The Planet 13 Holdings (CSE:PLTH) Share Price Has Soared 333%, Delighting Many Shareholders

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When you find (and hold) a big winner, you can markedly improve your finances. For example, the Planet 13 Holdings Inc. (CSE:PLTH) share price rocketed moonwards 333% in just one year. It's also good to see the share price up 44% over the last quarter. We'll need to follow Planet 13 Holdings for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Planet 13 Holdings

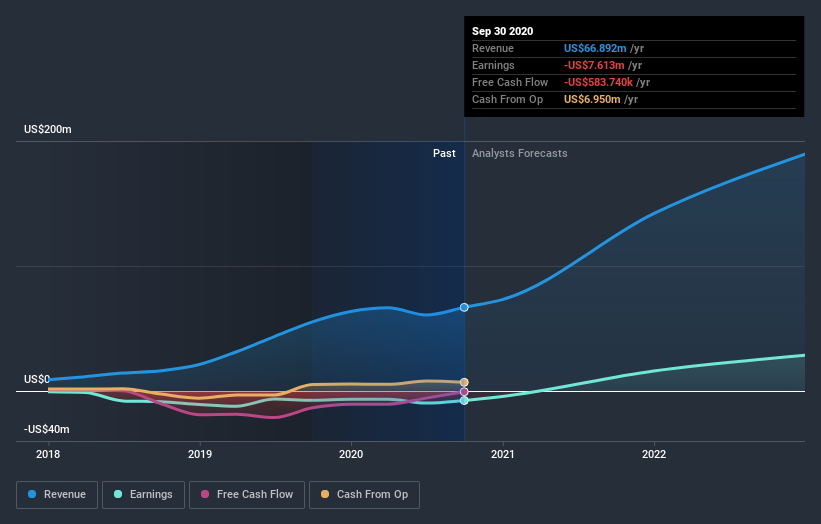

Planet 13 Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Planet 13 Holdings grew its revenue by 21% last year. We respect that sort of growth, no doubt. But the market is even more excited about it, with the price apparently bound for the moon, up 333% in one of earth's orbits. We're always cautious when the share price is up so much, but there's certainly enough revenue growth to justify taking a closer look at Planet 13 Holdings.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Planet 13 Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that Planet 13 Holdings shareholders have gained 333% over the last year. That's better than the more recent three month gain of 44%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Planet 13 Holdings you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade Planet 13 Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:PLTH

Planet 13 Holdings

Planet 13 Holdings Inc., together with its subsidiaries, cultivates and provides cannabis and cannabis-infused products for medical and retail cannabis markets in the United States.

Adequate balance sheet low.

Market Insights

Community Narratives