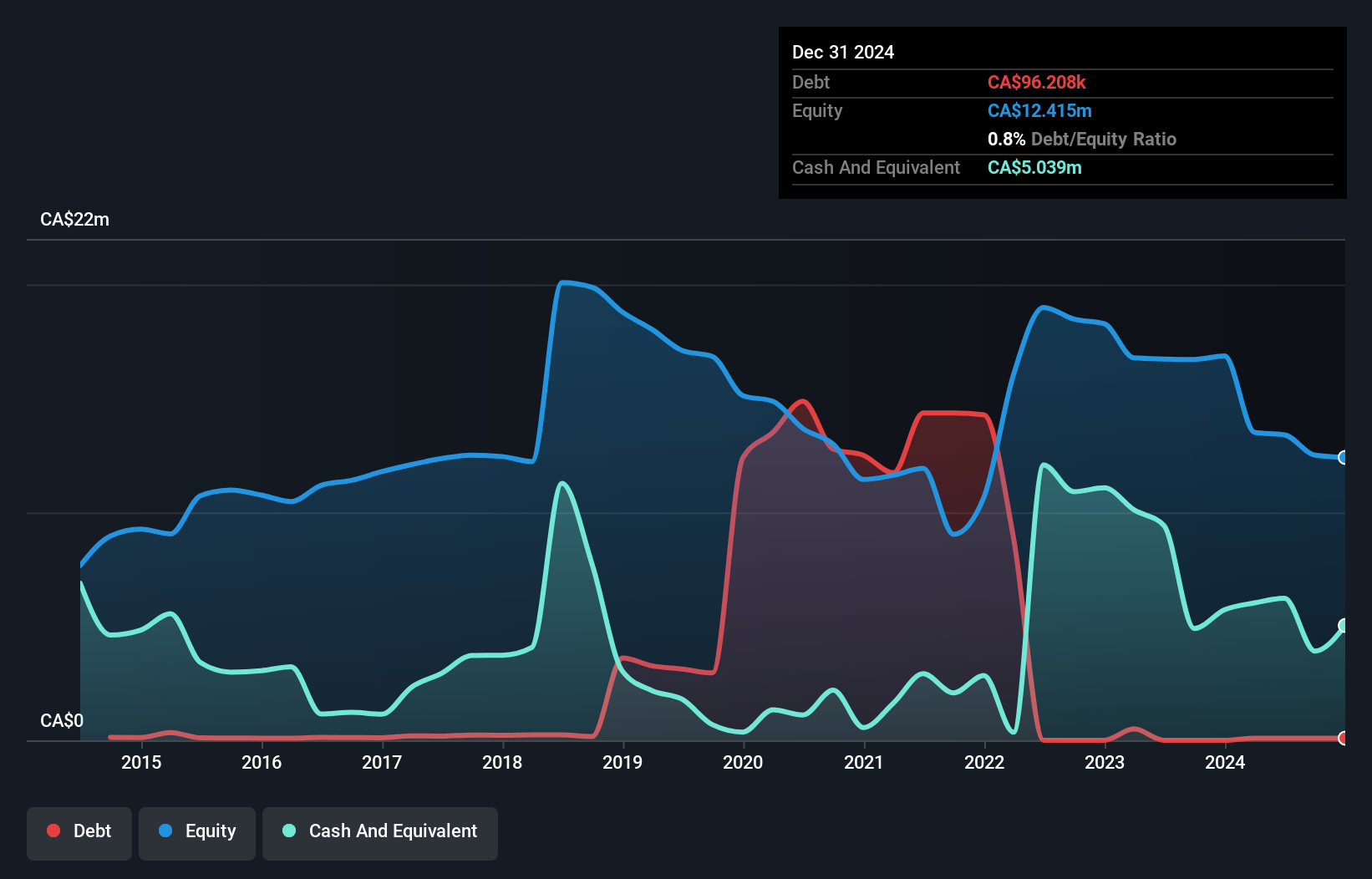

Bri-Chem Corp., involved in the distribution of oilfield chemicals, has faced challenges with declining sales, reporting CA$21.98 million for Q3 2024 compared to CA$26.83 million a year ago and a net loss of CA$0.27 million. Despite being unprofitable, Bri-Chem has reduced losses over five years by 37.1% annually and maintains a sufficient cash runway exceeding three years due to positive free cash flow. The company's debt levels remain high with a net debt to equity ratio of 102.3%, although short-term assets cover both short-term and long-term liabilities, offering some financial stability amidst volatility.

- Take a closer look at Bri-Chem's potential here in our financial health report.

- Examine Bri-Chem's past performance report to understand how it has performed in prior years.

Avante (TSXV:XX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avante Corp. develops security technologies, products, and solutions across several countries including Canada, the United States, and the United Kingdom with a market cap of CA$39.97 million.

Operations: The company generates revenue primarily from its Avante Security segment, amounting to CA$26.99 million.

Market Cap: CA$39.97M

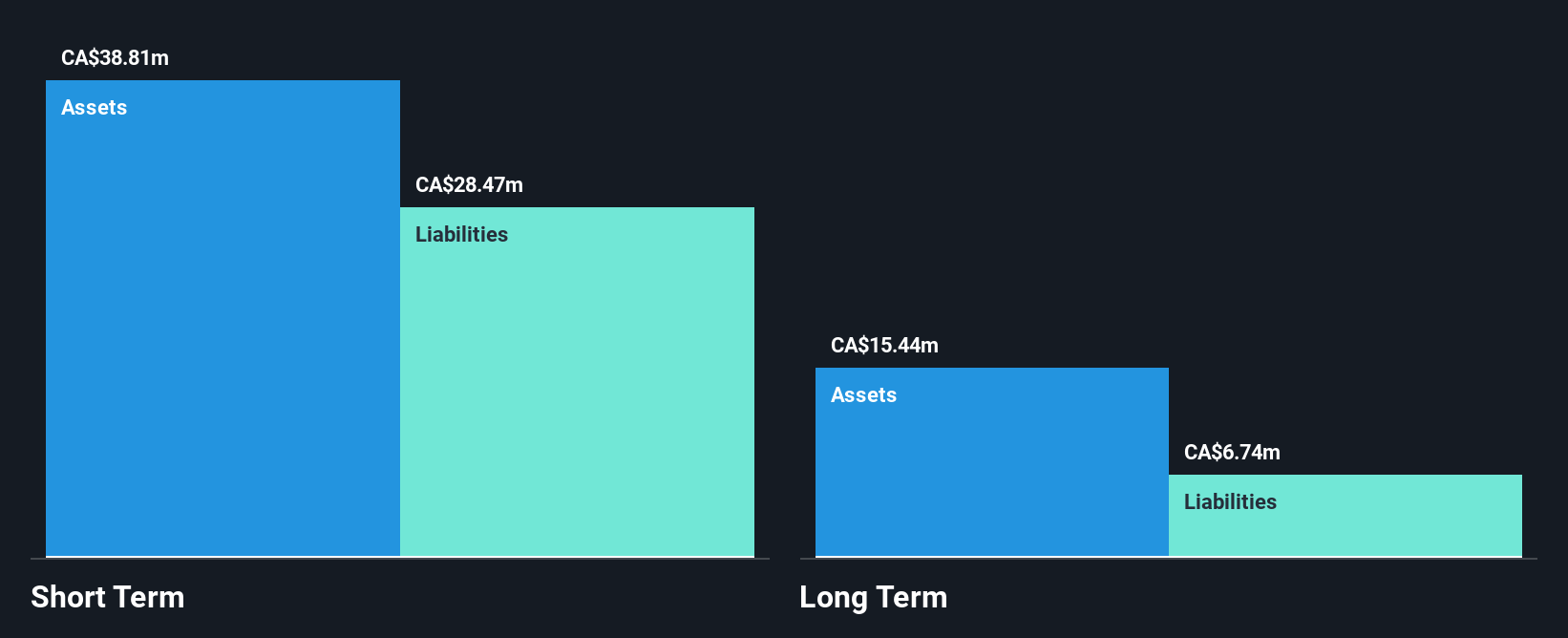

Avante Corp., with a market cap of CA$39.97 million, is navigating the penny stock landscape by focusing on innovative security solutions like its AI-powered Halo system and Avante Verified service. Despite being unprofitable with a net loss of CA$0.9 million for Q2 2024, the company has shown revenue growth, reporting sales of CA$8.09 million compared to CA$5.34 million last year. Avante's financial position is bolstered by more cash than debt and sufficient short-term assets to cover liabilities, providing some stability as it seeks acquisitions to expand its market presence further in Canada and beyond.

- Click to explore a detailed breakdown of our findings in Avante's financial health report.

- Explore historical data to track Avante's performance over time in our past results report.

Summing It All Up

- Take a closer look at our TSX Penny Stocks list of 936 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bri-Chem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BRY

Bri-Chem

Engages in the wholesale distribution of oilfield chemicals for the oil and gas industry in North America.

Excellent balance sheet and good value.

Market Insights

Community Narratives